When Looking For Pre Approval On A Car Loan You Should Not Overlook These Tips

Getting pre-approved for a car loan can save time and stress. It simplifies the buying process and helps you understand your budget.

But, there are common mistakes to avoid. When seeking pre-approval for a car loan, it’s easy to make errors. These mistakes can cost you money or delay your loan approval. Knowing what not to do is as important as knowing the right steps.

In this blog post, we’ll explore the pitfalls to avoid when getting pre-approved for a car loan. This ensures a smooth and hassle-free experience. Whether you are a first-time buyer or an experienced shopper, this guide will help you navigate the process with confidence. Let’s dive in and learn what to avoid for a successful pre-approval journey.

Importance Of Pre-approval

Getting pre-approved for a car loan is essential. It helps you understand how much you can spend on a car. This step can save you time and stress during the car buying process.

Benefits Of Pre-approval

Pre-approval offers many benefits. Firstly, it gives you a clear budget. You will know the exact amount you can afford. This prevents you from overspending.

Secondly, pre-approval can improve your negotiating power. Dealers take you more seriously. They know you are a committed buyer with financing ready. This can lead to better deals and discounts.

Lastly, pre-approval helps you compare interest rates. You can shop around and choose the best rate. This can save you money over the life of the loan.

Impact On Car Buying Process

Pre-approval makes the car buying process smoother. With a set budget, you can focus on cars within your range. This reduces the time spent at dealerships.

In addition, pre-approval speeds up the final paperwork. The dealer already knows your loan details. This means you can drive off the lot faster.

Pre-approval also reduces the risk of loan denial. You avoid the disappointment of falling in love with a car only to find out you can’t afford it.

In summary, pre-approval is crucial. It provides a clear budget, improves your negotiating power, and makes the car buying process smoother and quicker.

:max_bytes(150000):strip_icc()/how-to-get-pre-approved-for-a-car-loan-7485858-final-585e6b57c4374f26805bf922206eb7e8.jpg)

Credit: www.investopedia.com

Check Your Credit Score

Before seeking pre-approval on a car loan, it’s crucial to check your credit score. Your credit score plays a significant role in determining the interest rates you will receive. A higher score often results in better loan terms. Knowing your score can help you understand your financial standing and improve your chances of securing favorable loan conditions.

How To Access Your Credit Report

Accessing your credit report is straightforward. There are several ways to obtain your credit report. The three major credit bureaus—Experian, TransUnion, and Equifax—offer free annual reports.

- Visit the official website: AnnualCreditReport.com

- Complete the request form with your personal information.

- Choose which credit bureau’s report you want to access.

- Verify your identity by answering security questions.

- Download and review your credit report.

Make sure to review all three reports for accuracy. Errors on your credit report can negatively impact your score.

Improving Your Credit Score

Improving your credit score takes time and effort but is achievable with consistent actions. Here are some steps to help you improve your score:

- Pay your bills on time: Timely payments are crucial. Late payments can significantly lower your score.

- Reduce outstanding debt: High credit card balances can hurt your score. Aim to keep balances low.

- Avoid opening new accounts: New credit accounts can lower your score temporarily. Be cautious with new credit inquiries.

- Monitor your credit report: Regularly check your report for errors. Dispute any inaccuracies immediately.

By following these steps, you can improve your credit score. A better score can lead to more favorable car loan terms.

Budgeting For Your Car Purchase

Before seeking pre-approval for a car loan, it’s crucial to budget. Proper budgeting ensures you choose a car within your financial limits. This section will guide you through the process of calculating your budget and considering additional costs.

Calculating Your Budget

Begin by assessing your current financial situation. Look at your income, monthly expenses, and savings. This helps you understand how much you can allocate for a car payment.

- Income: Calculate your monthly income after taxes.

- Expenses: List all your monthly expenses, including rent, utilities, groceries, and debts.

- Savings: Determine how much you have saved for a down payment.

Use the 20/4/10 rule as a guideline: put down 20% of the car’s price, finance it for no more than four years, and ensure your monthly car payment is no more than 10% of your monthly income.

| Component | Percentage |

|---|---|

| Down Payment | 20% |

| Loan Term | 4 years max |

| Monthly Payment | 10% of income |

Considering Additional Costs

Remember, the car’s price is not the only cost you will face. Several additional expenses will affect your budget.

- Insurance: Car insurance is mandatory. Get quotes to estimate costs.

- Maintenance: Regular maintenance is essential. Plan for oil changes, tire rotations, etc.

- Registration and Fees: Calculate the cost of registering your car and any other fees.

- Fuel: Estimate your monthly fuel costs based on your driving habits.

- Depreciation: Understand that your car will lose value over time.

By considering these additional costs, you can avoid financial surprises. This ensures a smoother car ownership experience.

Credit: www.facebook.com

Understanding Loan Terms

Understanding loan terms is crucial before getting pre-approval for a car loan. Many people overlook this step, which can lead to confusion and unexpected costs. Knowing the basic terms can help you make better decisions.

Interest Rates

Interest rates determine how much extra you pay on top of the loan amount. They can vary widely depending on your credit score and the lender’s policies. A lower interest rate saves you money over the life of the loan. Always compare rates from multiple sources before committing.

Loan Duration

The loan duration affects your monthly payments and the total cost of the loan. A shorter duration means higher monthly payments but less interest paid overall. Conversely, a longer duration lowers your monthly payments but increases the total interest. Choose a duration that fits your financial situation.

Comparing Lenders

When seeking pre-approval for a car loan, comparing lenders is crucial. Different lenders offer various terms, interest rates, and benefits. Knowing what each lender provides can save you money and stress. Below, we’ll explore the different types of lenders and what factors to consider when comparing them.

