What Could Be A Good Option Available To You If You Are Behind On Loan Payments: Smart Solutions

Falling behind on loan payments can be stressful. You might feel overwhelmed and unsure of what to do next.

When you’re struggling to keep up with loan payments, finding a solution is crucial. Ignoring the problem won’t make it go away. Fortunately, there are options available to help you manage the situation. Understanding these options can provide relief and a path forward.

In this blog post, we’ll explore practical steps you can take if you’re behind on loan payments. We’ll discuss different strategies to help you regain control of your finances. By the end, you’ll have a clearer idea of how to handle your loan payments and reduce your stress. Let’s dive in and find the best option for you.

Credit: consumer.ftc.gov

Assess Your Financial Situation

Finding yourself behind on loan payments can be stressful. It’s important to assess your financial situation first. Understanding your finances helps you make informed decisions. This can pave the way to get back on track. Let’s break it down into manageable steps.

Evaluate Income And Expenses

Start by evaluating your income. Calculate the total money you receive monthly. Include your salary, side gigs, and any other sources. This gives you a clear picture of your earnings.

Next, list your expenses. Note down all monthly bills. Include rent, utilities, groceries, and other essentials. This helps you see where your money goes each month.

Identify Non-essential Spending

After noting your essential expenses, look for non-essential spending. These are things you can do without. Eating out, streaming services, and daily coffee runs are examples. Cutting back on these can free up cash.

Reducing non-essential spending can help you redirect money. Use this extra cash to catch up on loan payments. Every little bit helps. Small changes in spending habits can make a big difference.

Credit: www.facebook.com

Contact Your Lender

Falling behind on loan payments can be stressful. But contacting your lender is a smart first step. Lenders are often willing to help. They prefer to find a solution rather than see you default. Open communication can lead to better options.

Explain Your Situation

Be honest about your financial difficulties. Explain why you are behind on payments. Provide details like job loss or medical bills. This helps your lender understand your position. They may have programs to assist people in similar situations.

Explore Modification Options

Ask about possible loan modifications. This can include changing the loan terms. You might qualify for lower interest rates or extended payment periods. These options can make your monthly payments more manageable.

Some lenders offer temporary forbearance. This means pausing payments for a short period. It can give you time to get back on your feet. Always ask about all available options. It is important to know what help you can get.

Consider Loan Refinancing

If you are behind on loan payments, one good option to consider is loan refinancing. Refinancing can help you get a new loan with better terms. This could lower your monthly payments and make them more manageable. It can also help you avoid late fees and potential credit score damage.

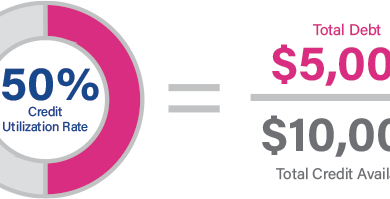

Research Interest Rates

Before you refinance, it is important to research interest rates. Interest rates can vary widely between lenders. A lower rate can save you a lot of money over the life of the loan.

Here are some steps to follow:

- Check current interest rates online.

- Visit your local bank or credit union.

- Ask about fixed vs. variable rates.

Make sure you understand how different rates will affect your payments. Use online calculators to see potential savings.

Compare Lender Offers

Once you have an idea of interest rates, it is time to compare lender offers. Different lenders may offer different terms and benefits.

Here are some factors to consider:

| Lender | Interest Rate | Loan Term | Fees |

|---|---|---|---|

| Bank A | 3.5% | 15 years | $300 |

| Credit Union B | 3.2% | 20 years | $250 |

| Online Lender C | 3.8% | 10 years | $200 |

Look at the total cost of the loan, not just the monthly payment. Consider the reputation and customer service of each lender. Read reviews from other borrowers.

After comparing, choose the offer that best fits your needs.

Look Into Debt Consolidation

If you are behind on loan payments, debt consolidation could be a good option. It helps combine multiple debts into one single loan. This makes it easier to manage payments and may lower your interest rate.

Combine Multiple Debts

Debt consolidation allows you to combine several debts into one. This can include credit card debt, personal loans, and other types of loans. By doing this, you only need to worry about one payment each month.

Imagine having five different loans. Each with its own interest rate and due date. It can be stressful and confusing to keep track of them all. Combining these debts into one loan simplifies things.

Simplify Payments

One of the main benefits of debt consolidation is that it simplifies your monthly payments. Instead of juggling multiple payments, you only have one. This reduces the risk of missing a payment.

With one payment, you can focus on paying down your debt faster. This can help improve your credit score over time. Plus, it makes budgeting much easier.

| Type of Debt | Interest Rate | Due Date |

|---|---|---|

| Credit Card 1 | 18% | 15th of each month |

| Credit Card 2 | 20% | 10th of each month |

| Personal Loan | 12% | 25th of each month |

Combining these debts into one loan with a lower interest rate can save you money. It also makes it easier to keep track of your payments.

- Combine multiple debts into one.

- Simplify monthly payments.

