Which Is A Positive Reason For Using A Credit Card To Finance Purchases: Smart Benefits

Using a credit card to finance purchases can be smart. It offers many benefits if used wisely.

Credit cards provide convenience and security. They help build your credit score when managed properly. By using a credit card, you can track your spending easily. This can lead to better budgeting and financial planning. Credit cards often come with rewards and cashback offers.

These incentives can save money on future purchases. Furthermore, many credit cards offer fraud protection. This can give you peace of mind when shopping. Understanding the positive reasons for using credit cards can enhance your financial strategy. So, let’s explore why using a credit card can be a beneficial financial decision.

Credit: moneycoach.ai

Introduction To Credit Cards

Credit cards are a popular financial tool. They offer convenience and flexibility. Using credit cards can have many benefits. This blog post explores the positive reasons for using a credit card to finance purchases. Let’s start with an introduction to credit cards.

Definition And Function

A credit card is a small plastic card. It allows you to borrow money for purchases. You agree to pay back the money later, often with interest. Credit cards come with a credit limit. This limit is the maximum amount you can borrow. Credit cards are issued by banks and financial institutions.

When you use a credit card, the issuer pays the merchant on your behalf. Later, you repay the issuer. You can choose to pay the full amount or make minimum payments. Making timely payments helps build a good credit history.

Popularity And Usage

Credit cards are widely used around the world. They are especially popular in the United States. According to a study, about 70% of Americans have at least one credit card. Credit cards are used for various purchases. These include online shopping, travel, and daily expenses.

Many people prefer credit cards for their rewards programs. These programs offer points, cash back, and other benefits. Credit cards also provide security. They protect against fraud and unauthorized charges. Using credit cards responsibly can improve your credit score.

Here is a table showing some popular uses of credit cards:

| Use | Percentage of Users |

|---|---|

| Online Shopping | 80% |

| Travel | 60% |

| Daily Expenses | 50% |

In summary, credit cards are a convenient financial tool. They offer many benefits when used wisely. Understanding how they work can help you make better financial decisions.

Credit: educounting.com

Reward Programs

Using a credit card to finance purchases can offer many benefits, especially through reward programs. These programs provide incentives for cardholders, making everyday spending more rewarding. By taking advantage of these perks, you can maximize the value of your credit card.

Cashback Offers

One of the most popular reward programs is cashback offers. With cashback cards, you earn a percentage of your spending back as cash. This can range from 1% to 5% or even higher for special categories.

For example, some cards offer higher cashback rates on groceries, gas, or dining. This means every time you use your card in these categories, you save money. Over time, these savings can add up significantly.

Here is a simple table to illustrate potential cashback earnings:

| Category | Cashback Rate | Monthly Spending | Monthly Cashback |

|---|---|---|---|

| Groceries | 3% | $500 | $15 |

| Gas | 2% | $200 | $4 |

| Dining | 4% | $250 | $10 |

Points And Miles

Another valuable type of reward program involves earning points and miles. These are typically associated with travel and can be redeemed for flights, hotel stays, and other travel-related expenses.

Each time you use your credit card, you accumulate points or miles based on your spending. For frequent travelers, these rewards can lead to significant savings on trips.

Consider this simple example:

- You earn 1 mile for every $1 spent.

- Each mile is worth approximately $0.01.

- Spending $1,000 per month could earn you 12,000 miles per year.

- 12,000 miles could be enough for a free domestic flight.

By using a card with a good points or miles program, you can enhance your travel experiences without extra cost.

