Which Statement Best Describes How An Investor Makes Money Off Debt: Expert Insights

An investor makes money off debt by earning interest or through capital gains. They either lend money and receive interest payments or invest in debt securities and sell them at a profit.

Debt investments are a crucial part of financial markets. Investors often use bonds, loans, or other debt instruments to earn returns. These options provide a steady income stream and can be less risky than stocks. Understanding how investors profit from debt can help you make informed decisions.

It’s not just about lending money; it’s about leveraging various financial tools. This blog will explore the key ways investors make money from debt. You’ll learn about interest income, capital gains, and other strategies. Let’s dive into how debt can be a profitable investment avenue.

Introduction To Debt Investment

Investing in debt can offer a steady income stream. It involves lending money to entities like corporations or governments. In return, investors receive regular interest payments. This method can be less risky compared to stock investments.

Types Of Debt Investment

There are several types of debt investment options. Bonds are the most common type. They include government bonds, corporate bonds, and municipal bonds. Each comes with different risk levels and returns. Another type is peer-to-peer lending. It allows individuals to lend money directly to borrowers.

Why Choose Debt Investment

Debt investments provide regular income through interest payments. They are often less volatile than stocks. This makes them a good choice for risk-averse investors. Debt investments can also offer tax advantages. Municipal bonds, for example, are often tax-free.

Interest Income

Interest income is a key way investors make money from debt. When an investor lends money to entities, they earn interest over time. This interest can be fixed or variable, providing different types of returns and risks.

Fixed Interest Payments

Fixed interest payments offer predictable income. The investor receives the same amount at regular intervals. This type of interest is usually found in bonds and certificates of deposit (CDs). The fixed rate ensures steady returns, making financial planning easier.

For example, if an investor buys a bond with a 5% annual interest rate, they know exactly how much they will earn each year. This predictability is appealing to conservative investors who prefer stable income.

| Investment Type | Interest Rate | Payment Frequency |

|---|---|---|

| Corporate Bond | 5% | Annually |

| Government Bond | 3% | Quarterly |

| Certificate of Deposit | 2.5% | Monthly |

Variable Interest Payments

Variable interest payments fluctuate based on market conditions. These payments are common in adjustable-rate mortgages (ARMs) and some corporate bonds. The interest rate adjusts periodically, impacting the income received.

This type of interest can be more lucrative but also riskier. For instance, if market rates rise, the investor earns more. Conversely, if rates drop, income decreases. This variability requires careful monitoring and may suit more experienced investors.

Here’s a simple list to compare fixed vs variable interest payments:

- Fixed: Predictable income, lower risk

- Variable: Potential for higher income, higher risk

Understanding these two types of interest payments can help investors choose the right debt instruments. Whether seeking stability or growth, both fixed and variable interest payments offer opportunities to earn income from debt.

Capital Gains

Understanding capital gains is crucial for investors. Capital gains occur when an asset is sold for a higher price than its purchase cost. This concept applies to various assets, including debt instruments. Making money through capital gains on debt involves selling the debt instrument at a profit. Let’s dive into how this works.

Selling Debt Instruments

Investors can purchase debt instruments like bonds or notes. Over time, the value of these instruments can rise. If an investor sells the instrument for a higher price than they paid, they earn a profit. This profit is known as a capital gain.

Different factors can influence the price of debt instruments. Interest rate changes, credit ratings, and economic conditions are some examples. Investors must monitor these factors to make informed decisions about selling.

Market Value Appreciation

The market value of debt instruments can appreciate over time. Appreciation means the value increases, often due to external factors. For example, if interest rates drop, existing bonds with higher rates become more valuable. Investors holding these bonds can sell them at a premium.

Another factor is the credit rating of the issuer. If the issuer’s credit rating improves, the debt instrument’s value may rise. Investors can take advantage of this appreciation by selling the instrument for a profit.

Consider the following example:

| Scenario | Original Price | Sale Price | Capital Gain |

|---|---|---|---|

| Bond Purchase | $1,000 | $1,200 | $200 |

In this example, the investor purchased a bond for $1,000. Later, they sold it for $1,200. The capital gain is $200, representing the profit from the sale.

Investors must understand the market dynamics to maximize capital gains. They should stay informed about interest rates, credit ratings, and economic conditions. This knowledge helps them determine the best time to sell and achieve the highest possible profit.