- Potentially lower your interest rate.

- Reduce stress and improve credit score.

Explore Hardship Programs

If you are behind on loan payments, consider exploring hardship programs. These programs can provide temporary relief. They are designed to help you manage payments during tough times. Many lenders offer such programs to assist borrowers.

Check Eligibility Criteria

The first step is to check your eligibility. Not all borrowers qualify for hardship programs. Eligibility depends on the lender’s criteria. You may need to provide proof of financial hardship. This could include job loss, medical emergencies, or other financial struggles.

Understand Relief Options

Hardship programs offer various relief options. One common option is a temporary reduction in payments. Another option is to defer payments for a short period. Some programs may extend the loan term. This reduces monthly payments by spreading them over a longer period.

Each lender has different relief options. Understanding these options can help you choose the best one for your situation. Always ask your lender for details. Make sure you know the terms and conditions.

Credit: www.citizensbank.com

Create A Budget Plan

Falling behind on loan payments can be stressful. One effective way to regain control is to create a budget plan. This plan helps you track income and expenses. It can reveal where you need to cut back. By following a budget, you can manage your payments better and reduce stress.

Prioritize Essential Payments

Start by listing your essential payments. These include rent, utilities, and groceries. Paying these first ensures you can maintain basic needs. Missing these can lead to bigger problems. So, always put them at the top of your list.

Set Financial Goals

Set clear financial goals. Decide what you want to achieve in the short and long term. These goals can motivate you to stick to your budget. They can also help you see progress. For example, aim to pay off a certain amount of debt each month.

Seek Professional Advice

Falling behind on loan payments can be stressful. Seeking professional advice can help you navigate through financial difficulties. Professionals can provide tailored solutions and strategies.

Consult Financial Advisors

Financial advisors can offer valuable insights. They help you understand your financial situation. They assess your income, expenses, and debts.

Financial advisors create a budget plan. This plan helps you manage your money better. It can include strategies to reduce expenses. They also suggest ways to increase your income.

Here are some benefits of consulting a financial advisor:

- Personalized financial plan

- Debt repayment strategies

- Long-term financial goals

Get Credit Counseling

Credit counseling services offer support. These services help you manage your debt. Credit counselors work with you to create a debt management plan.

Credit counselors negotiate with creditors on your behalf. They may help lower interest rates or waive late fees. This can make your payments more affordable.

Consider these benefits of credit counseling:

- Lower interest rates

- Reduced monthly payments

- Improved credit score

Seeking professional advice can be a good option. It helps you regain control of your finances. Consult financial advisors and get credit counseling to explore your options.

Explore Alternative Income Sources

Being behind on loan payments can be stressful. Finding ways to increase your income can help you catch up. There are many options available to you. Exploring alternative income sources is a practical solution. Let’s look at some options you can consider.

Freelancing Opportunities

Freelancing offers flexibility and variety. You can work in many fields. Some popular options include:

- Writing: Many companies need blog posts, articles, and content.

- Graphic Design: Create logos, brochures, and social media graphics.

- Web Development: Build and maintain websites for businesses.

- Virtual Assistance: Help with administrative tasks online.

Freelancing platforms like Upwork, Fiverr, and Freelancer can help you find jobs. Register on these platforms and create a strong profile. Highlight your skills and past work. Set competitive rates to attract clients.

Part-time Jobs

Part-time jobs can provide a steady income. They are often more predictable than freelancing. Some common part-time jobs include:

| Job Type | Description |

|---|---|

| Retail | Work in stores helping customers and stocking shelves. |

| Food Service | Work in restaurants as a server, cook, or cashier. |

| Delivery | Deliver food, packages, or groceries to customers. |

| Tutoring | Help students with their studies in various subjects. |

Many companies offer flexible hours for part-time employees. Check local job boards and company websites. Apply to positions that fit your schedule and skills.

Exploring alternative income sources can ease your financial burden. Freelancing and part-time jobs are excellent options to consider. They provide opportunities to earn extra money and catch up on loan payments.

Frequently Asked Questions

What Are My Options If I’m Behind On Loan Payments?

If you’re behind on loan payments, consider refinancing, loan modification, or a repayment plan. Contact your lender immediately to discuss potential solutions.

Can I Refinance My Loan To Lower Payments?

Yes, refinancing your loan can lower monthly payments. It can extend the repayment period or reduce your interest rate.

What Is A Loan Modification?

A loan modification adjusts the terms of your loan. It can lower interest rates, extend the term, or reduce the principal balance.

Should I Contact My Lender If I Can’t Pay?

Yes, contact your lender immediately if you can’t make payments. They can offer solutions such as forbearance or a repayment plan.

Conclusion

Exploring options when behind on loan payments is crucial. Consider contacting your lender. They may offer a repayment plan. Refinancing could also be a viable solution. Seek help from a financial advisor. They can provide personalized advice. Remember, taking action sooner is better.

This can prevent further financial stress. Stay informed and proactive. Managing your loans successfully can be within reach.