Car Lease Agreements Come With A Stipulation That You Must Pay A Penalty If You Break The Terms

Car lease agreements can be attractive due to lower monthly payments. But they come with rules you must follow.

One key stipulation is the penalty for breaking the contract. Understanding car lease agreements is crucial to avoid unexpected costs. Leases often have strict terms and conditions. You must know these to prevent any penalties. Whether it’s exceeding mileage limits or ending the lease early, these actions can incur fees.

This blog will help you understand these stipulations better. Knowing what you’re getting into can save you money and stress. So, let’s delve into the details of car lease agreements and the penalties involved.

Introduction To Car Lease Agreements

Car lease agreements are common in the automotive world. These agreements allow drivers to use a vehicle for a specified period. At the end of this period, the car is returned to the leasing company. It’s a great option for those who prefer to drive new cars often.

Basics Of Leasing

Leasing a car is different from buying. You only pay for the vehicle’s depreciation during the lease term. Monthly payments are usually lower compared to purchasing. Here’s what you need to know:

- Lease Term: This is the duration you will lease the car. Common terms are 24, 36, or 48 months.

- Mileage Limit: Most leases have a yearly mileage limit, usually between 10,000 and 15,000 miles. Exceeding this limit incurs additional charges.

- Residual Value: This is the car’s value at the end of the lease. It’s a key factor in determining your monthly payments.

Purpose Of Lease Agreements

The main goal of a car lease agreement is to outline the terms and conditions of the lease. It protects both the lessee (you) and the lessor (leasing company). Key elements include:

- Monthly Payments: The amount you pay each month for the lease.

- Maintenance Obligations: Who is responsible for maintaining the vehicle.

- Penalties: Fees for breaking the lease early or exceeding mileage limits.

Understanding these elements helps you make informed decisions. It ensures a smooth leasing experience.

Credit: www.reddit.com

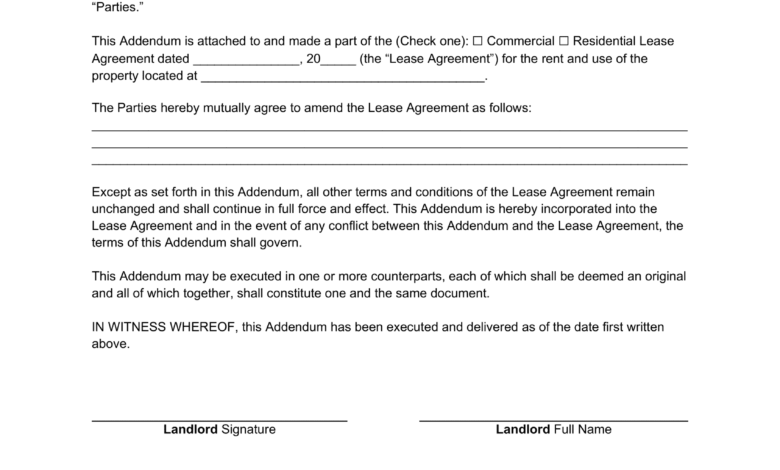

Common Terms In Lease Agreements

Car lease agreements often come with specific terms. These terms help protect both the lessor and the lessee. Understanding these terms is crucial before signing any agreement. Below are some common terms you might find in a car lease agreement.

Monthly Payments

Monthly payments are a key component of car lease agreements. These payments cover the cost of using the car. The amount is determined by the car’s value, lease term, and interest rate.

- Lease Term: The duration of the lease, often 24 to 36 months.

- Interest Rate: The cost of borrowing money to lease the car.

- Residual Value: The car’s estimated value at the end of the lease.

It’s essential to budget for these monthly payments. Missing a payment can lead to penalties.

Mileage Limits

Mileage limits are another common term in lease agreements. This limit restricts how many miles you can drive each year. Exceeding this limit can result in extra charges.

| Annual Mileage Limit | Excess Mileage Charge |

|---|---|

| 10,000 miles | $0.15 per mile |

| 12,000 miles | $0.20 per mile |

| 15,000 miles | $0.25 per mile |

It’s vital to estimate your annual mileage accurately. Going over the limit can be costly. Plan your driving habits accordingly.

Understanding Penalties For Breaking Terms

Car lease agreements come with strict terms and conditions. Breaking these terms often leads to penalties. Understanding these penalties helps you make informed decisions.

Financial Penalties

Financial penalties are common in car lease agreements. You may face charges for early termination. The earlier you end the lease, the higher the penalty. Here’s a table showing typical penalties:

| Months Remaining | Penalty Amount |

|---|---|

| 12 or more | $1,000 |

| 6-11 | $600 |

| 1-5 | $300 |

Late payments also incur fees. These fees can add up quickly. Always pay on time to avoid extra costs.

Legal Consequences

Breaking lease terms can lead to legal issues. You may face a lawsuit. The leasing company can take you to court. This may result in a judgment against you. A judgment can impact your credit score.

In severe cases, the company may repossess the car. Repossession affects your ability to lease in the future.

Be sure to read your lease agreement carefully. Understand all penalties before signing. This knowledge can save you money and legal trouble.