Credit: quizlet.com

Dividend Payments

Many investors earn money through dividend payments. Companies distribute these to shareholders. Dividends provide a steady income stream. This makes them attractive to many investors. Two key types of investments offer dividends: preferred stocks and convertible bonds.

Preferred Stocks

Preferred stocks often pay higher dividends than common stocks. They offer priority over common stocks in dividend distribution. If a company has limited funds, preferred stockholders get paid first. This makes preferred stocks less risky. Investors benefit from regular and predictable dividend payments. These payments can be quarterly or annually.

Convertible Bonds

Convertible bonds are another way to earn dividends. These bonds can be converted into common stock. They offer the benefits of both bonds and stocks. Investors earn regular interest payments. If the company’s stock performs well, they can convert the bonds. This allows them to benefit from stock price increases.

Bond Investments

Bond investments allow investors to earn money through debt. By purchasing bonds, investors lend money to issuers who agree to pay back with interest. Bonds are considered safer than stocks. They offer regular interest payments, known as coupons. Let’s explore the two main types of bonds: government bonds and corporate bonds.

Government Bonds

Government bonds, also called sovereign bonds, are issued by national governments. They are considered one of the safest investments. This is because they are backed by the government. Investors receive regular interest payments and the principal amount at maturity.

- U.S. Treasury Bonds: These are issued by the U.S. government. They are very safe.

- Savings Bonds: These are low-risk bonds for individual investors. They have a fixed interest rate.

- Municipal Bonds: Issued by local governments, these bonds fund public projects. They often offer tax-free interest.

Corporate Bonds

Corporate bonds are issued by companies. They offer higher interest rates compared to government bonds. This is because they carry more risk. Companies issue bonds to raise capital for expansion and operations.

- Investment-Grade Bonds: These bonds are issued by financially stable companies. They offer lower risk and moderate returns.

- High-Yield Bonds: Also known as junk bonds, they are issued by companies with lower credit ratings. They offer higher returns but come with higher risk.

- Convertible Bonds: These can be converted into a company’s stock. They offer the potential for higher returns if the company’s stock price rises.

Both government and corporate bonds can be a valuable part of an investment portfolio. They provide regular income and help diversify risk. Choose bonds based on your risk tolerance and investment goals.

Credit: quizlet.com

Loan Investments

Loan investments provide a way for investors to make money off debt. They lend money and earn interest in return. This income can be steady and reliable. Loan investments can take many forms. Let’s explore two popular types: peer-to-peer lending and private loans.

Peer-to-peer Lending

Peer-to-peer (P2P) lending connects borrowers directly with investors through online platforms. Borrowers apply for loans, and investors fund them. Investors earn interest on the money they lend. P2P platforms handle the process. They assess borrowers’ creditworthiness and manage payments. This makes it easier for investors to get involved.

Here are some benefits of P2P lending:

- Higher returns compared to traditional savings accounts

- Diversification of investment portfolio

- Low barriers to entry

Investors can start with small amounts. They can lend to multiple borrowers, spreading risk. This helps protect against defaults. Peer-to-peer lending can be a great addition to an investment strategy.

Private Loans

Private loans involve lending money directly to individuals or businesses. This type of investment can offer higher returns. Investors often negotiate terms directly with borrowers. They set interest rates, repayment schedules, and other conditions. Private loans can be secured or unsecured. Secured loans have collateral, such as property or assets. Unsecured loans rely on the borrower’s creditworthiness.

Advantages of private loans include:

- Potential for higher interest rates

- Direct control over loan terms

- Opportunity to build relationships with borrowers

Private loans can be more risky. Investors need to carefully assess borrowers. They should also ensure proper legal documentation. This protects their investment and ensures repayment.

| Feature | Peer-to-Peer Lending | Private Loans |

|---|---|---|

| Platform | Online | Direct |

| Risk | Moderate | Higher |

| Control | Limited | High |

| Returns | Moderate to High | High |

Both peer-to-peer lending and private loans offer unique benefits. They can be valuable parts of a diversified investment portfolio. Investors should consider their goals, risk tolerance, and resources.

