What Is A Reason To Pay More Than The Minimum Payment Due On Your Credit Statement Each Month: Boost Your Credit Score

Paying more than the minimum payment on your credit card helps reduce debt faster. It also saves money on interest charges.

But there’s more to it. Credit cards are a convenient way to manage expenses. However, only paying the minimum each month can trap you in a cycle of debt. This can lead to high-interest costs over time. By paying more than the minimum, you take control of your finances.

It helps improve your credit score and financial stability. Let’s explore why paying more than the minimum is crucial for your financial health. This habit can make a big difference in your long-term financial well-being.

Credit: www.reddit.com

Importance Of Credit Score

The importance of a credit score cannot be overstated. A good credit score opens many financial doors. It reflects your creditworthiness and financial responsibility.

Impact On Financial Health

Paying more than the minimum payment improves your credit score. A higher credit score means lower interest rates on loans. It saves you money in the long run. It also shows lenders you are reliable. This can lead to better loan terms and higher credit limits.

Influence On Loan Approval

Lenders check your credit score before approving loans. A high credit score increases your chances of getting approved. It also affects the loan amount and interest rate you get. Paying more than the minimum payment shows you manage debt well. This can be a deciding factor for lenders.

Minimum Payment Explained

Understanding the minimum payment on your credit statement can help manage your debt. It is crucial to know the basics. This section breaks down the minimum payment, its definition, and common misconceptions.

Definition

The minimum payment is the smallest amount you must pay each month. It is usually a small percentage of your total balance. This amount keeps your account in good standing. It prevents late fees and penalties. Paying only the minimum can lead to long-term debt.

Common Misconceptions

Many believe paying the minimum is enough to stay debt-free. This is not true. The minimum payment mostly covers interest. Very little goes towards the principal balance. This means your debt reduces very slowly.

Another misconception is that paying the minimum improves your credit score. While it prevents negative marks, it does not boost your score significantly. Paying more than the minimum helps reduce your debt faster. It also improves your credit utilization ratio.

Consequences Of Paying Only The Minimum

Paying only the minimum amount on your credit card bill each month may seem manageable. But it can lead to long-term financial consequences. Understanding these effects can help you make better financial decisions.

Accumulating Interest

Credit cards usually carry high-interest rates. Paying only the minimum means the remaining balance accrues interest. This can quickly add up, increasing your overall debt.

Over time, the interest can become a significant portion of your monthly payment. This makes it harder to reduce your balance. The more interest you accumulate, the more difficult it becomes to pay off your debt.

Extended Debt Period

Paying only the minimum extends the time it takes to clear your debt. Your monthly payments mostly cover interest and fees. The principal amount reduces very slowly.

This means you remain in debt for a longer period. Extended debt periods can strain your finances and limit your ability to save or invest in other areas.

Credit: www.experian.com

Benefits Of Paying More Than The Minimum

Paying more than the minimum payment on your credit card each month can have several advantages. It can help you manage your debt more effectively and save you money. Here are some key benefits:

Faster Debt Reduction

When you pay more than the minimum amount, you reduce your debt faster. This is because more of your payment goes towards the principal balance. Reducing your principal balance quickly can help you pay off your credit card debt sooner.

Consider this example:

| Monthly Payment | Time to Pay Off | Total Interest Paid |

|---|---|---|

| Minimum Payment | 10 years | $2,000 |

| Double the Minimum | 5 years | $1,000 |

As you can see, paying more each month can significantly reduce the time it takes to pay off your debt.

Lower Interest Payments

Paying more than the minimum also lowers the interest you pay over time. Credit card interest is calculated on your remaining balance. By reducing your balance faster, you pay less interest overall.

Here are some reasons why lower interest payments are beneficial:

- You save money in the long run.

- You can use saved money for other expenses.

- Your financial stress decreases.

In summary, paying more than the minimum can help you save money and reduce your debt faster. It is a smart financial move that offers many benefits.

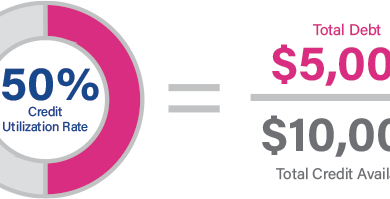

Impact On Credit Utilization Ratio

Paying more than the minimum payment on your credit card each month can positively impact your credit utilization ratio. This is a key factor in determining your credit score. A lower credit utilization ratio can lead to a better credit score. Let’s dive into the importance of credit utilization ratio and how it affects your financial health.

Definition Of Credit Utilization

Credit utilization is the ratio of your credit card balances to your credit limit. It shows how much of your available credit you are using at any given time.

