Credit Cards Can Help You Save and Build Financial Freedom: Pay On Time

Credit cards often get a bad reputation. Many see them as tools for debt.

But, used wisely, credit cards can be quite beneficial. Credit cards can help you save money and build financial freedom. Paying off your balance on time is key. This habit keeps you from paying high interest rates. You can also earn rewards and cashback on purchases.

These perks add up over time. Responsible credit card use can also improve your credit score. A good credit score opens doors to better loan rates and financial opportunities. So, using credit cards smartly is a step towards financial independence.

Introduction To Credit Cards

Credit cards are a popular financial tool. They can help you save and build financial freedom. This is especially true when you pay them off on time regularly. Understanding how credit cards work is key to using them wisely.

What Are Credit Cards?

Credit cards are small plastic cards issued by banks or financial institutions. They let you borrow money up to a certain limit. You can use them to make purchases, pay bills, or withdraw cash.

Each card has a credit limit. This is the maximum amount you can borrow. You must repay the borrowed amount within a specific time. If you pay on time, you avoid interest charges. This can help you save money.

How Credit Cards Work

Credit cards work by providing a short-term loan. When you use a credit card, you borrow money from the issuer. You must repay this money by the due date. If you do, you can avoid interest charges.

Here is a simple process of how credit cards work:

- Apply for a credit card from a bank or financial institution.

- Receive approval and your credit card.

- Use the card to make purchases or pay bills.

- Receive a monthly statement with details of your transactions.

- Pay the full amount or minimum amount by the due date.

If you pay the full amount on time, you will not incur interest charges. This helps you save money. Paying off your credit card balance on time also builds a good credit score. A good credit score can lead to better financial opportunities.

In summary, credit cards can be a powerful tool. They can help you save money and build financial freedom. The key is to use them wisely and pay off the balance on time.

Benefits Of Using Credit Cards

Credit cards offer numerous benefits that can help you save money and build financial freedom. They provide a range of features that can be advantageous when used responsibly. Regular on-time payments can lead to significant financial rewards and better credit scores.

Rewards And Cashbacks

Many credit cards offer rewards programs. These programs give you points for every dollar spent. You can redeem these points for travel, merchandise, or gift cards. Some credit cards also offer cash back. With cash back, you get a percentage of your purchases returned to you. This can add up to substantial savings over time.

Building Credit Score

Using credit cards responsibly helps build your credit score. A good credit score is essential for securing loans with low-interest rates. Regular, on-time payments show lenders that you are reliable. This can also lead to higher credit limits and better loan terms in the future. A strong credit score opens up many financial opportunities.

Paying On Time

Paying on time is a crucial habit to develop when using credit cards. Not only does it help you avoid unnecessary fees, but it also plays a significant role in building your financial freedom. Let’s explore the importance of timely payments and how it can impact your financial health.

Importance Of Timely Payments

Timely payments can significantly affect your credit score. A good credit score can open doors to better loan rates and financial opportunities. It shows lenders that you are a responsible borrower.

When you pay your credit card bills on time, you avoid interest charges. This means you save money in the long run. Consistent on-time payments can also increase your credit limit. This gives you more financial flexibility.

Avoiding Late Fees

Late fees can quickly add up and become a financial burden. Most credit card companies charge a fee if you miss a payment deadline. These fees can range from $25 to $35 or more.

Here’s a simple breakdown of late fees:

| Payment Delay | Late Fee |

|---|---|

| 1-30 days | $25 |

| 31-60 days | $35 |

| 61+ days | $35+ |

Besides late fees, missing payments can lead to a penalty interest rate. This higher rate can apply to your balance, increasing your debt faster.

To avoid late fees, consider setting up automatic payments. This ensures your bills are paid on time every month. You can also set reminders on your phone or calendar.

Paying your credit card bills on time not only helps you save money, but it also builds your financial freedom. Make timely payments a priority and enjoy the benefits of good financial health.

Financial Freedom With Credit Cards

Credit cards can help save money and build financial freedom. Pay off balances on time regularly to avoid interest.

