What Are Three Questions To Ask Yourself Before You Spend Your Emergency Fund: Essential Guide

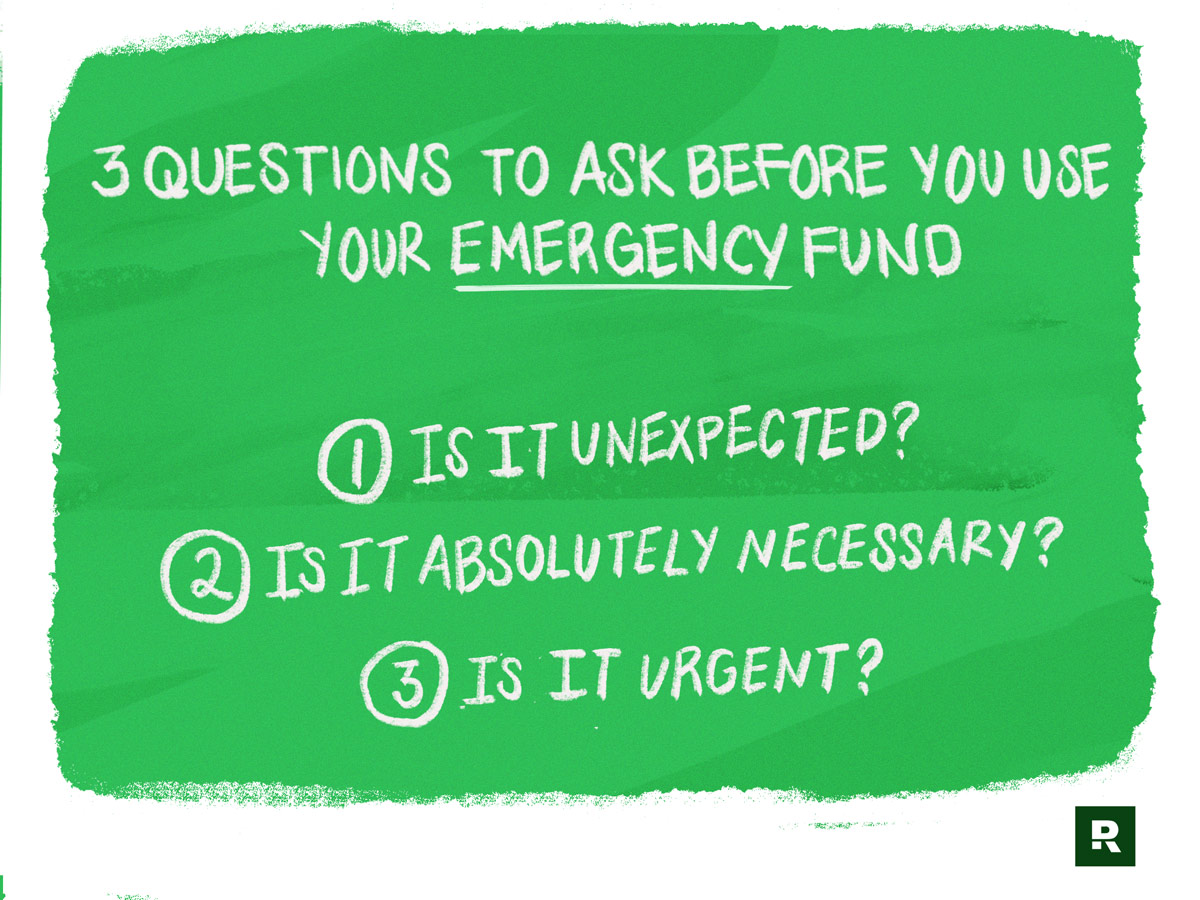

Before you dip into your emergency fund, ask yourself three crucial questions. This ensures that you use the money wisely and only in genuine emergencies.

An emergency fund is a safety net for unexpected expenses. It gives you peace of mind and financial security. But, it’s essential to know when to use it. Spending this fund without careful thought can lead to future financial troubles.

