Which Of The Following Statements About Savings Accounts Is False: Uncover Myths

Savings accounts are essential for managing money. They offer safety and interest.

But not everything said about them is true. In this blog post, we will explore common statements about savings accounts. Some of these claims might be misleading or false. Understanding these misconceptions will help you make better financial decisions. By the end, you will be able to spot the false statements and protect your savings.

Let’s dive into the world of savings accounts and uncover the truth.

Credit: www.studypool.com

Introduction To Savings Accounts

Saving money is crucial. A savings account helps you do this. It is a safe place to store your funds. It also earns interest over time. But not all statements about savings accounts are true. Understanding the basics can help you make informed decisions.

Importance Of Savings Accounts

Savings accounts are essential for financial health. They provide a secure place to keep your money. They also offer easy access when needed. You can save for emergencies, big purchases, or future plans. Interest earned helps grow your savings over time. This makes it an effective way to build wealth.

Common Features

Savings accounts have several common features. Most accounts require a minimum balance. They pay interest on the money you save. Interest rates vary between banks. Some accounts offer higher rates for larger balances. Withdrawals are limited to a certain number per month. This encourages saving and reduces spending.

Accounts are insured up to a certain amount. This provides security for your money. Online banking access is often available. This makes it easy to manage your savings. Some accounts come with additional perks. These may include financial advice or bonuses for regular deposits.

Credit: www.chegg.com

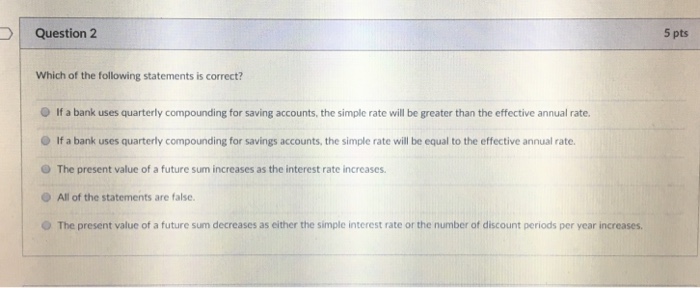

Myth: High-interest Rates Are Guaranteed

Many people believe that opening a savings account guarantees high-interest rates. This is a common misconception. The truth is, interest rates on savings accounts can fluctuate. Let’s explore why this myth persists and what factors influence these rates.

Variable Interest Rates

Savings accounts often come with variable interest rates. This means the interest rate can change over time. Banks adjust these rates based on various factors, including the economy and market conditions. So, while you might start with a high rate, it can decrease.

Market Influence

The market has a significant impact on savings account interest rates. When the economy is strong, interest rates might be higher. During economic downturns, rates often drop. Banks also look at the Federal Reserve’s rates when setting their own.

| Factor | Impact on Interest Rates |

|---|---|

| Economic Conditions | Can cause rates to rise or fall |

| Federal Reserve Rates | Banks adjust rates based on these |

| Bank Policies | Individual banks set their own rates |

Understanding these factors can help you manage expectations. It’s essential to remember that a high-interest rate today doesn’t mean it will stay high forever.

Myth: No Fees For Savings Accounts

Many people believe that savings accounts do not have any fees. This is a common misconception. While some savings accounts are fee-free, many have hidden costs. It’s important to understand these fees before opening an account. Let’s dive into this myth and uncover the truth.

Monthly Maintenance Fees

Not all savings accounts are free from monthly maintenance fees. Some banks charge a monthly fee if your balance falls below a certain amount. This fee can range from a few dollars to more than $10 per month. Always check the account terms before signing up.

| Bank | Minimum Balance | Monthly Fee |

|---|---|---|

| Bank A | $500 | $5 |

| Bank B | $1,000 | $8 |

| Bank C | $1,500 | $12 |

Transaction Limits

Savings accounts often have transaction limits. Banks typically limit the number of withdrawals or transfers you can make each month. Exceeding these limits can result in fees.

- Up to 6 transactions per month.

- Fees for extra transactions range from $1 to $15.

- Some banks may convert your savings account to a checking account if limits are exceeded regularly.

Understanding these fees and limits can help you manage your savings better. Always read the fine print to avoid unexpected charges. This will ensure that your savings account works for you.

Myth: Unlimited Withdrawals

Many people believe that savings accounts offer unlimited withdrawals. This common myth can lead to confusion. Understanding the truth behind withdrawal limits helps avoid potential penalties. Let’s explore the facts about savings accounts.

Federal Regulations

Federal regulations limit the number of withdrawals from savings accounts. Regulation D imposes a limit of six withdrawals per month. This rule ensures that savings accounts maintain their primary purpose. Exceeding this limit can result in fees or account changes.

Bank Policies

Each bank may have its own policies regarding withdrawals. Some banks might charge fees after the sixth withdrawal. Others may convert your savings account to a checking account. Always check your bank’s specific rules to avoid surprises. Being aware of these policies can help you manage your account effectively.

Myth: All Savings Accounts Are The Same

Many people believe that all savings accounts are identical. This is a common misconception. Savings accounts can vary greatly in terms of features, interest rates, and benefits. Understanding these differences can help you choose the best account for your needs.