For example, if you have a credit limit of $10,000 and a balance of $2,000, your credit utilization ratio is 20%.

Effect On Credit Score

Your credit utilization ratio makes up 30% of your credit score. Keeping this ratio low is crucial for a good credit score.

Here are a few ways a higher credit utilization ratio can harm your credit score:

- It may signal to lenders that you rely heavily on credit.

- It increases the risk of default, making you a less attractive borrower.

On the other hand, a lower credit utilization ratio can benefit you:

- It shows lenders that you manage credit responsibly.

- It boosts your credit score, making it easier to get loans.

By paying more than the minimum payment, you reduce your balance faster, which in turn lowers your credit utilization ratio.

This simple habit can improve your financial health over time.

Building Positive Payment History

Building a positive payment history is crucial for your financial health. Paying more than the minimum due on your credit card statement can help. Consistent payments above the minimum can improve your credit score. It shows lenders you are responsible with your finances.

Consistency In Payments

Paying more than the minimum each month displays financial discipline. Lenders see this as a sign of reliability. Consistent payments help build a strong credit history. This can lead to better loan offers in the future. Creditors prefer clients who pay more than the minimum.

Long-term Credit Benefits

A good payment history can lead to lower interest rates. Over time, this saves you money on loans and credit cards. With a higher credit score, you get better terms on mortgages and auto loans. Paying more than the minimum helps reduce your overall debt faster. This can improve your debt-to-income ratio, a key factor in credit scoring.

Strategies To Pay More Than The Minimum

Paying more than the minimum payment on your credit card can save you money. It helps you avoid high interest charges and reduces your debt faster. To achieve this, you need strategies that fit your lifestyle and financial situation. Here are some practical ways to ensure you pay more than the minimum each month.

Budgeting Tips

Create a monthly budget to track your income and expenses. This helps you find areas where you can save money. Use these savings to pay extra on your credit card. Allocate a specific amount each month towards your credit card debt. Make sure this amount is higher than the minimum payment. Adjust your budget as needed to stay on track.

Automated Payments

Set up automated payments through your bank or credit card provider. This ensures you never miss a payment. Schedule these payments for a higher amount than the minimum due. This way, you consistently reduce your debt. Automated payments also help avoid late fees and penalties.

Credit: www.shoeboxed.com

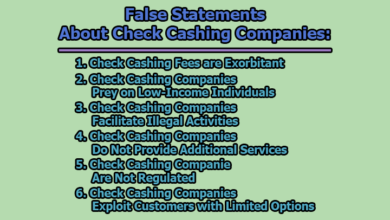

Common Myths About Credit Payments

Many people believe that paying only the minimum amount due on their credit card statement is sufficient. This belief stems from various myths about credit payments. It’s essential to understand the reality behind these myths to manage your finances effectively.

Myth Vs Reality

Myth: Paying the minimum amount due will keep you out of debt. Reality: Paying only the minimum keeps you in debt longer. This leads to paying more interest over time.

Myth: Paying more than the minimum amount doesn’t impact your credit score. Reality: Paying more reduces your overall debt, which can improve your credit score.

Myth: Minimum payments are designed to help you manage your debt. Reality: They are designed to benefit credit card companies. They earn more from the interest.

Practical Advice

Always aim to pay more than the minimum due. This helps reduce your debt faster and saves on interest. Set a budget to allocate more funds toward your credit card payments.

Track your spending. This helps you identify areas where you can cut back and redirect those funds to pay off your credit card balance.

Consider setting up automatic payments. This ensures you never miss a payment and can help you pay more than the minimum due.

Use windfalls like tax refunds or bonuses to make larger payments. This reduces your debt quicker and improves your financial health.

Frequently Asked Questions

Why Pay More Than The Minimum Payment?

Paying more than the minimum reduces your debt faster. It decreases interest charges and improves your credit score over time.

How Does Paying More Affect Interest?

Paying more than the minimum reduces the principal balance. This lowers the amount of interest you’ll be charged.

Can Paying Extra Improve Credit Score?

Yes, paying extra can improve your credit utilization ratio. This positively impacts your credit score significantly.

Is It Beneficial To Pay More Than Minimum?

Yes, it helps in paying off debt quicker. It also reduces the total interest paid over time.

Conclusion

Paying more than the minimum amount on your credit statement helps. It reduces debt faster. It saves you money on interest. It improves your credit score. It gives you financial freedom sooner. Avoiding debt stress is worth it. Smaller payments now lead to bigger savings later.

Make paying more a habit. Your future self will thank you. Start today and see the benefits. Every extra dollar counts. Manage your finances wisely.