Who Do You Contact If You’ve Already Accepted More Loan Money Than You Need?

If you’ve borrowed more money than you need, you might feel worried. But don’t panic.

You can take steps to fix this. Getting a loan can be tricky. Sometimes, you end up with more funds than necessary. This can lead to higher interest payments. It’s important to know who to contact to resolve this issue.

In this blog post, we’ll guide you through the process. You’ll learn who to reach out to and how to manage the extra money. This will help you avoid unnecessary debt and keep your finances on track. Stay with us as we explore your options and offer practical advice.

Assessing Your Loan Situation

It is crucial to assess your loan situation if you have accepted more money than needed. This ensures you manage your finances well and avoid unnecessary debt. Let’s break down the steps to understand your loan better.

Review Loan Terms

First, review the terms of your loan. Check the interest rate, repayment schedule, and any prepayment penalties. These details help you understand how the loan affects your finances.

- Interest rate: The cost of borrowing money

- Repayment schedule: When and how you will repay

- Prepayment penalties: Fees for paying off the loan early

Knowing these terms helps you make informed decisions. You can avoid extra costs and plan your repayments better.

Calculate Excess Amount

Next, calculate the excess amount. Determine how much loan money you do not need. This step is essential to avoid paying interest on unused funds.

- Write down the total loan amount.

- List your actual financial needs.

- Subtract your needs from the total loan amount.

For example, if your loan is $10,000 and your needs are $7,000, the excess amount is $3,000. Knowing this figure helps you decide your next steps.

| Loan Amount | Financial Needs | Excess Amount |

|---|---|---|

| $10,000 | $7,000 | $3,000 |

Understanding your excess amount helps you decide if you should return the extra funds or reallocate them. This assessment keeps your finances on track and saves you money.

Contacting Your Lender

If you have accepted more loan money than you need, contacting your lender is crucial. This step helps you avoid unnecessary debt. It also ensures proper use of funds. Here is a detailed guide on how to contact your lender effectively.

Identify Your Loan Provider

First, identify your loan provider. This could be a bank, credit union, or online lender. Look through your loan documents to find the name and contact information of your lender.

Check your email for any communications from your lender. Visit their official website for contact details. Make sure you have the correct information to avoid any delays.

Prepare Necessary Information

Before contacting your lender, gather all necessary information. This will help your conversation go smoothly.

- Your loan account number

- Personal identification details

- The amount of loan money you need to return

- Reason for returning the loan money

Having these details ready will save time. It will also help your lender understand your situation better.

Once you have all the information, make the call. Explain your situation clearly and ask for guidance on how to return the extra money.

| Information Needed | Details |

|---|---|

| Loan Account Number | Find it in your loan documents or emails |

| Personal Identification Details | Such as your ID or social security number |

| Amount to Return | Calculate the excess loan amount |

| Reason for Returning | Explain why you want to return the money |

Having a clear understanding of your situation will help you communicate effectively with your lender. It will also expedite the process of returning the excess loan money.

Requesting A Loan Adjustment

Accepted more loan money than you need? Don’t worry. You can request a loan adjustment. This process helps you reduce your loan amount. It can save you from paying extra interest.

Explain Your Situation

First, contact your loan provider. Explain your situation clearly. Tell them why you need less money. Be honest and provide any supporting documents. This helps them understand your needs better. A clear explanation increases your chances of approval.

Ask For Loan Reduction

Next, formally ask for a loan reduction. Write a request letter or email. Be specific about the amount you want to reduce. Mention your loan number and details. Keep your request polite and professional. Follow up if needed. Patience is key here.

Credit: digitalnewscity.com

Exploring Repayment Options

So, you’ve taken out more loan money than you need. Don’t worry. There are ways to handle this. Start exploring repayment options. This can help manage your finances better. Let’s dive into some strategies for repayment.

Check Early Repayment Terms

First, check the terms of your loan. See if early repayment is allowed. Some loans have penalties for this. Others may not. Look for any fees that apply. Understanding these terms is important. It helps you make informed decisions.