Credit: www.rentecdirect.com

Situations Leading To Penalties

Car lease agreements often come with various stipulations. One key stipulation is the imposition of penalties. Understanding these penalties is crucial for avoiding unexpected costs. Below are the common situations that lead to penalties in a car lease agreement.

Exceeding Mileage

Most lease agreements have a mileage limit. Exceeding this limit can result in significant penalties. This limit is usually between 10,000 and 15,000 miles per year.

Exceeding the mileage limit can incur charges ranging from $0.10 to $0.30 per mile. Here is a table showing the potential costs:

| Miles Over Limit | Cost per Mile | Total Cost |

|---|---|---|

| 1,000 | $0.20 | $200 |

| 5,000 | $0.20 | $1,000 |

| 10,000 | $0.20 | $2,000 |

Early Termination

Ending a car lease early can lead to steep penalties. Early termination fees can be very high, sometimes as much as the remaining lease payments.

Consider the following potential costs for early termination:

- Remaining lease payments: $4,000

- Early termination fee: $500

- Disposition fee: $300

In this example, the total cost of early termination could be $4,800. This is why it’s important to plan ahead before deciding to end a lease early.

Calculating Penalty Costs

Car lease agreements require paying a penalty for breaking the terms. This can include exceeding mileage limits or ending the lease early. Always review the contract details to avoid unexpected costs.

Understanding how penalty costs are calculated in car lease agreements is crucial. These penalties can surprise many lessees. Knowing what factors influence these costs can help you avoid unexpected expenses. Let’s break down the key points.Factors Influencing Costs

Several factors influence the penalty costs in car lease agreements. 1. Remaining Lease Term: The longer the remaining lease term, the higher the penalty. Leasing companies want to recover the lost income from an early termination. 2. Monthly Payment Amount: Higher monthly payments result in higher penalties. It’s a direct correlation. 3. Mileage Overages: Exceeding the agreed mileage can lead to additional charges. These can add up quickly. 4. Vehicle Condition: Any damage beyond normal wear and tear can increase penalties. The leasing company will charge for repairs. 5. Market Value of the Car: The current market value of the car at termination time matters. A higher market value can sometimes reduce the penalty.Examples Of Penalty Calculations

Let’s look at some examples to clarify how these penalties might be calculated. Example 1: You have 12 months left on a lease, and your monthly payment is $300. The leasing company charges a flat fee of three months’ payments for early termination. Your penalty would be $900. Example 2: Your lease agreement allows 12,000 miles per year. You return the car with 15,000 miles after two years. The penalty for the extra 6,000 miles at $0.20 per mile would be $1,200. Example 3: The car has minor damage that costs $500 to repair. This amount will be added to any other penalties. Understanding these examples can help you avoid surprises. Always read your lease agreement carefully. Knowing the terms can save you money. “`Avoiding Penalties

Car lease agreements can be tricky. One wrong step and you might face penalties. But don’t worry. Following some simple steps can help you avoid these penalties. Let’s look at two key areas: Adhering to Terms and Communicating with Lessor.

Adhering To Terms

The lease agreement has clear terms. Read them carefully. The key is to follow these terms strictly. Here are some important points:

- Mileage Limits: Stick to the agreed mileage. Exceeding this can lead to hefty charges.

- Maintenance: Keep the car in good condition. Regular servicing is a must.

- Modifications: Avoid making changes to the car. This includes adding custom parts or altering the paint.

Adhering to these terms helps in avoiding penalties. It also ensures a smooth leasing experience.

Communicating With Lessor

Good communication with the lessor is essential. It can help in resolving issues quickly. Here are some tips:

- Inform Early: Notify the lessor if you face any issues. Early communication can prevent misunderstandings.

- Seek Clarifications: If unclear about any terms, ask for clarification. It’s better to ask than assume.

- Report Damages: If the car gets damaged, report it immediately. This can help in quick repairs and avoiding penalties.

Building a good relationship with the lessor can be beneficial. It ensures transparency and trust. This can help in avoiding unexpected penalties.

Negotiating Lease Terms

Negotiating lease terms can be a vital step in securing a car lease that fits your needs. Many people assume lease agreements are set in stone, but there is often room for discussion. Understanding how to negotiate can help you avoid penalties and get more favorable terms.

Flexible Terms

Dealerships may offer flexible lease terms. This can include adjusting the mileage limit or the lease duration. Being upfront about your driving habits can help in negotiating these terms. Always ask if there are options available that better suit your needs. You might be surprised by the flexibility offered.

Penalty Waivers

Some lease agreements come with penalty waivers. These waivers can cover early termination or excess wear and tear. Be sure to inquire about these options. Sometimes, dealerships are willing to include penalty waivers in the contract. This can save you money down the line.

