Recommended Methods To Protect Yourself From Identity Theft And Fraud: Proven Strategies

Identity theft and fraud can happen to anyone. Protecting yourself is essential.

In today’s digital age, our personal information is more vulnerable than ever. Criminals constantly find new ways to steal identities and commit fraud. This can lead to serious financial and emotional harm. It’s crucial to stay informed and take proactive steps to safeguard your identity.

By understanding common threats and learning effective strategies, you can reduce the risk of becoming a victim. This guide will explore recommended methods to protect yourself from identity theft and fraud, helping you keep your personal information safe and secure. Stay with us to discover practical tips that you can start using today.

Credit: www.experian.com

Importance Of Identity Protection

Identity protection is crucial in today’s digital age. Every day, people share personal information online. This includes banking details, social security numbers, and more. Without proper safeguards, this data can be stolen. Once stolen, it can be used for fraudulent activities. Protecting your identity helps prevent such risks. It ensures that your personal and financial information stays safe.

Rising Cases Of Identity Theft

Identity theft cases are increasing rapidly. Many cybercriminals target individuals through phishing emails. Some use malware to access personal information. In 2022 alone, millions of people were victims. The rise in online transactions has made it easier for thieves. They can steal data without leaving any trace. This alarming trend underscores the need for robust identity protection.

Consequences Of Identity Fraud

Identity fraud can have severe consequences. Victims may face financial loss. Unauthorized purchases can drain bank accounts. It can also damage credit scores. This makes it harder to get loans or mortgages. Restoring your identity is a lengthy process. It requires time, effort, and sometimes legal action. Emotional stress is another consequence. Knowing someone else controls your identity is unsettling.

Strong Password Practices

Protecting yourself from identity theft and fraud is crucial in today’s digital age. One of the most effective ways to safeguard your personal information is by practicing strong password habits. Strong passwords act as a barrier, keeping your accounts secure from unauthorized access. In this section, we will explore how to create complex passwords and the benefits of using password managers.

Creating Complex Passwords

Creating complex passwords is the first step in securing your accounts. A strong password should be at least 12 characters long. Include a mix of uppercase and lowercase letters. Add numbers and special characters. Avoid using easily guessable information, like your name or birthdate. Instead, use a random combination of words or phrases. This makes it harder for cybercriminals to crack your password.

Using Password Managers

Using password managers can simplify the process of maintaining strong passwords. A password manager stores all your passwords in one secure place. You only need to remember one master password. This tool generates complex passwords for you. It also auto-fills login forms, saving you time and effort. By using a password manager, you can ensure all your accounts have unique, strong passwords without the hassle of remembering each one.

Two-factor Authentication

In today’s digital age, protecting your identity is crucial. One of the best ways to safeguard your personal information is through Two-Factor Authentication (2FA). This method adds an extra layer of security, making it harder for cybercriminals to access your accounts.

Benefits Of Two-factor Authentication

Two-Factor Authentication offers several key benefits:

- Enhanced Security: 2FA requires two forms of identification. This makes it difficult for hackers to gain access.

- Reduced Risk of Fraud: With 2FA, even if your password is stolen, the second layer of security keeps your account safe.

- Peace of Mind: Knowing your accounts are protected gives you confidence and reduces stress.

Setting Up Two-factor Authentication

Setting up 2FA is a straightforward process. Follow these steps to secure your accounts:

- Choose a 2FA Method: Common options include SMS codes, authentication apps, or hardware tokens.

- Enable 2FA: Go to your account settings. Look for the security section.

- Follow the Prompts: Each platform will guide you through the setup process. This usually involves entering your phone number or scanning a QR code.

- Verify Your Setup: Test your 2FA to ensure it works correctly. This might involve receiving a code via SMS or app.

Two-Factor Authentication is a simple yet effective way to protect yourself from identity theft and fraud. With enhanced security and peace of mind, you can browse the internet with confidence.

Securing Personal Information

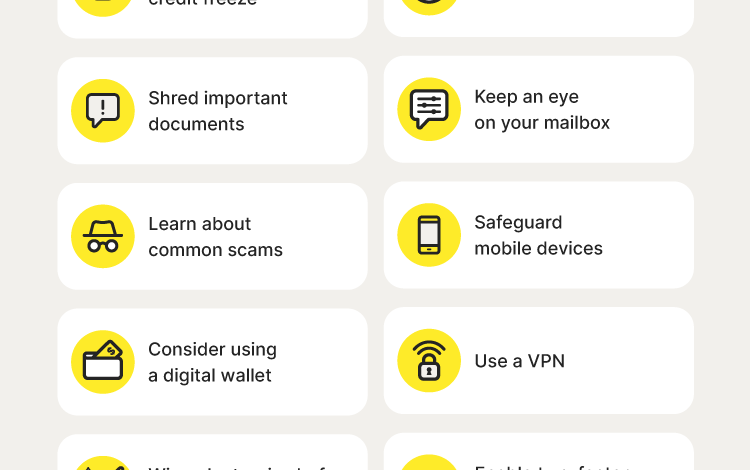

Protecting yourself from identity theft and fraud starts with securing your personal information. This involves taking steps to ensure that your data, both physical and digital, remains safe from prying eyes. Below are some recommended methods to help you safeguard your personal information effectively.

Shredding Documents

One of the simplest ways to protect your personal information is by shredding documents. Any paper containing sensitive information like bank statements, medical records, or credit card offers should be shredded. This prevents thieves from retrieving your details from the trash. Use a cross-cut shredder for added security, as it cuts the paper into smaller pieces than regular shredders.