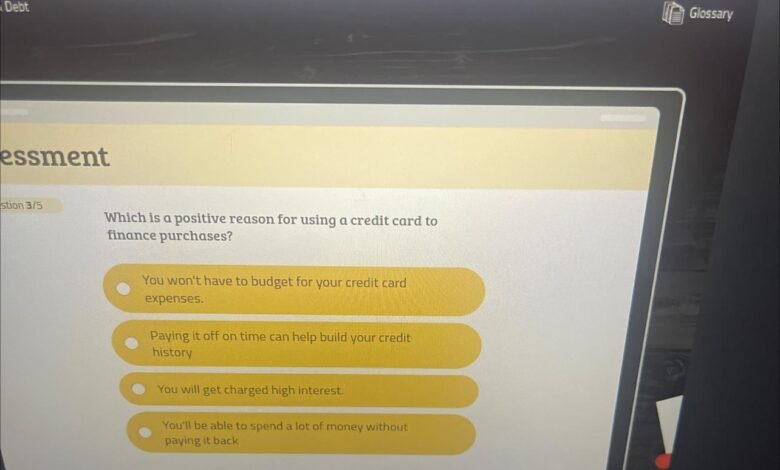

Building Credit History

Using a credit card wisely can be a smart financial decision. One of the most significant benefits is building credit history. A good credit history is essential for your financial future. It can help you secure loans, rent apartments, and even get better insurance rates.

Importance Of Credit Score

Your credit score is a three-digit number. It shows lenders how reliable you are with borrowing money. This score ranges from 300 to 850. The higher your score, the better. A good score can open doors to financial opportunities.

Here are some reasons why a good credit score is important:

- Lower interest rates on loans and credit cards

- Better chances of loan approval

- Higher credit limits

- Better rental agreements

How Credit Cards Help

Credit cards can be a tool to build and improve your credit score. Here’s how:

- Make regular purchases and pay them off on time. This shows lenders you are responsible.

- Keep your credit utilization low. Use less than 30% of your credit limit.

- Keep old accounts open. A long credit history can boost your score.

- Check your credit report for errors. Correcting mistakes can improve your score.

Using a credit card can be a positive financial decision. It can help you build a strong credit history. This opens up many financial opportunities for you in the future.

Purchase Protection

One of the most compelling reasons for using a credit card to finance purchases is purchase protection. This feature can safeguard your transactions and provide peace of mind. Credit cards often come with built-in protections that can save you money and headaches.

Fraud Protection

Credit cards offer robust fraud protection mechanisms. If your card is lost or stolen, you are generally not held responsible for unauthorized charges. This means you can shop without the worry of financial loss due to fraud.

Many credit card companies monitor your account for suspicious activity. They will alert you if anything unusual is detected. This makes it easier to catch fraudulent transactions early and minimize damage.

Some cards even offer zero-liability policies. This ensures you won’t pay a cent for unauthorized charges. It’s like having a safety net whenever you swipe your card.

Extended Warranties

Many credit cards provide extended warranties on items you purchase. This can be a significant benefit, especially for electronics and appliances. Typically, the card will extend the manufacturer’s warranty by an additional year.

Extended warranties mean you don’t need to buy separate protection plans. This saves you money and simplifies your shopping experience. If something goes wrong with your purchase, the credit card company will cover the repair or replacement.

Check your card’s terms and conditions to know which items qualify. Not all purchases are covered, so it’s essential to be informed. But when they are, you get extra peace of mind at no additional cost.

Convenience And Flexibility

Using a credit card to finance purchases offers convenience and flexibility. These benefits make managing your finances easier. Let’s explore the positive aspects of using a credit card under the subheadings: Ease of Use and Emergency Expenses.

Ease Of Use

Credit cards are extremely easy to use. You don’t need to carry cash. Just swipe or tap your card and you’re done. This is especially useful in today’s digital age.

Online shopping is another area where credit cards shine. You can easily make purchases from the comfort of your home. This reduces the need to visit physical stores.

Credit cards also help in tracking expenses. Monthly statements provide a clear record of your spending. This makes budgeting easier.

Emergency Expenses

Emergencies can happen at any time. Having a credit card can be a lifesaver. You might face unexpected medical bills or car repairs. A credit card ensures you have funds available immediately.

Credit cards offer a safety net. They allow you to handle emergencies without stress. You can pay off the balance over time, easing the financial burden.

Some credit cards come with additional benefits. These may include travel insurance or purchase protection. These features add extra security in emergency situations.

In conclusion, the convenience and flexibility of using a credit card make it a valuable financial tool. Whether it’s for ease of use or handling emergency expenses, credit cards offer numerous advantages.

