What Is The Main Benefit Of Taking Out A Federal Student Loan Instead Of A Private Loan: Unmatched Flexibility

The main benefit of taking out a federal student loan instead of a private loan is the range of borrower protections and flexible repayment options. Federal loans offer lower interest rates, income-driven repayment plans, and potential loan forgiveness programs.

Federal student loans come with several advantages that can make your borrowing experience smoother and less stressful. Unlike private loans, federal loans have fixed interest rates and do not require a credit check for most borrowers. This makes them accessible to a wider range of students.

Additionally, federal loans offer various repayment plans tailored to your income, ensuring manageable monthly payments. In times of financial hardship, you may qualify for deferment or forbearance, temporarily pausing your payments without penalty. These features collectively provide a safety net that private loans often lack, making federal student loans a more secure and flexible option for many students.

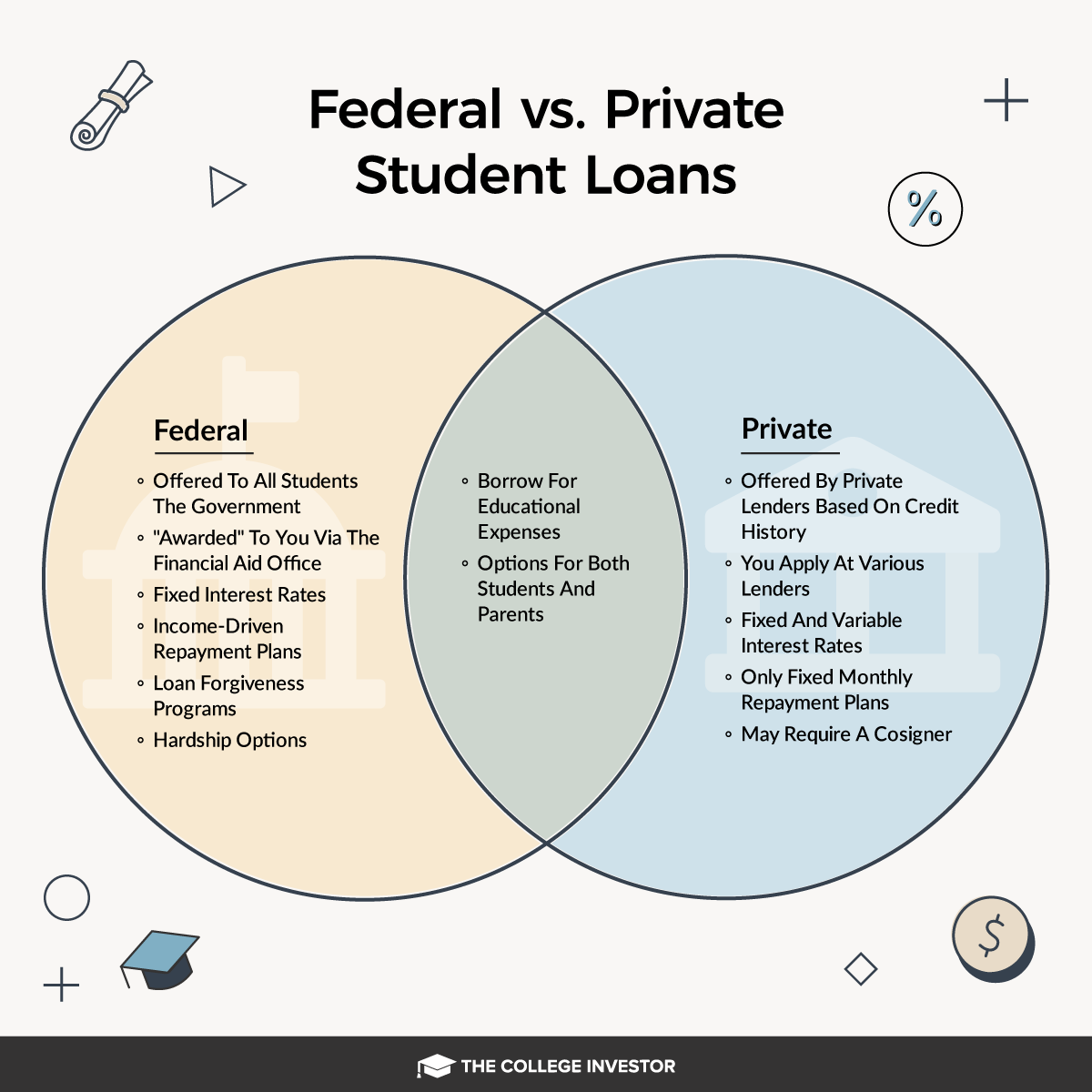

Credit: thecollegeinvestor.com

Introduction To Federal And Private Student Loans

Choosing the right student loan can be confusing. Federal and private student loans are two primary options. Understanding their differences is crucial for making an informed decision. This guide will explain the key aspects of federal and private student loans.

