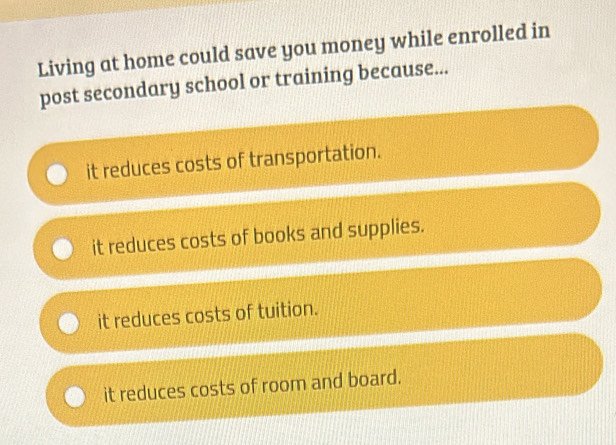

Living At Home Could Save You Money While Enrolled In Post Secondary School Or Training Because: Financial Benefits Abound

Living at home while in school can save you money. This choice offers financial relief and other benefits.

When you stay at home during your studies, you avoid rent and utility costs. These savings can make a big difference, especially with tuition and other school expenses. Living at home also means you have more support from your family.

This can help you focus better on your studies. Plus, you’ll have access to home-cooked meals, which are often healthier and cheaper than eating out. By staying at home, you can also reduce student loan debt. In the long run, this can lead to better financial stability. So, living at home is a smart choice for students who want to save money and succeed in their studies.

Reduced Housing Costs

Living at home during post-secondary school or training can significantly reduce housing costs. This choice allows students to save money on rent and utilities, making education more affordable.

Living at home during your post-secondary education can lead to significant savings. One of the biggest savings comes from reduced housing costs. Housing can be a major expense for students. By staying at home, you can avoid many of these costs.Avoid Rent Payments

Rent payments can take a big chunk out of your budget. Students often face high rent prices in college towns. Living at home means you do not have to worry about paying monthly rent. This can save you hundreds or even thousands of dollars each month. That money can be used for tuition, books, or other necessities.Save On Utilities

Utility bills can also add up quickly. When you live on your own, you have to pay for water, electricity, internet, and other services. Living at home allows you to share these costs with your family. This means lower utility bills for everyone. It’s another way to keep your expenses down while you study. “`Lower Food Expenses

Living at home during your post-secondary education or training can save you significant money. One of the most notable areas where you can cut costs is food. By living at home, you can lower your food expenses in various ways.

Share Family Meals

Sharing family meals means you don’t have to buy or cook your food. Parents often prepare meals for the whole family, saving you the effort and cost. This allows you to enjoy home-cooked meals without spending your own money.

Reduced Grocery Bills

Living at home can also reduce your grocery bills. Families usually buy groceries in bulk, which is cheaper. You can benefit from these economies of scale. This means you contribute less to the overall grocery budget. It lightens your financial burden. Moreover, you can access a well-stocked pantry at home.