By asking the right questions, you can make informed decisions. These questions help you determine if the situation truly warrants dipping into your savings. They also ensure you’re not using the fund for non-emergencies. Stay tuned as we explore the three key questions to ask yourself before spending your emergency fund. This guide will help you protect your financial future.

Credit: educounting.com

Evaluating The Necessity

Evaluating the necessity of using your emergency fund is crucial. You need to be sure that spending it is the right choice. This helps you keep your financial safety net intact. Ask yourself these three questions before making any decisions.

Is It Truly An Emergency?

Consider if the situation is a real emergency. Ask yourself if it affects your health, safety, or basic needs. Emergencies are unexpected and urgent. If it’s not urgent, it may not be worth dipping into your fund.

Can It Wait?

Some expenses feel like emergencies but can wait. Think about whether the expense can be postponed. Waiting may give you time to find another solution. This can help you save your emergency fund for a true crisis.

Credit: www.ramseysolutions.com

Exploring Alternative Solutions

Exploring alternative solutions before spending your emergency fund is crucial. It helps you preserve your savings for true emergencies. Here, we discuss two key questions to consider. These questions will guide you in finding other ways to manage financial challenges.

Are There Other Funding Options?

Consider all possible funding sources before dipping into your emergency fund. Could you take a short-term loan from a friend or family member? Look into community resources or grants for assistance. Are there any government programs that can provide support? These options may help you avoid using your savings.

Can You Cut Expenses?

Review your monthly expenses carefully. Identify non-essential spending that you can reduce or eliminate. Are there subscriptions you no longer use? Cutting back on dining out or entertainment can save money. Adjusting your budget can help you cover unexpected costs without touching your emergency fund.

Long-term Impact

Long-term Impact is a critical factor to consider before spending your emergency fund. Decisions made today can affect your financial future. It’s essential to think about how this expense will impact your financial stability and what future repercussions it may have.

Will This Affect Your Financial Stability?

Before spending your emergency fund, ask if it will affect your financial stability. Think about your monthly expenses and income. Will this expenditure make it hard to cover your regular costs? If so, it might be best to hold off.

Consider your long-term goals. Will using your emergency fund delay reaching those goals? If the answer is yes, it may be wise to reconsider. Your emergency fund is a safety net. Ensure it remains intact for genuine emergencies.

What Are The Future Repercussions?

Spending your emergency fund can have future repercussions. Reflect on what those might be. Will you need to rebuild the fund? If so, how long will it take? Think about the potential sacrifices you may need to make during this rebuilding period.

Also, consider the impact on your peace of mind. An emergency fund provides security. Spending it may increase stress and anxiety. Weigh the immediate need against these future repercussions. Your future self will thank you for making a thoughtful decision.

Assessing The Cost

Before spending your emergency fund, it’s crucial to assess the cost of the expense. This step ensures that you are making a wise decision and getting the most value for your money. Here are three questions to ask yourself to evaluate the cost effectively.

Is This The Best Price?

To ensure you are paying the best price, consider shopping around. Compare prices from different stores or websites. You can often find the same product or service at a lower cost. Make use of price comparison tools available online. This step can help you save a significant amount.

Can You Negotiate Or Find Discounts?

Negotiation can sometimes reduce the price. Don’t hesitate to ask for a discount or a better deal. Many service providers and retailers offer discounts if you ask. Look for coupons or promotional codes. Websites like RetailMeNot and Honey can help you find these codes. This can further reduce your expense.

Considering The Consequences

Before dipping into your emergency fund, it’s vital to weigh the consequences. Spending this money without careful thought can lead to long-term financial instability. Ask yourself these three questions to ensure you’re making the best decision for your financial health.

What If You Don’t Spend?

Imagine not spending your emergency fund. What would happen? Would your situation worsen or could you manage without it? Understanding the impact of not spending can guide your decision.

Here’s a table to help you assess the potential outcomes:

| Action | Outcome |

|---|---|

| Don’t spend | Financial stability remains intact |

| Spend | Emergency fund decreases, but immediate need is met |

How Will It Affect Your Goals?

Consider how spending your emergency fund impacts your financial goals. Are you saving for a house or a car? Will this expenditure delay your plans?