Definitions

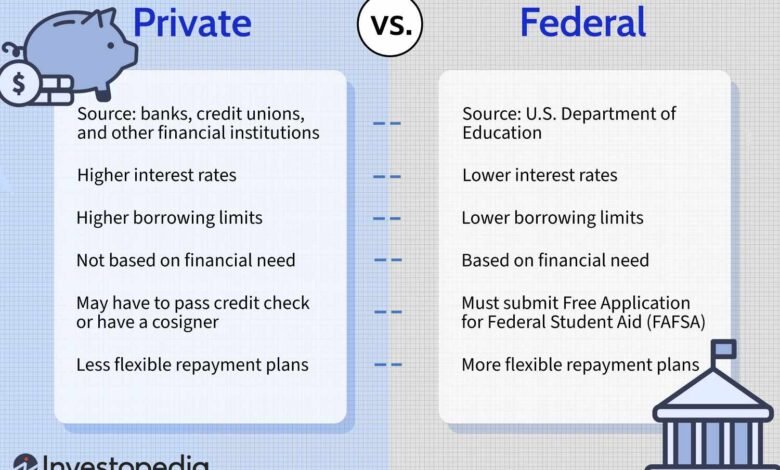

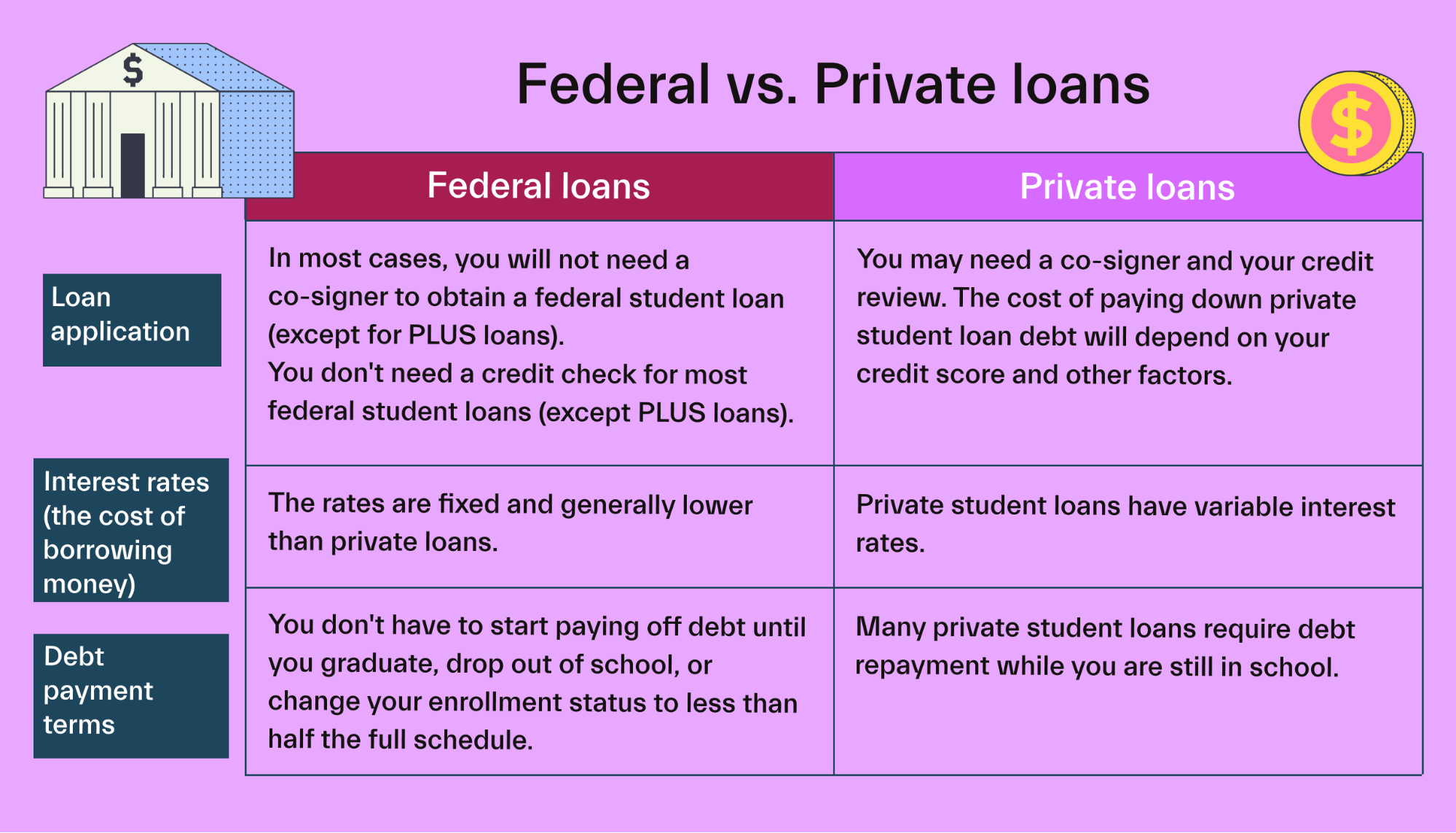

Federal student loans are funded by the U.S. government. They offer fixed interest rates and flexible repayment options. Private student loans are provided by banks, credit unions, and other private lenders. These loans often have variable interest rates and fewer repayment options.

Key Differences

The main differences lie in interest rates, repayment plans, and eligibility criteria. Federal loans usually have lower, fixed interest rates. Private loans may have higher, variable rates. Federal loans offer various repayment plans, including income-driven repayment. Private loans have fewer options. Eligibility for federal loans does not depend on credit history. Private loans often require a good credit score or a co-signer.

Credit: www.mos.com

Interest Rates Comparison

One key factor to consider when choosing between federal and private student loans is the interest rate. The interest rate impacts the total cost of your loan. A lower rate means less money paid over time.

Federal Loan Rates

Federal student loans generally offer lower interest rates. These rates are set by the government. They remain consistent regardless of your credit score. For the 2023-2024 academic year, the rates are:

| Loan Type | Interest Rate |

|---|---|

| Direct Subsidized Loans | 4.99% |

| Direct Unsubsidized Loans (Undergraduate) | 4.99% |

| Direct Unsubsidized Loans (Graduate) | 6.54% |

| Direct PLUS Loans | 7.54% |

These rates are often lower than those offered by private lenders. They provide a predictable cost over the life of the loan.

Private Loan Rates

Private student loan rates vary. They depend on your creditworthiness and the lender’s policies. Generally, these rates can be higher than federal loan rates. Private lenders often offer both fixed and variable rates:

- Fixed rates: Typically range between 3% and 14%

- Variable rates: Can start as low as 1%, but may increase over time

Private loans may require a co-signer. This can help secure a lower rate if the co-signer has good credit. But, the risk of higher rates and changing terms remains.

In summary, federal loans often provide more favorable and stable interest rates. Private loans might offer flexibility, but they come with potential risks.

Repayment Plans

Federal student loans offer a significant advantage over private loans. One of the main benefits is the variety of repayment plans available. These plans provide flexible options to manage your debt. Let’s explore the main types of repayment plans: Income-Driven Plans and Standard Plans.