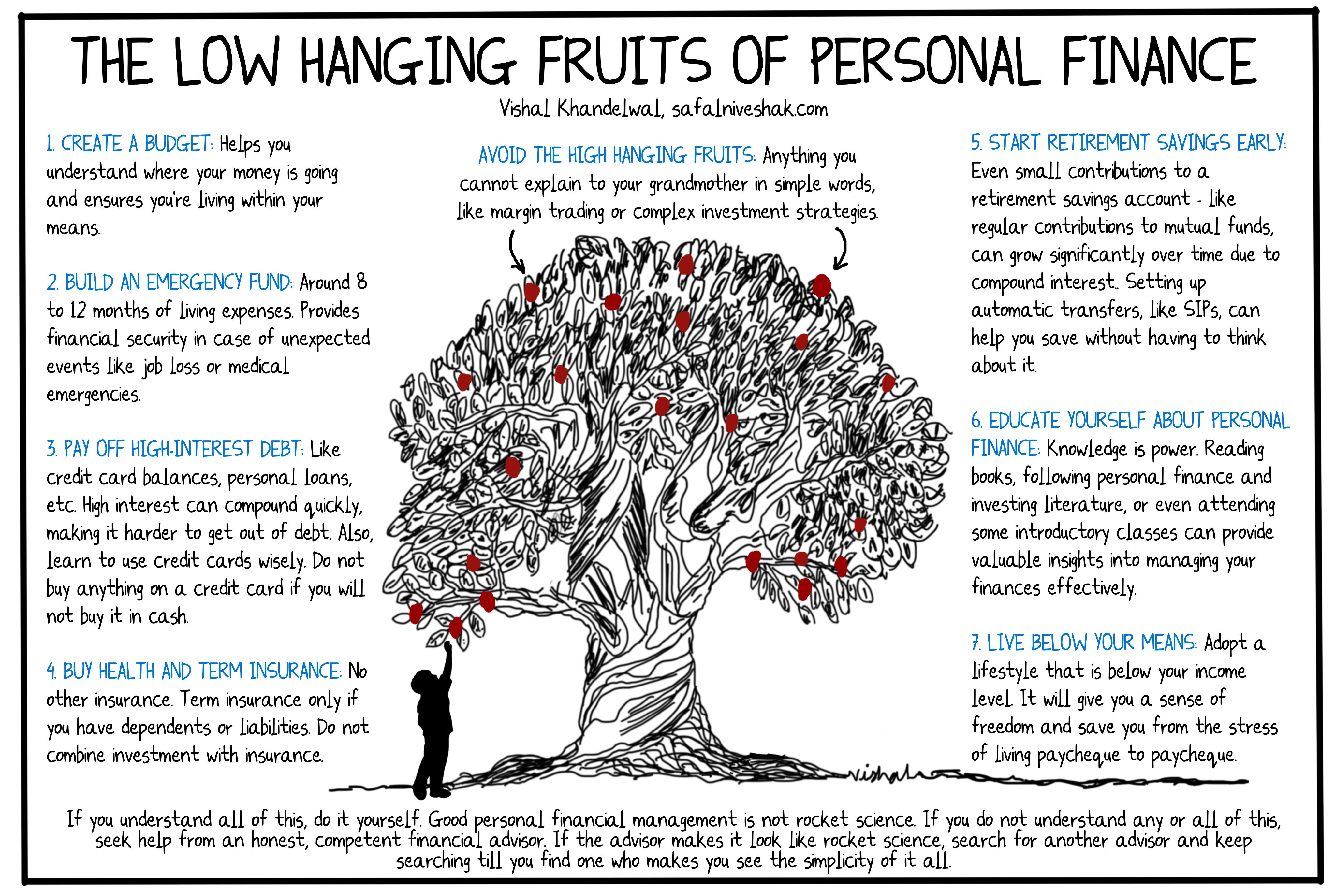

Credit cards can be powerful tools for financial freedom. When used wisely and paid off on time, they can help you save money and build a solid financial foundation. This section will explore how to manage your finances and budget effectively with credit cards.Managing Your Finances

Managing your finances with credit cards requires discipline. Track your spending to avoid overspending. This helps you stay within your budget. Regularly reviewing your statements can help you spot any unauthorized charges. Paying your balance in full each month saves you from paying interest. This also helps improve your credit score.Budgeting With Credit Cards

Budgeting with credit cards involves setting limits. Decide how much you can afford to spend. Use your credit card for planned purchases only. This helps you stick to your budget. Many credit cards offer rewards for spending. Use these rewards wisely to save money. Pay off your balance on time to avoid interest charges. This keeps your finances healthy and builds financial freedom. “`Maximizing Rewards And Benefits

Credit cards can be a powerful tool for building financial freedom. One of the main advantages is the ability to maximize rewards and benefits. By using your credit card wisely, you can earn points, cashback, and other perks that can help you save money. Let’s explore how to maximize these rewards.

Choosing The Right Credit Card

Selecting the right credit card is crucial. Different cards offer different rewards and benefits. Here are a few factors to consider:

- Annual Fees: Some cards have annual fees, while others do not. Choose one that fits your budget.

