What Are The Two Ways That Investors Can Make Money From Stocks: Proven Methods

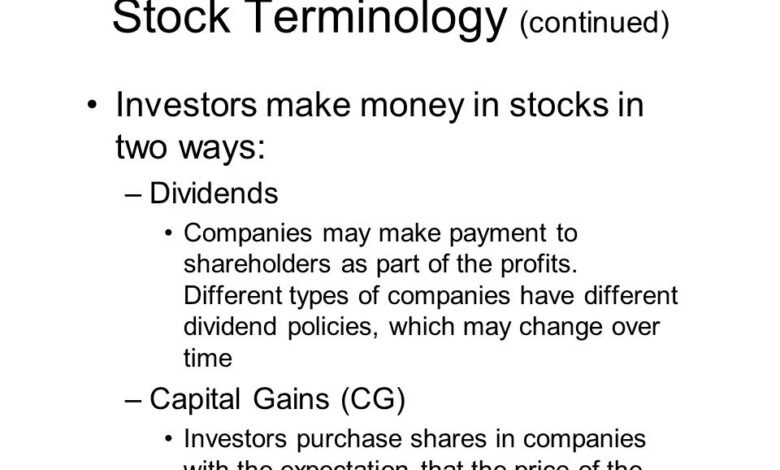

Investors can make money from stocks in two ways: capital gains and dividends. Capital gains come from selling stocks at a higher price than you paid.

Dividends are regular payments from the company to its shareholders. Stocks are a popular investment choice for many people. They offer the potential for both income and growth. Understanding how to make money from stocks can help you decide if this investment is right for you.

Some investors focus on buying and selling stocks for profit. Others prefer to hold onto stocks and receive regular dividend payments. Each method has its own benefits. In this blog post, we will explore these two ways in detail, helping you make informed investment decisions.

:max_bytes(150000):strip_icc()/investing.asp-final-9cbfccbd50344a828ddf1882a2fdc07c.png)

Credit: www.investopedia.com

Introduction To Stock Investments

Stock investments can be a powerful way to grow wealth over time. Many people invest in stocks to earn money. But how can they actually make money from stocks? Understanding the basics is the first step to successful investing.

Importance Of Stock Investments

Investing in stocks is crucial for several reasons:

- Potential for High Returns: Stocks have the potential to offer high returns over the long term.

- Ownership in Companies: When you buy stocks, you own a part of the company. This can be exciting.

- Liquidity: Stocks can be easily bought and sold. This makes them a flexible investment option.

Stocks are a key component of most investment portfolios. They can provide both capital gains and dividend income.

Common Goals Of Investors

Investors often have common goals when they invest in stocks:

- Wealth Accumulation: Many invest to grow their money over time.

- Income Generation: Some investors seek regular income through dividends.

- Retirement Savings: Stocks can be a valuable part of retirement savings plans.

- Diversification: Investing in stocks helps diversify an investment portfolio. This can reduce risk.

By understanding these goals, investors can make better decisions about their stock investments.

Credit: tacticalinvestor.com

Capital Gains

Capital gains are a key way investors make money from stocks. They occur when the value of a stock increases over time. Investors sell the stock at a higher price than what they paid for it. This difference in price is the profit, or capital gain.

Definition Of Capital Gains

A capital gain happens when an investment’s price rises. If you buy a stock for $50 and sell it for $70, you have a capital gain of $20. This gain is the profit you make from the increase in the stock’s value.

Buying Low, Selling High

The basic principle of capital gains is to buy low and sell high. Investors aim to purchase stocks at a low price. Then, they hold onto them until the price increases. Selling the stock at a higher price allows them to make a profit. This strategy requires patience and market knowledge. It is one of the most common ways to make money from stocks.

Dividends

Dividends are a way for investors to make money from stocks. Companies distribute a portion of their profits to shareholders. This payment is called a dividend.

Understanding Dividends

Dividends are regular payments made by companies to their shareholders. They are a reward for investing in the company. Dividends can provide a steady income stream. Not all companies pay dividends. Only profitable companies with stable earnings do. Investors look for companies with a strong history of paying dividends.

Types Of Dividends

There are different types of dividends that companies can pay:

- Cash Dividends: These are the most common type. The company pays cash directly to shareholders. The payment is usually made quarterly.

- Stock Dividends: Instead of cash, shareholders receive additional shares. This increases the number of shares they own.

- Property Dividends: Rarely, companies pay dividends in the form of assets. These can be products or other property.

- Special Dividends: These are one-time payments. Companies pay special dividends when they have excess profits.

Dividends can be a reliable source of income. Investors should understand the types and benefits of dividends.

Evaluating Company Performance

Investors can make money from stocks in two main ways: capital gains and dividends. To achieve these, evaluating company performance is crucial. Understanding how well a company performs can help investors make informed decisions. Let’s explore two key areas to consider when evaluating a company’s performance.

Financial Statements

Financial statements provide a snapshot of a company’s financial health. They include the income statement, balance sheet, and cash flow statement. Each document reveals different aspects of financial performance:

- Income Statement: Shows revenue, expenses, and profit over a period.