Income-driven Plans

Income-driven plans adjust your monthly payments based on your income. This means if your income is low, your payments will be lower. There are four main types of income-driven plans. They are Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans can make your loan payments more manageable. They also offer forgiveness of any remaining balance after 20 or 25 years of qualifying payments.

Standard Plans

The standard plan is the default repayment plan for federal loans. It requires fixed monthly payments over a period of 10 years. This plan is straightforward and helps you pay off your loan faster. It usually results in paying less interest over the life of the loan. This can be a good option if you have a stable income and can afford higher monthly payments.

Loan Forgiveness Programs

Loan forgiveness programs can be a lifesaver for many students. Federal student loans offer various options to ease the burden of repayment. These programs can reduce or even eliminate your debt over time.

Public Service Loan Forgiveness

Public Service Loan Forgiveness (PSLF) is a great program for those in public service jobs. This includes roles in government and non-profit organizations. After making 120 qualifying payments, the remaining loan balance gets forgiven. This program is a huge benefit for those committed to public service careers.

Teacher Loan Forgiveness

Teacher Loan Forgiveness is designed for educators. If you teach full-time in a low-income school for five consecutive years, you may qualify. You could get up to $17,500 of your loan forgiven. This program helps attract and retain teachers in underserved areas.

Deferment And Forbearance Options

Federal student loans offer a range of benefits over private loans. One of the key benefits is the availability of deferment and forbearance options. These options provide temporary relief from loan payments, which can be a lifesaver during financial hardship or other challenges.

Eligibility Criteria

To qualify for deferment or forbearance, you must meet certain criteria. For deferment, qualifying situations include:

- Enrollment in school at least half-time

- Unemployment or inability to find full-time employment

- Economic hardship

- Active duty military service

Forbearance is more flexible but still has specific requirements. You may qualify if you are experiencing:

- Financial difficulties

- Medical expenses

- Change in employment

Application Process

Applying for deferment or forbearance is straightforward. Follow these steps:

- Contact your loan servicer to discuss your options.