Different Account Types

There are various types of savings accounts available. Each type offers unique features. Here are some common types:

- Basic Savings Account: This is the most common type. It usually offers low interest rates but easy access to funds.

- High-Yield Savings Account: These accounts offer higher interest rates. They often require a higher minimum balance.

- Money Market Account: These accounts provide higher interest rates and check-writing privileges. They usually require a higher minimum balance.

- Certificate of Deposit (CD): These accounts lock your money for a fixed term. They offer higher interest rates in return.

Interest Rate Variations

Interest rates can vary significantly between savings accounts. Factors influencing interest rates include:

- Account Type: High-yield savings accounts and CDs generally offer higher rates.

- Financial Institution: Online banks often provide higher rates than traditional banks.

- Market Conditions: Rates can fluctuate based on economic factors.

Comparing interest rates is crucial. A higher interest rate means more money earned on your savings.

By understanding the different types and interest rates, you can make an informed decision. Not all savings accounts are the same. Choose wisely to maximize your savings.

Myth: Immediate Access To Funds

Many people believe that savings accounts offer immediate access to funds. This is a common myth. Savings accounts have certain rules and limitations. Understanding these can help you manage your finances better.

Withdrawal Delays

Withdrawal delays can happen with savings accounts. Banks often limit the number of withdrawals per month. Federal regulations typically allow six transfers or withdrawals per month from savings accounts.

Exceeding this limit can result in fees. In some cases, banks may convert your savings account to a checking account. This can impact your interest earnings.

Transfer Times

Transfer times can vary between banks. Transfers from a savings account to another account may not be instant. It often takes one to three business days for the transfer to complete.

Weekends and holidays can cause further delays. Planning ahead for transfers can help avoid these issues.

Here’s a quick comparison of withdrawal and transfer times:

| Aspect | Typical Time |

|---|---|

| Withdrawal Processing | Immediate to 3 Days |

| Transfer Processing | 1 to 3 Days |

Understanding these aspects can help you manage your savings account effectively. Remember, savings accounts are designed for saving, not frequent transactions.

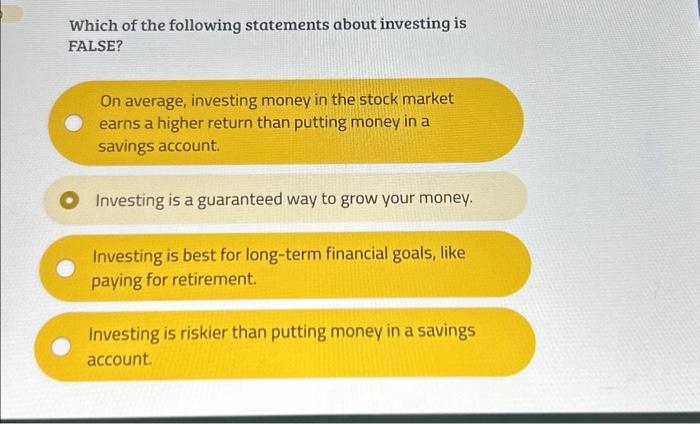

Myth: Savings Accounts Are Risk-free

Many believe that savings accounts are completely risk-free. While they are safer than investing in stocks, no financial product is without risk. Understanding the potential risks can help you make better decisions with your money.

Inflation Impact

Inflation affects your savings account. If the inflation rate is higher than your savings account interest rate, your money loses value. For example:

- Savings Account Interest Rate: 1%

- Inflation Rate: 3%

In this scenario, your savings decrease in purchasing power by 2% each year. This means you can buy less with the same amount of money over time.

Bank Failures

Though rare, banks can fail. Your deposits are protected by the FDIC, but only up to $250,000 per depositor, per bank. If you have more than this amount in a single bank, some of your money might be at risk.

To minimize this risk, you can:

- Spread your money across multiple banks.

- Keep track of your account balances.

- Ensure each account does not exceed the FDIC limit.

Being aware of these risks allows you to take steps to protect your savings. Always stay informed about where and how your money is stored.

Credit: www.chegg.com

Frequently Asked Questions

What Are The Benefits Of A Savings Account?

Savings accounts offer safety for your funds, easy access, and interest earnings. They provide a secure place to store money and grow it over time.

Can You Withdraw Money From A Savings Account Anytime?

Yes, you can withdraw money anytime, though some accounts may limit the number of withdrawals per month.

Do Savings Accounts Earn Interest?

Yes, savings accounts earn interest on your balance. The interest rate varies by bank and account type.

Are Savings Accounts Safe?

Yes, savings accounts are generally safe. They are typically insured by government agencies, protecting your money up to a certain limit.

Conclusion

Understanding savings accounts is crucial for managing your money wisely. Some beliefs about them can mislead. Always check the facts before opening one. Savings accounts offer different benefits, so research is important. Knowing the truth helps make better financial choices.

Stay informed and choose the right account for your needs. This way, you maximize your savings and avoid common pitfalls. Keep learning about financial tools to secure your future.