What Are The Main Differences Between A Checking And Savings Account: Key Insights

Checking and savings accounts are key parts of banking. They serve different purposes and offer unique benefits.

Understanding the differences between checking and savings accounts is crucial for managing your finances. Checking accounts are designed for daily transactions, like paying bills or buying groceries. In contrast, savings accounts help you save money over time, often earning interest.

Knowing which account suits your needs can help you make better financial decisions. This guide will explore the main differences between these two types of accounts. By the end, you’ll have a clearer idea of which one fits your financial goals. So, let’s dive in and see what sets them apart.

Credit: www.ramseysolutions.com

Introduction To Checking And Savings Accounts

Understanding the differences between checking and savings accounts is essential for managing your money. Both accounts serve distinct purposes and offer different features. This guide will help clarify these differences.

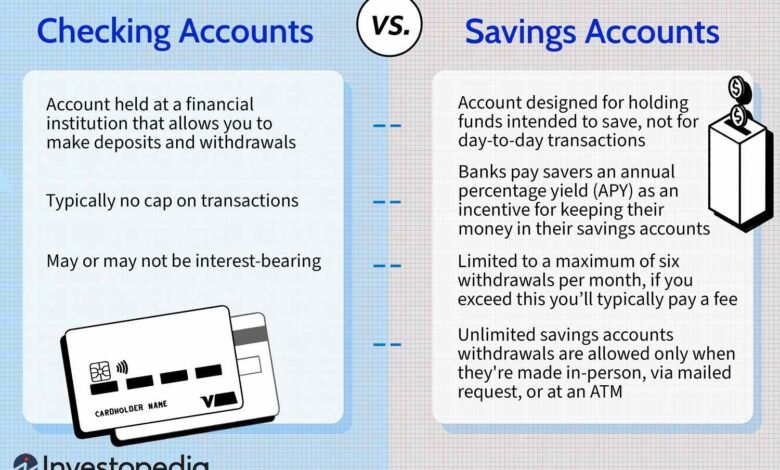

Purpose Of Accounts

Checking accounts are designed for daily transactions. They allow you to deposit and withdraw money frequently. You can use them to pay bills, make purchases, and transfer money.

In contrast, savings accounts are meant for saving money over time. They usually offer higher interest rates than checking accounts. Savings accounts help you grow your money by earning interest.

Basic Definitions

A checking account is a bank account that lets you deposit and withdraw money easily. These accounts come with a debit card and checks. You can use them for everyday expenses and bills.

A savings account is a bank account designed to hold money that you do not plan to spend immediately. These accounts offer interest on your deposits. This helps you save money for future needs.

| Feature | Checking Account | Savings Account |

|---|---|---|

| Purpose | Daily Transactions | Saving Money |

| Interest Rates | Low or None | Higher |

| Access | Frequent Withdrawals | Limited Withdrawals |

| Tools | Debit Card, Checks | No Debit Card, Limited Checks |

- Checking accounts are ideal for regular spending.

- Savings accounts help you save for future goals.

Knowing the purpose and basic definitions of these accounts is the first step in managing your finances effectively.

Key Features Of Checking Accounts

Checking accounts are essential for everyday transactions. They offer a range of features that make managing your finances easy. Let’s explore the key features of checking accounts.

Access And Usage

Checking accounts offer convenient access to your money. You can use a debit card, checks, or online banking. These accounts are designed for frequent transactions. You can deposit and withdraw funds as needed. There are no limits on the number of transactions.

Fees And Charges

Checking accounts may come with various fees. These can include monthly maintenance fees, overdraft fees, and ATM fees. Some banks waive fees if you meet certain conditions. Conditions may include maintaining a minimum balance or setting up direct deposits. Always check the fee structure before choosing an account.

Interest Rates

Most checking accounts offer low or no interest. The primary purpose is to facilitate transactions. If you seek interest earnings, consider a savings account. Some checking accounts may offer interest, but the rates are usually minimal.

Key Features Of Savings Accounts

Understanding the key features of a savings account can help you manage your finances better. Savings accounts are designed to help you save money over time. They offer unique benefits that differentiate them from other types of accounts.

Interest Earnings

Savings accounts typically offer interest earnings on the money you deposit. This means your money grows over time. The interest rate can vary from bank to bank. Some banks offer higher rates to attract more customers. It’s essential to compare rates before choosing a savings account.

Withdrawal Limits

Savings accounts often have withdrawal limits. This encourages you to save more and spend less. Federal regulations may limit you to six withdrawals per month. Exceeding this limit might result in fees. Always check the terms with your bank to avoid unexpected charges.

Account Maintenance

Maintaining a savings account is generally straightforward. Many banks offer free savings accounts. However, some may have maintenance fees if your balance falls below a certain amount. It’s important to understand the terms to avoid these fees. Opt for an account with no or low maintenance fees to maximize your savings.

Below is a quick comparison table of the key features:

| Feature | Details |

|---|---|

| Interest Earnings | Earn interest on deposits |

| Withdrawal Limits | Up to six withdrawals per month |

| Account Maintenance | Possible fees if balance is low |

Credit: getschooled.com

Accessibility And Convenience

Accessibility and convenience are crucial factors when choosing between a checking and savings account. Each account type offers different features that cater to various needs. Let’s explore these differences in detail.

