An Unanticipated Expense That Will Make It Difficult To Get By Day To Day Would Be A Candidate For Financial Hardship

Life can be full of surprises, some pleasant and others challenging. An unexpected expense can disrupt your daily life.

It can make managing your finances very hard. Imagine suddenly needing to pay for a car repair or a medical bill. Such expenses can come out of nowhere. They can drain your savings and create stress. Handling these costs is tough when you already live on a tight budget.

The key is to prepare for such situations. In this blog post, we will explore strategies to cope with unplanned expenses. You will learn practical tips to make it easier to get by day to day. Stay tuned to understand how to manage your finances better and keep stress at bay.

Credit: www.smartypig.com

Financial Hardship Defined

Facing an unexpected financial burden can disrupt daily life. This is known as financial hardship. It occurs when you struggle to meet basic needs such as food, rent, and utilities due to sudden expenses.

Types Of Financial Hardship

- Short-term hardship: Occurs for a brief period, like a few months.

- Long-term hardship: Lasts for a longer period, often more than a year.

Common Triggers

| Trigger | Explanation |

|---|---|

| Job Loss | Loss of income can lead to financial distress. |

| Medical Bills | Unexpected health issues can create large bills. |

| Car Repairs | Unplanned repairs can be costly and necessary. |

| Natural Disasters | Events like floods and fires can damage property. |

Understanding these triggers helps in planning and being prepared. Awareness can make managing financial hardship easier.

Impact Of Unexpected Expenses

Unexpected expenses can create major financial stress. Such costs can make daily living difficult. Managing these surprises requires careful planning.

Unexpected expenses can disrupt daily life. They can strain your budget and cause stress. These unforeseen costs can make it hard to meet your basic needs. Many people live paycheck to paycheck. A sudden expense can lead to financial hardship.Examples Of Unanticipated Costs

Medical bills often come without warning. An emergency room visit can be very expensive. Car repairs are another common surprise. A broken-down car can cost hundreds or thousands of dollars to fix. Home repairs can also be unexpected. A burst pipe or broken heater can create a large expense.Short-term And Long-term Effects

In the short-term, unexpected costs can drain savings. This can leave you with no safety net. You might need to cut back on essentials. Groceries and utilities may be affected. Long-term effects are more severe. Continued financial strain can lead to debt. High-interest loans or credit cards may be used. This increases financial pressure over time. Mental health can also suffer. Anxiety and stress can affect your well-being. “`Budgeting Challenges

Facing an unexpected expense can throw a wrench into your budgeting plans. Managing your finances becomes even harder when such expenses arise. Let’s delve into some common budgeting challenges you might face and how to tackle them effectively.

Balancing Income And Expenses

Balancing your income and expenses is crucial. Start by listing your monthly income. Next, list all your expenses. Categorize these expenses into essential and non-essential. This will help you see where your money goes. Prioritize the essentials first. Cut back on non-essential spending if needed.

| Category | Amount |

|---|---|

| Income | $2,000 |

| Rent | $800 |

| Groceries | $300 |

| Utilities | $150 |

| Transport | $100 |

| Entertainment | $150 |

Tracking Spending

Tracking your spending is essential. Keep a record of every expense. Use a notebook or an app. This helps you see your spending habits. Identify areas where you can save money. Regularly review your spending. Adjust your budget as needed.

- Record every purchase

- Use budgeting apps

- Review weekly

- Adjust spending habits

By tracking your spending, you gain control. This makes it easier to handle unexpected expenses. Plan ahead and stay prepared.

Credit: cast.ai

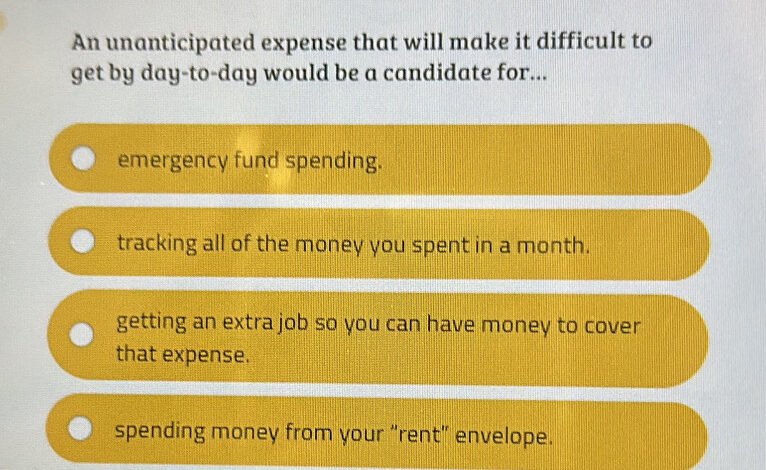

Emergency Funds Importance

An unanticipated expense can throw your budget off balance. This is where emergency funds come into play. They act as a financial cushion, helping you manage sudden costs without stress. Whether it’s a medical bill, car repair, or job loss, having an emergency fund can keep you afloat.

Building An Emergency Fund

Setting up an emergency fund doesn’t have to be daunting. Start small. Begin by saving a portion of your income each month. Aim for consistency. Use an online savings account for easy access and better interest rates.

Consider automatic transfers. Set them up to move money from your checking account to your savings account. This makes saving effortless and regular. Track your progress. Adjust your contributions as needed.

How Much To Save

Deciding how much to save depends on your expenses. A common rule of thumb is to save three to six months’ worth of living expenses. This might seem like a lot, but it provides a solid safety net.

Break it down into smaller goals. Start with one month’s worth of expenses. Once you reach that, aim for three months. Gradually build up to six months. Monitor your spending. Adjust your savings goals if your expenses change.