Safeguarding Digital Information

Securing digital information is crucial in the age of the internet. Start by using strong, unique passwords for all your accounts. Avoid using easily guessed passwords like “123456” or “password”. Regularly update your passwords and use two-factor authentication for added security.

Be cautious of phishing emails and websites. Never click on suspicious links or download attachments from unknown sources. Install antivirus software on your devices and keep it updated. This helps protect against malware and other cyber threats.

Also, encrypt sensitive files and back up your data regularly. This ensures that even if your device is compromised, your information remains secure. Store backups in a separate location, preferably offline, to prevent unauthorized access.

Monitoring Financial Accounts

Monitoring your financial accounts is essential to protect yourself from identity theft and fraud. Keeping a close eye on your transactions can help you spot unusual activities early. This vigilance minimizes potential damage to your finances and credit score.

Regular Account Reviews

Check your bank and credit card statements frequently. Look for unfamiliar transactions or charges. Even small amounts can indicate fraudulent activity. Reviewing accounts weekly helps you catch issues early.

Use online banking tools for easy access to your account details. These tools often provide real-time updates. They make it simple to monitor your financial activities. If you notice something suspicious, report it immediately.

Setting Up Alerts

Many banks offer alert services. These alerts notify you of specific account activities. You can receive alerts for large transactions, low balances, or logins from new devices. Setting up these alerts helps you stay informed.

Use both email and SMS alerts for better coverage. This way, you won’t miss important notifications. Alerts act as a first line of defense against fraud. They provide instant warnings, allowing you to take swift action.

Credit: consumer.ftc.gov

Recognizing Phishing Scams

Phishing scams are one of the most common methods used by cybercriminals to steal personal information. Recognizing these scams is the first step to protect yourself from identity theft and fraud. By being aware of the signs, you can avoid falling victim to these malicious attempts.

Identifying Phishing Emails

Phishing emails often look like they are from legitimate sources. They may ask for personal information or prompt you to click on a link. Here are some tips to identify phishing emails:

- Check the sender’s email address. Fraudulent emails often use addresses that look similar to real ones.

- Look for generic greetings such as “Dear Customer” instead of your name.

- Be cautious of urgent language or threats, like “Your account will be closed.”

- Check for spelling and grammatical errors. Legitimate companies usually avoid these mistakes.

Avoiding Malicious Links

Phishing emails often contain malicious links that can lead to harmful websites. To protect yourself:

- Hover over links to see the actual URL before clicking. Ensure it matches the official website.

- Do not click on links in unsolicited emails. Instead, go directly to the company’s website.

- Use security software that can detect and block malicious websites.

- Keep your browser and security software updated to protect against new threats.

By recognizing phishing scams, you can significantly reduce the risk of identity theft and fraud. Stay vigilant and follow these tips to protect your personal information.

Protecting Devices

In today’s digital age, protecting your devices is crucial to prevent identity theft and fraud. Your smartphone, tablet, and computer hold vast amounts of personal data. Keeping these devices secure can save you from potential threats.

Installing Antivirus Software

Installing antivirus software is a vital step in protecting your devices. Antivirus programs help detect and remove malicious software. They can prevent viruses, malware, and spyware from accessing your personal information.

- Choose a reputable antivirus program.

- Ensure it provides real-time protection.

- Run regular scans to catch any threats.

Updating Software Regularly

Updating software is essential for device security. Software updates often include security patches that fix vulnerabilities. Ignoring updates can leave your device exposed to threats.

- Enable automatic updates on all devices.

- Check for updates manually if needed.

- Update all applications, not just the operating system.

Reporting Identity Theft

Identity theft can lead to financial loss and emotional stress. Prompt reporting is vital to mitigate damage. Below are essential steps to follow:

Contacting Authorities

If you suspect identity theft, the first step is to contact the authorities. Begin by filing a report with your local police department. Provide them with all necessary details and obtain a copy of the report for your records.

Next, report the theft to the Federal Trade Commission (FTC). You can do this online at IdentityTheft.gov or by phone. The FTC will provide you with a recovery plan and a personal recovery assistant.

Additionally, consider contacting your state’s consumer protection office. They can offer guidance and resources to help you recover from identity theft.

Notifying Financial Institutions

Inform your financial institutions immediately. Contact your bank, credit card companies, and any other relevant entities. Report the theft and request that they place alerts on your accounts.

Most banks and financial institutions have fraud departments that can assist you. They may issue new account numbers, cards, and secure your accounts from further unauthorized access.

It is also wise to check your credit report regularly. Request a free credit report from AnnualCreditReport.com. Look for any suspicious activity and report it immediately.

Consider placing a fraud alert or credit freeze on your credit report. This makes it harder for thieves to open new accounts in your name. Contact one of the three major credit bureaus—Equifax, Experian, or TransUnion—to initiate these security measures.

Credit: schneiderdowns.com

Frequently Asked Questions

What Is Identity Theft?

Identity theft is when someone steals your personal information. They use it to commit fraud or other crimes.

How Can I Protect My Identity Online?

Use strong passwords and change them regularly. Enable two-factor authentication. Avoid sharing personal information on social media.

What Are Common Signs Of Identity Theft?

Unexpected bills or credit card charges. Denied loan or credit card applications. Unauthorized bank transactions or withdrawals.

How Do I Report Identity Theft?

Contact your bank and credit card companies immediately. Report to the Federal Trade Commission (FTC). File a police report.

Conclusion

Protecting yourself from identity theft and fraud is crucial. Follow these steps. Use strong passwords. Monitor your bank statements. Shred sensitive documents. Be cautious online. Avoid sharing personal information. Stay informed about new threats. Simple actions make a big difference.

Your safety is in your hands. Be proactive. Stay safe and secure. Protect your identity today.