- Balance Sheet: Lists assets, liabilities, and shareholders’ equity at a specific point.

- Cash Flow Statement: Tracks cash inflows and outflows from operations, investing, and financing.

By analyzing these statements, investors can assess a company’s profitability, liquidity, and financial stability.

Key Performance Indicators

Key Performance Indicators (KPIs) are metrics that measure a company’s success in achieving its goals. Some important KPIs to consider include:

- Earnings Per Share (EPS): Indicates the portion of a company’s profit allocated to each share.

- Price-to-Earnings (P/E) Ratio: Compares a company’s share price to its earnings per share.

- Return on Equity (ROE): Measures the return generated on shareholders’ equity.

- Debt-to-Equity Ratio: Assesses a company’s financial leverage by comparing its total liabilities to shareholders’ equity.

Understanding these KPIs helps investors gauge a company’s performance relative to its peers. It also provides insights into potential future growth.

Market Trends And Timing

Understanding market trends and timing can significantly impact how investors make money from stocks. These factors help investors decide when to buy or sell shares. This can maximize their returns. Let’s explore how analyzing market trends and perfecting the timing of investments can benefit investors.

Market Analysis

Market analysis involves studying current market trends. Investors look at various factors, including economic indicators, industry performance, and company news. This helps them understand the market’s direction. They can predict if stock prices will rise or fall. Accurate market analysis can lead to more informed investment decisions. It reduces the risk of loss and increases the chances of profit.

Timing Your Investments

Timing your investments is crucial for maximizing returns. This means buying stocks when prices are low and selling when prices are high. Perfect timing can lead to significant gains. Investors often use market analysis to decide the best times to trade. They monitor market signals and trends. This helps them make timely decisions. Effective timing reduces the risk of holding stocks during market downturns. It also capitalizes on upswings.

Risk Management

Investing in stocks can be rewarding, but it’s not without risks. Effective risk management can help protect your investments. By managing risk, investors can mitigate potential losses. Two popular risk management techniques include diversification and hedging strategies.

Diversification

Diversification involves spreading investments across various assets. This reduces the impact of a poor-performing stock. By diversifying, you don’t rely on a single stock’s success. Instead, you balance potential gains and losses. For example, invest in different sectors. Consider tech, healthcare, and consumer goods. This strategy can provide more stability. It lowers the chance of significant losses.

Hedging Strategies

Hedging is another way to manage risk. It protects investments from market volatility. Investors use derivatives like options and futures. These financial tools can limit potential losses. For instance, buying a put option can safeguard against a stock’s price drop. Hedging can be complex. It’s essential to understand the instruments used. Proper hedging can minimize risks and protect your portfolio.

Long-term Vs Short-term Strategies

Investors can make money from stocks using two main strategies: long-term and short-term. Each strategy has unique benefits and risks. Understanding these strategies helps investors make informed decisions.

Benefits Of Long-term Holding

Long-term holding involves buying stocks and keeping them for several years. This strategy benefits from the power of compound interest. Reinvesting dividends and capital gains increases returns over time. Long-term investors can ride out market fluctuations. They benefit from the overall growth of the stock market. Historically, the stock market grows over long periods. Patience and perseverance are key to this strategy. Holding stocks for the long term can reduce transaction costs. It also lowers the impact of short-term market volatility.

Short-term Profit Opportunities

Short-term strategies focus on quick gains. These include day trading and swing trading. Short-term traders buy and sell stocks within a few days or weeks. They capitalize on market trends and price movements. Short-term trading requires active monitoring. It can lead to higher returns in a short period. But, it also carries higher risks. Short-term traders need to stay updated with market news and trends. They use technical analysis to make informed decisions. This strategy requires a good understanding of market mechanics. Quick decisions and timely actions are essential for success.

:max_bytes(150000):strip_icc()/dotdash-TheBalance-what-are-stocks-3306181-Final-75b1bb359b7141d9a22cb1b706f2cf2f.jpg)

Credit: www.thebalancemoney.com

Frequently Asked Questions

How Do Investors Make Money From Stocks?

Investors can make money from stocks through capital gains and dividends. Capital gains occur when stock prices rise. Dividends are payments made by companies to shareholders from their profits.

What Is A Capital Gain In Stocks?

A capital gain happens when you sell a stock for more than you paid. It’s the profit from the increase in stock value.

How Do Stock Dividends Work?

Companies pay dividends to shareholders as a portion of their profits. Dividends provide a regular income to investors.

Are Dividends Guaranteed For Stock Investors?

No, dividends are not guaranteed. Companies may reduce or eliminate dividends based on their financial performance.

Conclusion

Investors can make money from stocks in two main ways: dividends and capital gains. Dividends are payments made by companies to shareholders. They provide regular income. Capital gains occur when you sell stocks for more than you paid. This difference is your profit.

Both methods require careful planning. Understanding these basics helps you make better investment choices. Start with small investments. Learn as you go. This approach minimizes risk and increases your financial literacy. Happy investing!