Transportation Savings

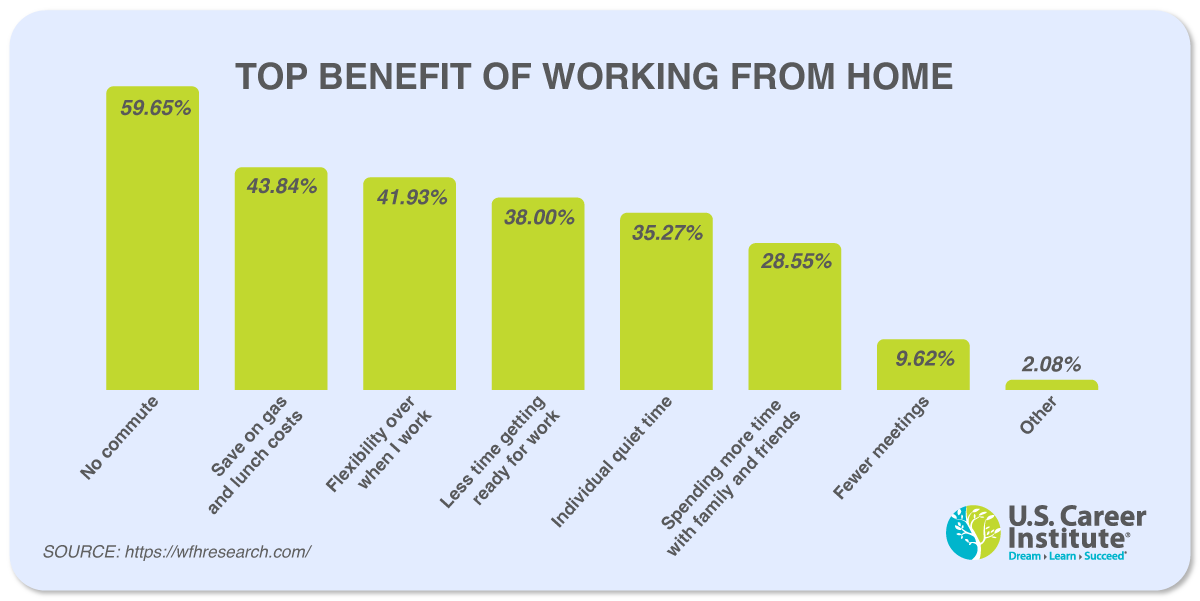

Living at home during post-secondary education or training can help you save money on various expenses. One significant area of savings is transportation costs. By staying at home, you can avoid spending on daily commutes, reduce the need for a personal vehicle, and benefit from sharing a family car. These savings can add up quickly, easing your financial burden during your studies.

No Commuting Costs

By living at home, you can eliminate the need to commute to your school or training center daily. This can save you a significant amount of money on gas, parking fees, and public transportation fares. For students who live far from their campus, commuting costs can be quite high. Cutting these costs can free up funds for other essential expenses like textbooks, supplies, and meals.

Consider the average costs of commuting:

- Gas: $50-$100 per month

- Parking fees: $20-$50 per month

- Public transportation: $30-$70 per month

By staying at home, you can save between $100 and $220 per month. That’s a significant amount that can be better spent on your education.

Use Family Vehicle

Living at home often means having access to the family vehicle. This can save you the expense of buying, insuring, and maintaining your own car. The costs associated with owning a vehicle can be quite high and include:

| Expense | Monthly Cost |

|---|---|

| Car Payment | $200-$500 |

| Insurance | $100-$200 |

| Maintenance | $50-$100 |

By sharing a family vehicle, you can avoid these costs entirely. This can save you between $350 and $800 per month. Having access to a reliable vehicle without the financial burden allows you to focus more on your studies and less on transportation logistics.

In addition to cost savings, using the family vehicle can also provide more convenience and flexibility. You won’t have to rely on public transportation schedules or worry about parking on campus. This can save you time and reduce stress, making your academic journey smoother.

Credit: www.uscareerinstitute.edu

Access To Family Resources

Living at home while enrolled in post-secondary school or training offers many benefits. One of the most significant advantages is access to family resources. These resources can help you save money and reduce stress during your studies.

Use Of Household Supplies

At home, you can use household supplies without extra cost. Items like cleaning products, toiletries, and groceries are readily available. This access eliminates the need to buy these items yourself. It also saves time as you don’t have to shop as often.

Shared Technology

Living at home means you can share technology with family members. You can use the family computer, printer, and internet connection. This access is crucial for completing assignments and research. It saves you from buying expensive gadgets or paying for additional internet services.

Support System

Living at home during your post-secondary studies can have significant benefits. One of the most valuable advantages is having a strong support system. This support system can provide emotional aid, academic help, and a sense of stability. Below, we will explore how each of these elements can contribute to your success.

Emotional Support

Having family around offers a comforting presence. They understand your stress and can provide a listening ear. This emotional support helps you manage the pressures of academic life.

When you’re feeling overwhelmed, a familiar voice can make a big difference. This can reduce anxiety and improve your overall well-being. A strong emotional foundation helps you stay focused on your studies.

Academic Assistance

Family members can often assist with your studies. They may have knowledge in subjects you find challenging. Their help can improve your understanding and boost your grades.

Parents or siblings might offer to review your papers or help you study for exams. This added academic assistance can be invaluable. It ensures that you are not struggling alone.