Risk Factors

Investing in debt can be profitable, but it comes with risks. Understanding these risk factors is crucial to making informed decisions. Let’s explore some key risks involved in debt investments.

Default Risk

Default risk is the chance that the borrower won’t repay the loan. This can happen if the borrower faces financial difficulties. When a borrower defaults, investors lose their money. Assessing the borrower’s creditworthiness helps reduce this risk. Look at credit ratings and financial statements.

Interest Rate Risk

Interest rate risk arises from fluctuating interest rates. If rates increase, the value of existing debt drops. This happens because new debt offers better returns. Conversely, if rates fall, the value of existing debt rises. Investors must monitor interest rate trends to manage this risk.

Credit: www.chegg.com

Expert Tips

Investing in debt can be a reliable way to earn returns. However, making money off debt requires careful planning and strategy. Here are some expert tips to help you make the most of your debt investments.

Diversification Strategies

Diversification is key to managing risk. Spreading your investments across different types of debt can protect you from market fluctuations. Consider various options such as:

- Government Bonds: These are considered safe. They offer stable returns.

- Corporate Bonds: These can be riskier but offer higher yields.

- Municipal Bonds: These are tax-free and provide steady income.

Balancing these types can help stabilize your portfolio. Use a mix that aligns with your risk tolerance.

Monitoring Market Trends

Staying updated on market trends is crucial. Changes in interest rates, inflation, and economic policies can impact your returns.

Here are some tips to keep an eye on the market:

- Follow Financial News: Stay informed about economic changes.

- Use Financial Tools: Leverage apps and websites for real-time data.

- Consult Experts: Financial advisors can provide valuable insights.

By monitoring trends, you can make timely decisions. This helps to maximize your earnings and reduce risks.

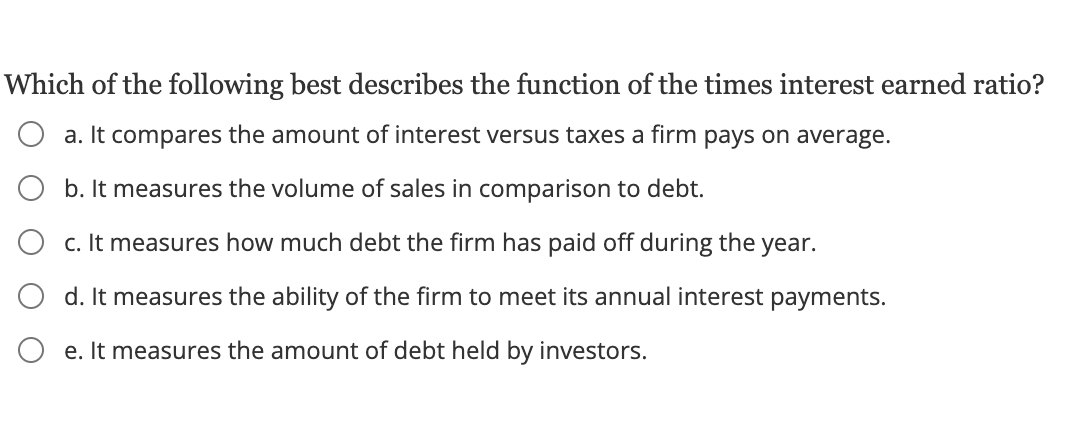

Frequently Asked Questions

How Do Investors Make Money From Debt?

Investors make money from debt through interest payments and capital gains. They lend money to borrowers who repay with interest. This provides a steady income stream.

What Is The Primary Way To Profit From Debt?

The primary way to profit from debt is through interest. Lenders earn interest over the loan term, generating consistent returns.

Can Debt Investments Offer Capital Gains?

Yes, debt investments can offer capital gains. If interest rates drop, bond prices rise, allowing investors to sell at a profit.

Are Bonds A Common Debt Investment?

Yes, bonds are a common debt investment. Investors buy bonds, which pay interest over time, providing steady income.

Conclusion

Investors make money from debt through interest payments. They lend money to borrowers. In return, they receive interest. This interest becomes their profit. Another way is through bonds. Investors buy bonds and earn interest over time. Finally, debt investments can offer steady income.

This income helps in building wealth over time. Understanding these methods is key. It makes debt investing clearer. Always research and stay informed. That way, you can make smarter investment decisions.