- Short-term goals: Will you still be able to meet your immediate financial targets?

- Long-term goals: How will this spending affect your future plans?

Evaluate the trade-offs to make an informed decision.

Credit: www.ramseysolutions.com

Understanding Your Financial Health

Before you decide to spend your emergency fund, it’s crucial to understand your financial health. Knowing where you stand financially helps you make better decisions. This awareness can prevent you from depleting your emergency fund unnecessarily. Here are three vital questions to ask yourself.

What Is Your Current Financial Situation?

Evaluate your income and expenses. Are you living paycheck to paycheck? Do you have any outstanding debts? Consider your savings outside the emergency fund. Knowing these details gives you a clear picture of your financial health. It also helps you decide if spending the emergency fund is the right choice.

Do You Have A Backup Plan?

Think about your alternatives. Do you have other savings or assets? Can you cut down on non-essential expenses? Having a backup plan can reduce the need to dip into your emergency fund. It also provides a safety net if things go wrong.

Emotional Factors

Before you spend your emergency fund, consider the emotional factors involved. Emotions can significantly impact financial decisions. Understanding your feelings can help you make better choices.

Are Emotions Influencing Your Decision?

Ask yourself if your emotions are driving the decision to use your emergency fund. Are you feeling anxious, excited, or stressed? Emotions can cloud judgment. It’s important to recognize them.

Consider the following:

- Are you upset about an unexpected expense?

- Do you feel pressured to resolve an issue quickly?

- Is there a sense of urgency that may not be necessary?

Identifying emotional triggers can help you pause and think rationally.

Is There Stress Or Pressure Involved?

Stress can lead to hasty decisions. Ask yourself if there is external pressure pushing you to spend the fund. Stressful situations can make it hard to think clearly.

Reflect on these points:

- Is someone else pressuring you to spend?

- Are you stressed about future events that may not happen?

- Do you feel a need to make a quick decision?

Take a step back. Evaluate if the pressure is real or perceived.

By addressing these emotional factors, you can better decide when to use your emergency fund wisely.

Seeking Professional Advice

When facing financial uncertainty, it’s wise to consider your options carefully. Seeking professional advice can help you make informed decisions about using your emergency fund. A financial advisor provides expert guidance to ensure you make the best choices for your financial health.

When To Consult A Financial Advisor?

Consult a financial advisor if you are unsure about your financial situation. They can help you assess whether using your emergency fund is the right move. If you have multiple debts, a financial advisor can guide you on which to prioritize. They also offer insight into the impact of using your emergency fund on your long-term financial goals.

What Expert Advice Can Offer?

Expert advice can offer several benefits:

- Personalized financial plans: Advisors tailor advice to your specific needs and goals.

- Risk assessment: They help you understand the risks involved in spending your emergency fund.

- Debt management strategies: Advisors can suggest ways to manage or consolidate your debts effectively.

- Investment guidance: They provide insights on whether to use your fund or seek alternative financial solutions.

With professional advice, you gain clarity and confidence in your financial decisions. This can make a significant difference in maintaining your financial stability.

Frequently Asked Questions

What Is An Emergency Fund?

An emergency fund is a savings account set aside for unexpected expenses. It provides financial security in emergencies. This fund covers expenses like medical bills, car repairs, or job loss.

When Should I Use My Emergency Fund?

Use your emergency fund only for urgent, unexpected expenses. These include medical emergencies, job loss, or essential home repairs. Avoid using it for non-essential purchases.

How Much Should Be In My Emergency Fund?

Aim to have three to six months’ worth of living expenses. This amount provides a financial cushion. It ensures you can cover essential costs during emergencies.

Can I Rebuild My Emergency Fund?

Yes, you can and should rebuild your emergency fund. Prioritize replenishing it after any withdrawal. This maintains your financial security for future emergencies.

Conclusion

Spending your emergency fund wisely is crucial. Ask yourself these three questions first. Is this expense truly urgent? Can I find another solution? Will this affect my future? Being careful ensures your fund lasts. Always think before you spend. Your future self will thank you.

Stay prepared, stay secure.