Consider Partial Repayment

You don’t have to repay the full amount at once. Consider partial repayment instead. This can reduce your interest over time. It also lowers your monthly payments. Start by paying a small portion back. Then, gradually increase the amount.

Contact your lender. Ask about partial repayment options. They can provide guidance. This helps you manage your loan more effectively.

Seeking Financial Advice

Accepting more loan money than needed can be stressful. The next step is to seek financial advice. This advice can help you manage the extra funds wisely.

Consult A Financial Advisor

A financial advisor can guide you on the best use of the extra loan money. They can help you create a repayment plan. This plan will ensure you do not waste the funds.

Here are some benefits of consulting a financial advisor:

- Expert advice on managing debt

- Personalized financial planning

- Strategies to reduce interest payments

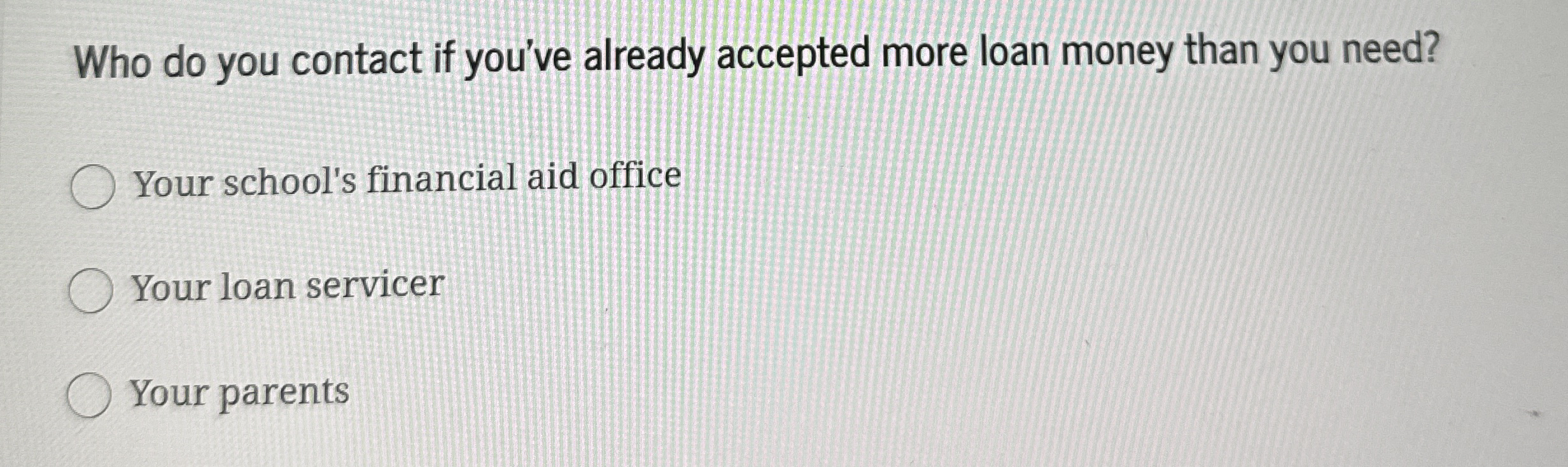

Utilize School Financial Aid Office

The school financial aid office is a valuable resource. They can provide guidance specific to your school’s policies. This can include returning the excess loan amount.

Steps to take:

- Contact the financial aid office.

- Explain your situation.

- Ask about the process for returning excess loan funds.

By following these steps, you can ensure you make informed decisions. This will help you manage your student loans effectively.

Credit: www.chegg.com

Understanding Implications

Accepting more loan money than you need can have several implications. It’s important to understand how this affects your financial health. Let’s break down the key aspects.

Impact On Interest Rates

When you borrow more money, the interest you pay increases. This means you end up paying more over the life of the loan. Even a small increase in the loan amount can lead to significant extra costs. This is especially true for long-term loans.