- Rewards Programs: Look for cards that offer rewards you will use. For example, travel points or cashback.

- Interest Rates: Be aware of the interest rates. Lower rates can save you money if you carry a balance.

- Sign-up Bonuses: Many cards offer bonuses for new users. These can be a great way to boost your rewards.

Using Rewards Wisely

Earning rewards is just the first step. You also need to use them wisely. Here are some tips:

- Redeem Points for High-Value Items: Use your points for items that give you the most value. This could be travel, gift cards, or statement credits.

- Avoid Unnecessary Purchases: Don’t buy things just to earn points. Only spend what you can afford to pay off.

- Track Expiration Dates: Some rewards have expiration dates. Make sure to use them before they expire.

- Combine Rewards: Some programs allow you to combine points from different sources. This can help you accumulate rewards faster.

By choosing the right credit card and using rewards wisely, you can maximize the benefits and save money.

Credit: x.com

Common Pitfalls To Avoid

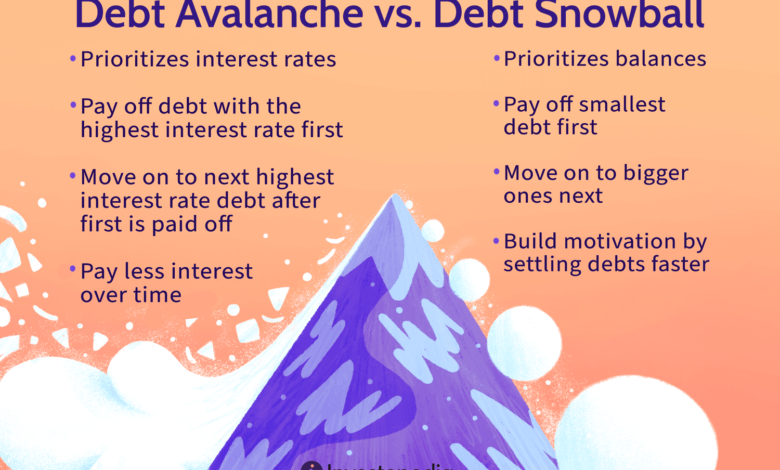

Using credit cards wisely can help you save and achieve financial freedom. But, many people fall into common pitfalls that can derail their financial goals. Understanding these pitfalls is crucial.

High-interest Rates

One major pitfall is high-interest rates. Credit cards often come with high rates. If you carry a balance, interest can add up fast. This makes it hard to pay off your debt. Always aim to pay your full balance each month. This way, you avoid interest charges.

Overspending Risks

Credit cards can make it easy to overspend. The temptation to buy now and pay later is strong. But, this can lead to debt. Create a budget and stick to it. Monitor your spending closely. Avoid impulse purchases. These habits can help you use credit cards wisely.

Tips For Responsible Credit Card Use

Using credit cards responsibly can help you build financial freedom. Paying off your balance on time is key. Here are some tips to help you manage your credit card use wisely.

Setting Payment Reminders

It’s easy to forget payment dates. Setting reminders can help you stay on track. You can use your phone’s calendar to set alerts. Many banks also offer email or text reminders. This way, you won’t miss a payment.

Monitoring Your Spending

Keeping an eye on your spending is crucial. Check your statement regularly. This helps you see where your money goes. Many banks offer apps to track your spending. Use these tools to stay within your budget.

Credit: www.linkedin.com

Credit: www.linkedin.com

Frequently Asked Questions

How Can Credit Cards Help Save Money?

Credit cards offer rewards and cash back on purchases. When used wisely, these benefits can add up. Paying off the balance on time avoids interest charges, helping you save money.

How Do Credit Cards Build Financial Freedom?

Credit cards help build credit history when paid on time. A good credit score can lead to better loan terms. This financial freedom allows you to access more opportunities.

What Happens If I Don’t Pay Credit Cards On Time?

Not paying on time results in interest charges and late fees. This negatively impacts your credit score. Over time, it can lead to debt accumulation and financial stress.

Are There Benefits To Using Credit Cards Regularly?

Yes, using credit cards regularly and responsibly builds credit history. It can earn you rewards, cash back, and other perks. Always pay off the balance on time to maximize benefits.

Conclusion

Paying off credit cards on time brings many benefits. It helps build financial freedom. Regular, timely payments save you money on interest. They also improve your credit score. A better credit score means better loan rates. Financial discipline with credit cards is key.

It prevents debt accumulation. It fosters savings habits. Credit cards, when managed well, are powerful tools. They support long-term financial goals. Start today. Pay on time. Secure your financial future.