In some cases, having someone to discuss ideas with can spark new insights. This collaborative learning can deepen your comprehension and retention of material.

Time Management

Living at home during post-secondary school or training can help you save money. One significant benefit is improved time management. Managing your time well can lead to academic success and less stress. Let’s explore how living at home can give you more control over your time.

More Study Time

Living at home can provide a quiet and comfortable study environment. You can focus better without the distractions of dorm life. This extra study time can lead to better grades. You can dedicate more hours to your coursework. This can be especially helpful during exam periods.

Flexible Schedule

When you live at home, you often have a more flexible schedule. You can adjust your study times according to your needs. This flexibility allows you to work on assignments at your own pace. You can also take breaks when needed without the pressure of a busy campus life. Balancing work, study, and rest becomes easier.

Debt Reduction

Living at home while enrolled in post-secondary school or training can significantly help in reducing debt. By staying with family, students can save money on rent, utilities, and other living expenses. This financial relief allows them to focus on their studies without the stress of accumulating excessive debt. Here are some ways living at home can help with debt reduction:

Lower Student Loans

One major benefit of living at home is the potential to take out lower student loans. Without the need to pay for housing, students can borrow less money. This reduces the total amount of student loan debt they accumulate. In the long run, this means fewer monthly payments and less interest to pay off.

| Expense | Living at Home | Living Away |

|---|---|---|

| Rent | $0 | $800/month |

| Utilities | $0 | $150/month |

| Food | $100/month | $300/month |

| Total | $100/month | $1,250/month |

As the table shows, living at home can save a student significant monthly expenses. This translates into needing less financial aid and fewer loans.

Avoid Credit Card Debt

Living at home helps students avoid credit card debt. With fewer expenses, students are less likely to rely on credit cards for daily necessities. This reduces the risk of falling into high-interest debt. Credit card debt can quickly spiral out of control, leading to long-term financial problems.

- No rent payments mean lower monthly costs.

- Reduced need for borrowing money.

- Less temptation to use credit cards for emergencies.

By avoiding credit card debt, students can maintain a healthier financial profile. This sets them up for better financial stability post-graduation.

Credit: edubirdie.com

Opportunity To Save

Living at home during post-secondary education or training can be a smart financial decision. It offers numerous opportunities to save money. You can allocate these savings towards important financial goals. This strategy can make your financial future more secure.

Build Emergency Fund

Building an emergency fund is essential. It gives you a safety net for unexpected expenses. You might face sudden health issues or car repairs. Having savings can reduce stress during these times. Living at home can help you save more money for this purpose.

By not paying rent, you can save a significant amount. This money can be directed towards your emergency fund. Aim to save at least three to six months’ worth of living expenses. This will give you peace of mind. You will be better prepared for financial emergencies.

Save For Future Expenses

Living at home can also help you save for future expenses. Tuition fees, books, and supplies can be costly. You might also want to save for a car or a vacation. Setting aside money now can make these expenses more manageable later.

Consider creating a budget to track your savings. Allocate a portion of your income towards future expenses. This disciplined approach can help you achieve your financial goals. You will feel more secure and prepared for the future. Living at home can make a big difference in your financial stability.

Credit: news.delaware.gov

Frequently Asked Questions

How Does Living At Home Save Money?

Living at home saves money by eliminating rent and utility costs. It also reduces expenses for groceries and transportation.

Can Living At Home Reduce Student Debt?

Yes, living at home can significantly reduce student debt. It lowers living expenses, allowing you to allocate more funds towards tuition.

Is Living At Home Beneficial For Mental Health?

Living at home can provide emotional support. It offers a familiar environment, reducing stress and anxiety during your studies.

What Are The Financial Benefits Of Living At Home?

Financial benefits include savings on rent, utilities, and food. It also allows you to save more money for future investments.

Conclusion

Saving money while attending school is crucial. Living at home helps you achieve that. You can avoid rent and other expenses. This allows you to focus on studies and training. It reduces financial stress. You can invest saved money in other needs.

Living at home provides a support system. It can make your school life easier. Consider this option for a smoother educational journey. Remember, every penny saved now benefits your future.