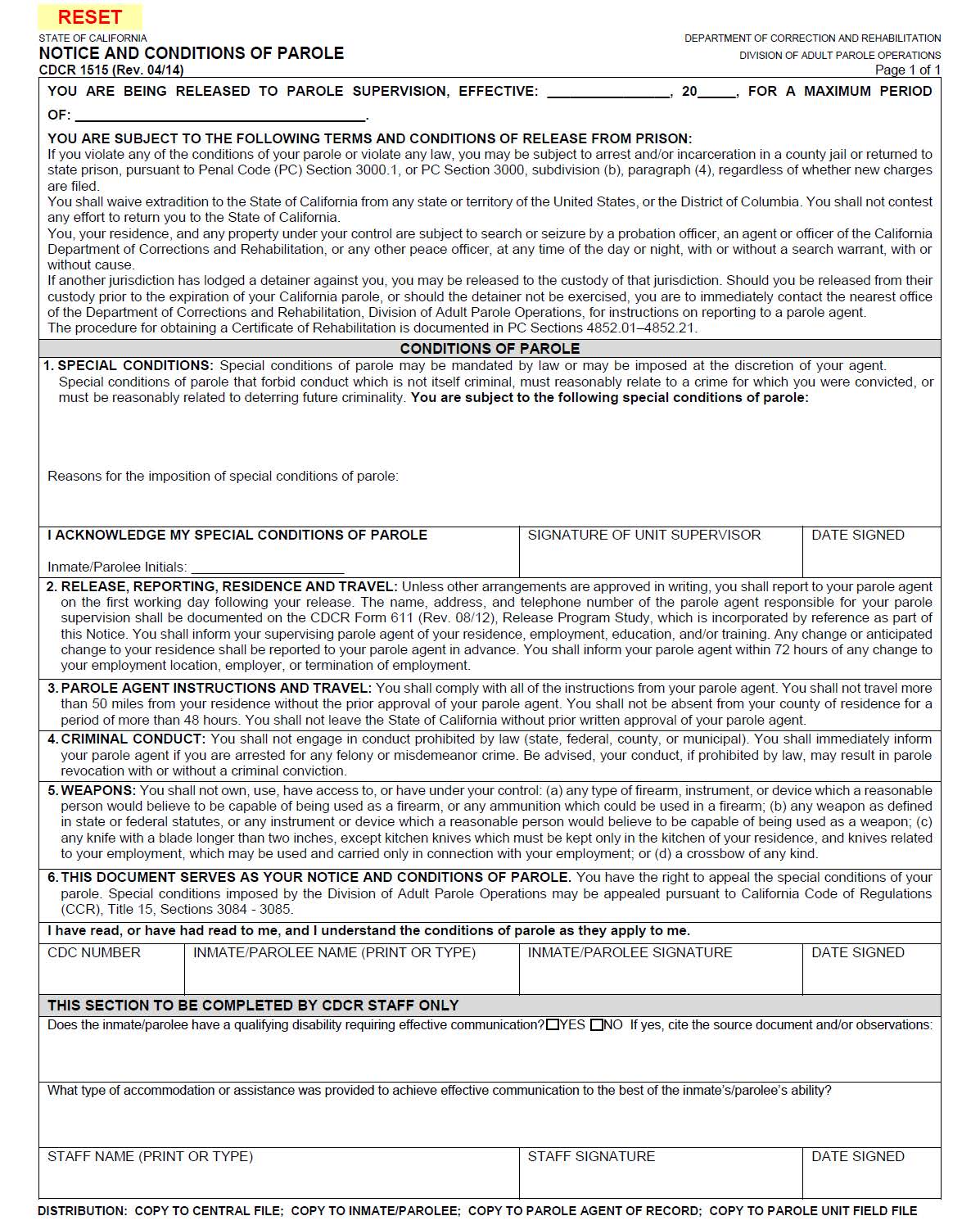

Alternatives To Breaking Lease

Breaking a car lease agreement can come with hefty penalties. But there are alternatives to breaking lease. These options can save you money and stress. Let’s explore some of these alternatives.

Lease Transfers

One alternative is a lease transfer. This means transferring your lease to another person. They take over the remaining payments and terms. You need to find someone willing to take the lease. There are online platforms that help with this. Ensure the new lessee meets the leasing company’s requirements. This process can help you avoid penalties.

Buying Out The Lease

Another option is buying out the lease. This means paying off the remaining balance on your lease. You then own the car outright. This can be a good option if you like the car. Check your lease agreement for the buyout amount. Compare this to the car’s current market value. This can help you decide if buying out the lease is worth it.

Credit: www.cdcr.ca.gov

Frequently Asked Questions

What Is A Car Lease Penalty?

A car lease penalty is a fee charged if you break lease terms. This includes early termination or excess mileage. Always read your lease agreement to understand these penalties.

How Much Is The Car Lease Penalty?

The penalty amount varies by lease agreement and can range from hundreds to thousands of dollars. Check your lease contract for specifics.

Can I Avoid Car Lease Penalties?

Yes, you can avoid penalties by adhering to the lease terms. This includes returning the car on time and staying within the mileage limit.

What Happens If I Exceed Lease Mileage?

Exceeding the mileage limit results in a penalty fee. This fee is usually charged per mile over the limit.

Conclusion

Pay attention to lease agreements before signing. Penalties can add unexpected costs. Always read the fine print. Understand all the terms. Ask questions if anything seems unclear. Avoid surprises later. Knowledge helps you make better decisions. Careful planning can save you money.

Protect yourself from unnecessary fees. Happy leasing!