Atm And Branch Access

Checking accounts typically provide more access to ATMs and bank branches. Customers can withdraw money, make deposits, and perform other transactions with ease. Savings accounts, on the other hand, may have limited ATM access. Some savings accounts restrict the number of withdrawals per month. This can make it less convenient for frequent transactions.

Online And Mobile Banking

Both checking and savings accounts offer online and mobile banking options. However, checking accounts often come with more features. Users can pay bills, transfer funds, and check their balances in real-time. Savings accounts also provide online access but may lack some transactional features. For example, they might not support direct payments to merchants.

Interest Rates Comparison

When choosing between a checking and savings account, interest rates play a crucial role. Understanding the differences can help you make the right decision for your finances. Let’s compare the interest rates for both types of accounts.

Checking Accounts Interest

Checking accounts usually offer little to no interest. These accounts are designed for daily transactions. They provide easy access to your money. Some banks offer interest-bearing checking accounts, but the rates are very low. Typically, the interest rates range from 0.01% to 0.05%.

Here is a quick comparison table to illustrate:

| Account Type | Interest Rate |

|---|---|

| Standard Checking | 0% |

| Interest-Bearing Checking | 0.01% – 0.05% |

Savings Accounts Interest

Savings accounts offer higher interest rates compared to checking accounts. These accounts are ideal for storing money you don’t need for daily use. The interest rate for savings accounts usually ranges from 0.05% to 2.00%.

Here’s a table for quick reference:

| Account Type | Interest Rate |

|---|---|

| Standard Savings | 0.05% – 0.10% |

| High-Yield Savings | 1.00% – 2.00% |

In summary, savings accounts provide better interest rates. This makes them suitable for growing your savings over time.

Fees And Charges Comparison

Understanding the fees and charges associated with checking and savings accounts is important. Each account type has its own set of costs that can affect your financial decisions. This section explores the differences in monthly maintenance fees and transaction fees for both account types.

Monthly Maintenance Fees

Checking accounts often come with monthly maintenance fees. These fees can range from $5 to $15. Some banks waive these fees if you meet certain criteria. For example, maintaining a minimum balance or setting up direct deposits.

Savings accounts typically have lower or no maintenance fees. If they do, it is usually easy to avoid them. For instance, by maintaining a minimum balance.

Here is a comparison:

| Account Type | Monthly Maintenance Fee | How to Avoid |

|---|---|---|

| Checking Account | $5 – $15 | Minimum balance, direct deposits |

| Savings Account | $0 – $5 | Minimum balance |

Transaction Fees

Checking accounts often have unlimited transactions. Yet, some banks charge for using ATMs outside their network. These fees range from $2 to $5 per transaction.

Savings accounts limit the number of withdrawals. Often, you can make up to six withdrawals per month. Exceeding this limit incurs fees, typically $5 to $10 per transaction.

Here is a simple breakdown:

| Account Type | Transaction Limit | Fee for Exceeding Limit |

|---|---|---|

| Checking Account | Unlimited | $2 – $5 (out-of-network ATM) |

| Savings Account | Up to 6 per month | $5 – $10 |

Knowing these fees and charges helps you choose the right account for your needs. Always read the fine print to avoid unexpected costs.

Best Use Cases

Understanding the best use cases for checking and savings accounts is crucial. Each type of account serves different financial needs. Let’s dive into how each account can be most effectively utilized.

Daily Transactions

A checking account is ideal for daily transactions. It allows easy access to your money. You can pay bills, make purchases, or withdraw cash.

- Write checks

- Use a debit card

- Set up direct deposits

- Transfer funds electronically

Many checking accounts also offer online banking. This makes it easier to manage your finances. You can track spending, check balances, and set up automatic payments.

Long-term Savings

A savings account is best for long-term savings. It helps you grow your money over time. Savings accounts usually offer higher interest rates than checking accounts.

| Feature | Checking Account | Savings Account |

|---|---|---|

| Purpose | Daily transactions | Long-term savings |

| Interest Rate | Lower | Higher |

| Withdrawal Limits | No limits | Limited withdrawals |

Savings accounts often have withdrawal limits. This encourages you to save money rather than spend it. Some banks offer special savings accounts for specific goals. Examples include college funds, retirement, or emergency savings.

By understanding these use cases, you can better manage your finances. Choose the right account based on your needs. This will help you achieve your financial goals.