Different Types Of Lenders

There are several types of lenders to consider for a car loan. Traditional banks, credit unions, and online lenders are the most common.

Banks usually have strict approval criteria. They may offer higher interest rates but provide a sense of security and trust.

Credit unions often have lower interest rates. They are member-owned, so they might offer better customer service and more flexible terms.

Online lenders can be convenient. They offer fast approvals and competitive rates but lack the personal touch of local institutions.

Factors To Consider

When comparing lenders, focus on a few key factors. Interest rates, loan terms, fees, and customer service should top your list.

Interest rates can vary widely. A lower rate can save you a lot of money over the life of the loan.

Loan terms also matter. Shorter terms might mean higher monthly payments but lower total interest paid. Longer terms can make payments more manageable but increase total interest costs.

Be aware of any fees. Application fees, late payment fees, and prepayment penalties can add up. Always read the fine print.

Customer service is vital. You want a lender who is helpful and available when you need them. Look for reviews and ask for recommendations.

By focusing on these factors, you can find the best lender for your car loan needs.

Gather Necessary Documentation

Securing pre-approval for a car loan involves several essential steps. One key step is gathering necessary documentation. Proper documentation helps lenders assess your financial stability. It also ensures a smoother approval process.

Proof Of Income

Showing proof of income is crucial. Lenders need to verify your ability to repay the loan. Recent pay stubs are often required. These documents show your earnings and employment status. If you are self-employed, provide recent tax returns. Bank statements can also be helpful. They offer a clear picture of your financial health.

Identification Requirements

Valid identification is another vital requirement. Lenders need to confirm your identity. A driver’s license is usually accepted. Sometimes, a passport or state ID may be needed. Ensure your ID is current and not expired. This helps avoid delays in the approval process.

Pre-approval Application Process

Getting pre-approved for a car loan gives you an edge. It helps in knowing your budget. It also makes car buying smoother. But how do you start? What steps should you follow? Let’s dive into the pre-approval application process.

Steps To Apply

- Gather Your Documents: Collect proof of income, identification, and credit history.

- Check Your Credit Score: Ensure your credit score is accurate. This affects your loan terms.

- Research Lenders: Compare different lenders. Look at interest rates and terms.

- Fill Out the Application: Complete the pre-approval form. Provide all necessary information.

- Submit the Application: Send your application to the lender. Wait for their response.

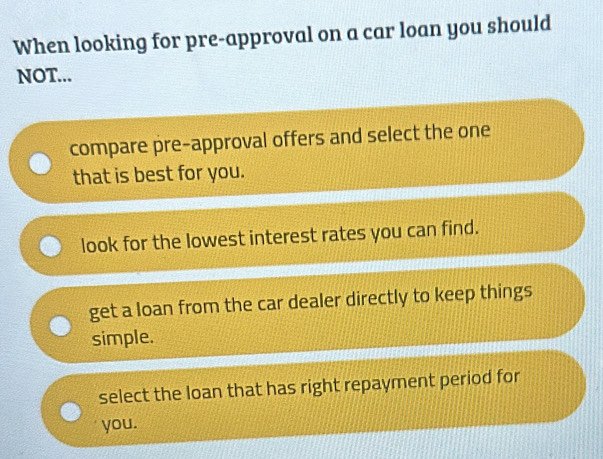

Common Mistakes To Avoid

- Not Checking Your Credit Score: Always check your credit score before applying. It affects your loan eligibility.

- Providing Incomplete Information: Incomplete forms can delay the process. Ensure all fields are filled.

- Ignoring Loan Terms: Look at all loan terms, not just the interest rate. Consider the repayment period and other fees.

- Applying to Too Many Lenders: Multiple applications can hurt your credit score. Choose a few trusted lenders instead.

- Not Comparing Offers: Different lenders offer different terms. Compare offers to get the best deal.

Negotiating With Dealers

Negotiating with car dealers can be a daunting task. The process can feel overwhelming. But having a pre-approval for a car loan can ease the stress. It gives you a sense of control and direction. This can be a powerful tool during your negotiations.

Using Pre-approval As Leverage

A pre-approval shows dealers that you are a serious buyer. It confirms your ability to finance the car. This can strengthen your position. Dealers are more likely to offer better deals to pre-approved buyers. They know you have done your homework. You have a budget and are ready to buy.

Securing The Best Deal

With pre-approval, you can focus on getting the best price. You can avoid costly financing options from the dealer. Stick to your pre-approved loan amount. This ensures you do not overspend. It also simplifies the negotiation process. You know your limits and can negotiate confidently.

Credit: www.reddit.com

Frequently Asked Questions

What Is A Pre-approval For A Car Loan?

A pre-approval for a car loan is a lender’s conditional commitment. It details the loan amount and terms before you shop for a car.

Why Is Car Loan Pre-approval Important?

Car loan pre-approval is important because it gives you a clear budget. It also strengthens your negotiating power with dealerships.

How Does Pre-approval Affect Credit Score?

Pre-approval may cause a slight dip in your credit score. This happens due to the lender’s credit inquiry.

Can You Negotiate Car Prices With Pre-approval?

Yes, you can negotiate car prices with pre-approval. It shows sellers you’re a serious buyer with financing ready.

Conclusion

Avoid rushing the car loan pre-approval process. Take your time. Research carefully. Understand your credit score’s impact. Compare different loan offers. Be sure to read all terms. Don’t ignore hidden fees. Consult with a financial advisor if needed. Avoid making hasty decisions.

Make informed choices. Secure the best deal for your car loan. Happy car shopping!