Here’s a simple table to guide you:

| Expense Type | Monthly Cost | Three Months | Six Months |

|---|---|---|---|

| Rent/Mortgage | $1,000 | $3,000 | $6,000 |

| Utilities | $200 | $600 | $1,200 |

| Groceries | $300 | $900 | $1,800 |

Remember, the key is to start small and be consistent. Your future self will thank you.

Debt Management Strategies

An unanticipated expense can disrupt your daily life. Managing debt effectively is crucial. Effective debt management strategies can help you regain control. These strategies focus on paying off debts and avoiding financial pitfalls.

Prioritizing Payments

Prioritize your payments to avoid missing deadlines. Focus on high-interest debts first. This helps reduce the amount you owe over time. List all your debts with due dates and interest rates. Create a payment calendar to stay organized. Consider the following steps:

- List debts by interest rate.

- Pay off high-interest debts first.

- Make minimum payments on other debts.

- Use extra money to pay off prioritized debt.

This approach reduces financial strain. It helps in managing your expenses better.

Debt Consolidation Options

Debt consolidation can simplify your financial obligations. It involves combining multiple debts into one. This can lead to lower interest rates and easier management. Here are some common debt consolidation options:

| Option | Description |

|---|---|

| Personal Loan | Combine debts into a single loan. Often with a lower interest rate. |

| Balance Transfer Credit Card | Transfer multiple credit card balances to one card. Enjoy a lower or zero interest rate for a limited time. |

| Home Equity Loan | Use home equity to secure a loan. Often provides lower interest rates. |

Choose the option that suits your financial situation. Ensure you understand the terms and conditions. Proper debt consolidation can ease your financial burden.

Seeking Financial Assistance

An unanticipated expense can throw your financial stability off balance. It can be a medical bill, car repair, or emergency travel. In such cases, seeking financial assistance becomes essential. Several resources can help you navigate these tough times.

Government Aid Programs

Government aid programs can provide a lifeline. These programs offer various forms of support. Food assistance, housing subsidies, and emergency funds are common examples. Check eligibility criteria to apply. Visit the official government websites for accurate information.

Charitable Organizations

Charitable organizations also provide crucial support. They offer financial help, food, and clothing. Some even cover medical expenses. Research local charities in your area. Many have specific programs for emergency situations.

Financial Literacy

Understanding financial literacy can help manage unexpected expenses. It involves knowing how to budget, save, and make informed financial decisions. This knowledge can prevent financial stress when unplanned costs arise.

Educational Resources

Many free resources are available to learn about finances. Websites, books, and online courses offer valuable lessons. These resources teach budgeting, saving, and investing basics. They help build a strong financial foundation.

Local community centers often provide financial literacy workshops. These workshops cover essential topics in an easy-to-understand format. Attending these sessions can enhance financial knowledge. It can also connect you with experts who can offer personalized advice.

Planning For Future Stability

Planning ahead can provide peace of mind. Start by creating a budget to track income and expenses. This helps identify areas where you can save money. Setting aside funds for emergencies is crucial. Aim to save a small amount each month.

Consider setting financial goals. These goals can be short-term, like saving for a minor repair, or long-term, like building a retirement fund. Regularly reviewing and adjusting your financial plan ensures it remains effective. This proactive approach can make unexpected expenses more manageable.

Credit: www.sec.gov

Mental Health Considerations

Facing an unexpected expense can be challenging. It can affect your mental health significantly. Stress and anxiety often increase when finances are tight. Seeking professional help can make a difference. This section will discuss how to manage your mental health during these tough times.

Stress And Anxiety

Unexpected expenses can lead to high levels of stress. This stress can impact your daily life. You may find it hard to focus on tasks. Anxiety may also set in. This can cause sleepless nights and constant worry.

It is important to identify the signs of stress and anxiety early. Look out for the following symptoms:

- Restlessness

- Fatigue

- Difficulty concentrating

- Increased irritability

Recognizing these signs can help you take action sooner. Managing stress effectively can prevent it from escalating.

Seeking Professional Help

Sometimes, managing stress and anxiety on your own is difficult. Seeking professional help can be beneficial. Therapists and counselors offer support and guidance. They can provide coping strategies tailored to your needs.

Consider the following options when seeking help:

- Individual therapy

- Group therapy

- Financial counseling

These options can provide you with valuable tools and resources. They can help you manage your mental health and navigate financial challenges. Never hesitate to reach out for help when needed.

Taking care of your mental health is essential. Especially during financially stressful times. It can make a significant difference in your overall well-being.

Frequently Asked Questions

What Is An Unanticipated Expense?

An unanticipated expense is a sudden, unexpected cost. It can disrupt your daily budget. Examples include medical bills or car repairs.

How Can Unanticipated Expenses Affect Daily Life?

Unanticipated expenses can strain your finances. They make it difficult to cover daily needs. This can lead to stress and financial instability.

What Are Examples Of Unanticipated Expenses?

Common examples include emergency medical expenses, car repairs, and home repairs. These costs are often unavoidable and urgent.

How To Prepare For Unanticipated Expenses?

Build an emergency fund to cover unexpected costs. Save a small amount regularly. This will provide financial security.

Conclusion

Facing an unanticipated expense can be stressful and overwhelming. It disrupts your daily life. Planning ahead can help manage these financial surprises. Start by building an emergency fund. Even small savings add up over time. Prioritize essential expenses. Cut unnecessary costs.

Seek advice from a financial counselor if needed. Staying proactive can ease the burden. Remember, you are not alone. Many face similar challenges. Taking these steps can provide stability.