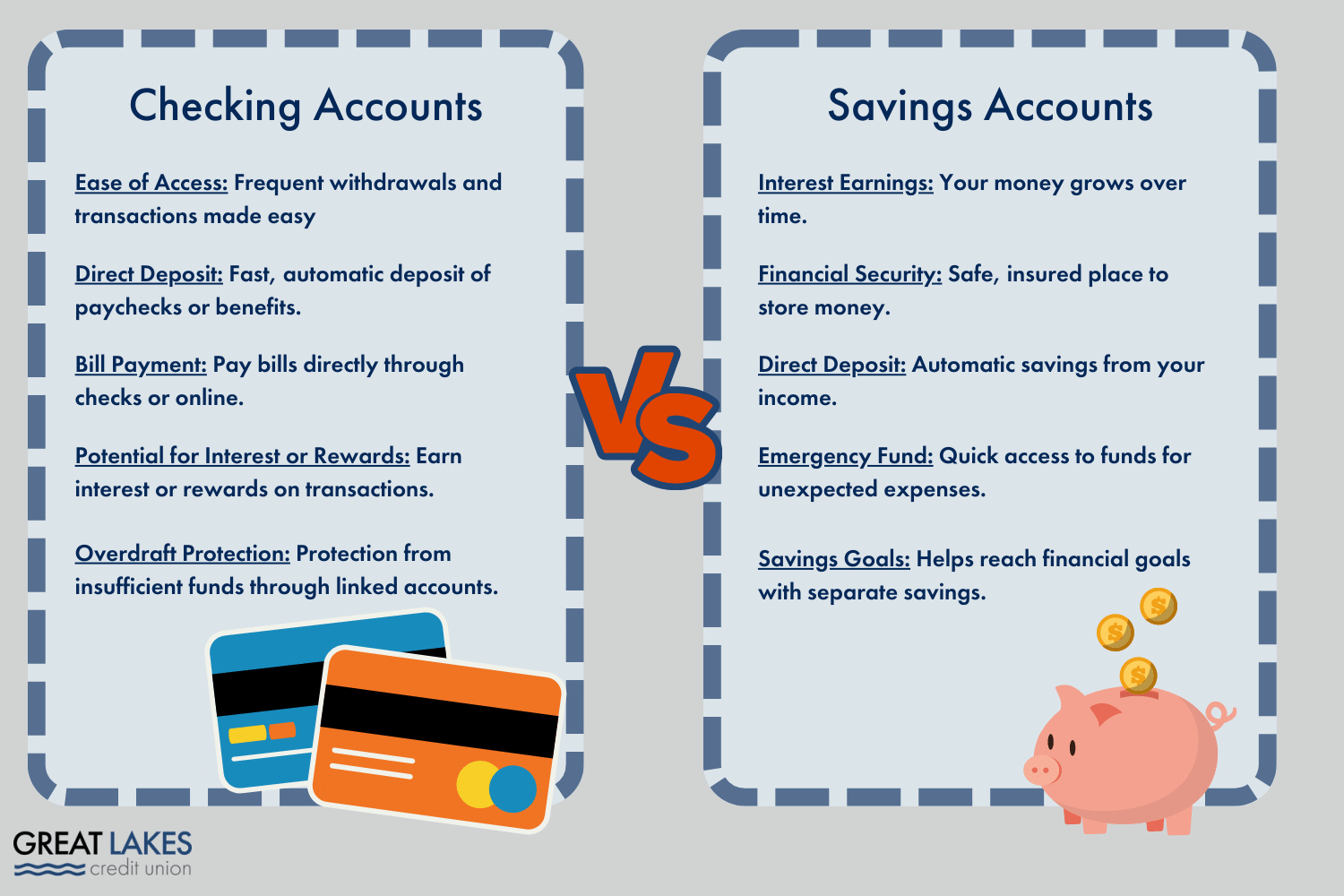

Choosing The Right Account

Choosing the right bank account is crucial for managing your money effectively. Both checking and savings accounts have their unique features. The decision largely depends on your needs and financial goals. Let’s explore these factors to help you make an informed choice.

Personal Financial Goals

Your financial goals will guide you to the right account. If you need easy access to your money for daily expenses, a checking account is ideal. It allows frequent transactions with no limits. Savings accounts are better for storing money long-term. They earn interest, helping your savings grow over time.

Account Features And Benefits

Checking accounts offer features like debit cards and online bill pay. These make it easy to manage daily spending. They usually come with low or no interest. Savings accounts, on the other hand, offer higher interest rates. They may limit the number of withdrawals per month. This helps you save more efficiently.

Credit: www.glcu.org

Frequently Asked Questions

What Is A Checking Account?

A checking account is a type of bank account used for daily transactions. It allows easy access to funds via checks, debit cards, and online transfers. Checking accounts often come with minimal or no interest.

What Is A Savings Account?

A savings account is a bank account that helps you save money. It typically offers higher interest rates than checking accounts. Savings accounts are designed for holding funds over a longer term.

How Do Checking And Savings Accounts Differ?

Checking accounts are for daily transactions, while savings accounts are for saving money. Checking accounts offer easy access to funds. Savings accounts generally offer higher interest rates.

Can You Transfer Money Between Checking And Savings Accounts?

Yes, you can transfer money between checking and savings accounts. Most banks offer easy transfer options through online banking or mobile apps.

Conclusion

Choosing between a checking and savings account depends on your needs. Checking accounts offer easy access to your money. Savings accounts are great for storing and growing funds. Understand your spending habits before deciding. Use checking for daily expenses and savings for future goals.

Both account types have their unique benefits. Balancing both can help you manage your finances better. Make informed choices to secure your financial future. Happy banking!