- Complete the necessary application form.

- Submit any required documentation to support your request.

- Wait for your loan servicer to process your application.

During the application review, you might still need to make payments. Always confirm with your loan servicer.

Borrower Protections

When choosing between federal student loans and private loans, one critical aspect to consider is Borrower Protections. Federal student loans offer several safeguards for borrowers, ensuring a level of security and flexibility that private loans often lack. These protections can make a significant difference in managing your debt effectively.

Consumer Rights

Federal student loans come with specific consumer rights that are designed to protect borrowers. These rights include:

- The ability to defer payments during periods of financial hardship.

- Access to income-driven repayment plans, which adjust payments based on your income.

- The option to consolidate loans to simplify repayment.

- Eligibility for loan forgiveness programs for certain public service jobs.

These consumer rights ensure that borrowers have options and support if they face financial difficulties.

Federal Protections

Federal student loans also provide various federal protections that are not available with private loans. These include:

- Grace Periods: Federal loans typically offer a grace period after graduation, allowing time to secure employment before starting repayment.

- Subsidized Loans: For eligible students, the government pays the interest on subsidized loans while in school and during grace periods.

- Forbearance and Deferment: Borrowers can temporarily pause or reduce payments during financial hardship or other qualifying situations.

- Loan Forgiveness Programs: Programs like Public Service Loan Forgiveness (PSLF) can forgive remaining debt after a certain number of qualifying payments.

These protections offer significant advantages, providing a safety net that helps manage and eventually reduce student loan debt.

Impact On Credit Score

One important aspect to consider when choosing between federal and private student loans is their impact on your credit score. This is crucial for your financial future. Good credit can help you secure better interest rates on future loans. It can also make it easier to rent an apartment or even get a job.

Federal Loans And Credit

Federal student loans typically have a minimal impact on your credit score. The government does not check your credit for most federal loans. This means you can get a loan even if you have no credit history or poor credit. Repaying federal loans on time can help you build a positive credit history. This can improve your credit score over time.

Private Loans And Credit

Private student loans, on the other hand, often require a credit check. Lenders look at your credit score to decide if they will approve your loan. They also use it to set your interest rate. If you have a low credit score, you might not get approved. Or you could end up with a high interest rate. Missing payments on private loans can harm your credit score. This can make it harder to get loans in the future.

Credit: letsgotocollegeca.org

Final Thoughts

Choosing between federal student loans and private loans can be tough. Understanding the benefits is crucial. Let’s sum it up and help you make an informed decision.

Summary Of Benefits

Federal student loans offer many advantages over private loans:

- Lower Interest Rates: Federal loans typically have lower and fixed rates.

- Flexible Repayment Plans: Options include income-driven repayment plans.

- Forgiveness Programs: Some loans may be forgiven after certain conditions.

- Deferment and Forbearance: You can temporarily pause payments if needed.

- Subsidized Loans: The government may pay interest while you are in school.

Making An Informed Decision

Consider these factors when choosing a loan:

| Factor | Federal Loans | Private Loans |

|---|---|---|

| Interest Rates | Fixed and lower | Variable and higher |

| Repayment Flexibility | Multiple plans | Limited options |

| Forgiveness Programs | Available | Not available |

| Credit Requirements | Not required | Credit check needed |

Evaluate your needs and financial situation. Federal loans offer more benefits. They provide safety nets like deferment and forbearance. Private loans might be necessary if federal funds are insufficient. Always compare terms and conditions. Make sure you understand the long-term impact of your choice. Careful planning helps you avoid future financial stress.

Frequently Asked Questions

What Are The Benefits Of Federal Student Loans?

Federal student loans offer lower interest rates and flexible repayment plans. They also provide options for loan forgiveness and deferment.

Why Choose Federal Student Loans Over Private Loans?

Federal loans have more borrower protections, including income-driven repayment plans and potential loan forgiveness programs.

Are Federal Student Loans Easier To Get?

Yes, federal student loans are easier to qualify for as they do not require a credit check.

Do Federal Student Loans Have Fixed Interest Rates?

Yes, federal student loans come with fixed interest rates, providing consistency in monthly payments.

Conclusion

Taking out a federal student loan offers significant benefits. Lower interest rates save you money. Flexible repayment options ease financial pressure. Federal loans provide better borrower protections. Private loans lack these advantages. Consider federal loans for affordable, manageable debt. Your education journey becomes less stressful.

Making smart financial choices today helps build a stronger future. Choose wisely for long-term success.