Here’s a simple table to show the impact of borrowing more:

| Loan Amount | Interest Rate | Total Interest Paid |

|---|---|---|

| $10,000 | 5% | $500 |

| $15,000 | 5% | $750 |

As shown, borrowing $15,000 instead of $10,000 results in higher interest costs. This can put a strain on your finances. Carefully evaluate how much you need before accepting a loan.

Effect On Credit Score

Taking on more debt than necessary can also affect your credit score. Lenders look at your debt-to-income ratio. If this ratio is too high, your credit score may drop. This makes it harder to get loans in the future.

Here are some key points to consider:

- A high debt-to-income ratio can lower your credit score.

- Too much debt can make you look risky to lenders.

- Paying off loans on time can improve your credit score.

Managing your debt wisely is crucial. Only borrow what you need and can afford to repay.

Monitoring Loan Statements

Monitoring your loan statements is crucial. It ensures you stay on top of your loan balance. This helps you avoid any unexpected financial surprises.

Verify Adjustments

Regularly check your loan statements. Look for any adjustments or changes. Ensure that all transactions are accurate.

- Check if any payments have been applied correctly.

- Look for any unexpected fees or charges.

- Verify that interest rates are as agreed.

If you find any discrepancies, contact your loan provider immediately. Correcting errors early can save you money.

Track Your Loan Balance

Tracking your loan balance is essential. It helps you understand how much you owe. This can help you plan your payments better.

- Note your starting loan balance.

- Record each payment you make.

- Compare your records with your loan statements.

Keeping track of your loan balance can also help you spot errors early. Accurate records can give you peace of mind.

| Task | Frequency |

|---|---|

| Verify Adjustments | Monthly |

| Track Your Loan Balance | Ongoing |

By monitoring your loan statements, you stay informed. This helps you manage your loan better and avoid unnecessary costs.

Credit: digitalnewscity.com

Planning For Future Borrowing

Planning for future borrowing is crucial if you’ve accepted more loan money than you need. It’s essential to understand your financial needs and borrow responsibly. This not only helps in managing current funds but also prepares you for future financial commitments.

Evaluate Financial Needs

Assess your current financial situation. Determine how much money you actually need. Consider your tuition, living expenses, and other costs. Compare this with the loan amount you have accepted. If there’s a significant difference, you may need to return the excess money. This will prevent unnecessary debt.

Think about your future expenses as well. Will you need more funds next semester? Plan ahead to avoid borrowing more than necessary later. This step is vital for maintaining financial stability.

Borrow Responsibly

Responsible borrowing means only taking what you need. Avoid the temptation to spend extra loan money on non-essential items. This can lead to financial stress in the future.

Understand the terms of your loan. Know the interest rates and repayment schedules. This knowledge helps in making informed decisions. Always read the fine print before accepting a loan.

Consult with a financial advisor if needed. They can provide valuable insights and help you make the best choices for your financial future.

Frequently Asked Questions

Who Should You Contact About Excess Loan Money?

Contact your loan servicer if you’ve accepted more loan money than you need. They can guide you on how to return the excess funds.

How Do You Return Excess Student Loan Money?

You can return excess student loan money by contacting your loan servicer. They will provide instructions for returning the funds.

Can You Reduce Your Loan Amount After Acceptance?

Yes, you can reduce your loan amount after acceptance. Contact your loan servicer to adjust the loan amount.

What Happens If You Don’t Return Excess Loan Money?

If you don’t return excess loan money, you’ll have to repay it with interest. This increases your total debt.

Conclusion

Contacting your lender is crucial. Explain your situation clearly. Request options for returning extra funds. This avoids unnecessary interest. Seek advice from financial advisors. They offer personalized guidance. Managing loans wisely ensures financial stability. Stay informed about your loan terms.

Always read the fine print. Taking action now prevents future stress. Make smart decisions for better financial health.