Credit: educounting.com

Budgeting And Tracking

Using a credit card for financing purchases can offer several advantages. One of the main benefits is the ability to budget and track expenses effectively. Credit cards come with various tools and features that can help you manage your finances more efficiently. Below, we delve into some of these features and explain how they can aid in better budgeting and tracking.

Expense Management Tools

Most credit cards provide expense management tools. These tools allow you to categorize your spending. You can see where your money goes each month. Many cards offer apps or online portals. These platforms show detailed spending reports. They can help you identify patterns and areas for improvement.

Some credit cards even offer budgeting features. You can set spending limits for different categories. This helps you stay within your budget. It also alerts you if you are about to overspend. Here are some common features:

- Spending categories

- Monthly budgets

- Spending alerts

- Spending reports

Monthly Statements

Credit cards provide detailed monthly statements. These statements list all your transactions. You can easily review your purchases. This helps you track your spending. You can also verify that all charges are accurate. Reviewing statements can help you catch any unauthorized transactions.

Monthly statements are also useful for budgeting. You can see how much you spend each month. This helps you plan your finances better. It also makes it easier to stick to your budget. Here is what you typically find in a statement:

| Transaction Date | Description | Amount |

|---|---|---|

| 01/01/2022 | Grocery Store | $50.00 |

| 01/02/2022 | Restaurant | $30.00 |

Using these tools and statements, you can better manage your finances. This helps you make informed decisions and improve your spending habits.

Introductory Offers

Introductory offers provide an excellent reason for using a credit card to finance purchases. These offers often include benefits that can save you money and provide rewards. Let’s explore two popular types of introductory offers.

0% Apr Promotions

Many credit cards offer 0% APR promotions as an introductory deal. With these promotions, you pay no interest on your purchases for a set period. This period can range from six months to over a year. It gives you time to pay off your balance without extra costs.

Using a credit card with a 0% APR promotion can help manage large purchases. You can spread payments over several months. This avoids the burden of immediate full payment. It’s a useful tool for budgeting and managing expenses.

Sign-up Bonuses

Sign-up bonuses are another attractive feature of credit card introductory offers. These bonuses often reward new cardholders with points, cashback, or miles. To qualify, you must spend a specific amount within a set timeframe. This can be as low as a few hundred dollars.

Sign-up bonuses can provide significant value. They help offset the cost of your purchases. For example, a sign-up bonus might cover a portion of a vacation or a large purchase. This makes the initial spending more rewarding and beneficial.

Travel Benefits

Using a credit card for travel purchases can offer several benefits. These benefits can make your travel experience smoother and more enjoyable. One of the main perks is travel-related protections and services.

Travel Insurance

Many credit cards offer travel insurance. This can cover trip cancellations, delays, or interruptions. If your trip gets canceled, you may get a refund for non-refundable expenses. Travel insurance can also cover lost or delayed luggage. This means you won’t have to worry about your belongings.

Lounge Access

Some credit cards offer access to airport lounges. These lounges provide a comfortable space to relax before your flight. Free snacks, drinks, and Wi-Fi are often available. Lounges can make long layovers more bearable. Enjoy a quiet space, away from the crowded airport.

Frequently Asked Questions

What Are The Benefits Of Using A Credit Card?

Using a credit card offers convenience, rewards, and building credit history. It provides purchase protection and fraud liability. Many cards offer cashback, points, or travel rewards.

Is It Safer To Use A Credit Card?

Yes, credit cards offer better fraud protection compared to debit cards. They provide zero liability for unauthorized transactions.

How Does A Credit Card Build Credit?

Responsible credit card use helps build a good credit history. On-time payments and low balances improve your credit score.

Can Credit Cards Offer Purchase Protection?

Yes, many credit cards offer purchase protection. This includes extended warranties, return protection, and coverage for damaged or stolen items.

Conclusion

Using a credit card wisely offers many benefits. It helps build your credit score. You can earn rewards on everyday purchases. Paying on time avoids interest fees. Credit cards provide fraud protection. They are convenient and widely accepted. Manage spending to avoid debt.

Credit cards can be a helpful tool. Use them responsibly for maximum benefits. Happy spending!