Preparing To Pay For Higher Education Can Start In 9th Grade: Smart Tips

Preparing to pay for higher education is a task best started early. Beginning in 9th grade, or even earlier, can make a significant difference.

Planning ahead can ease the financial burden of college. Early preparation allows families to explore savings options, scholarships, and financial aid. Starting in 9th grade gives students and parents ample time to understand costs and create a solid plan. This approach helps in building a strong financial foundation.

Moreover, it encourages students to focus on their academic goals. By thinking ahead, families can reduce stress and make informed decisions. In this blog, we will explore strategies and tips for starting early to fund higher education. Let’s dive into the steps that can set you up for success.

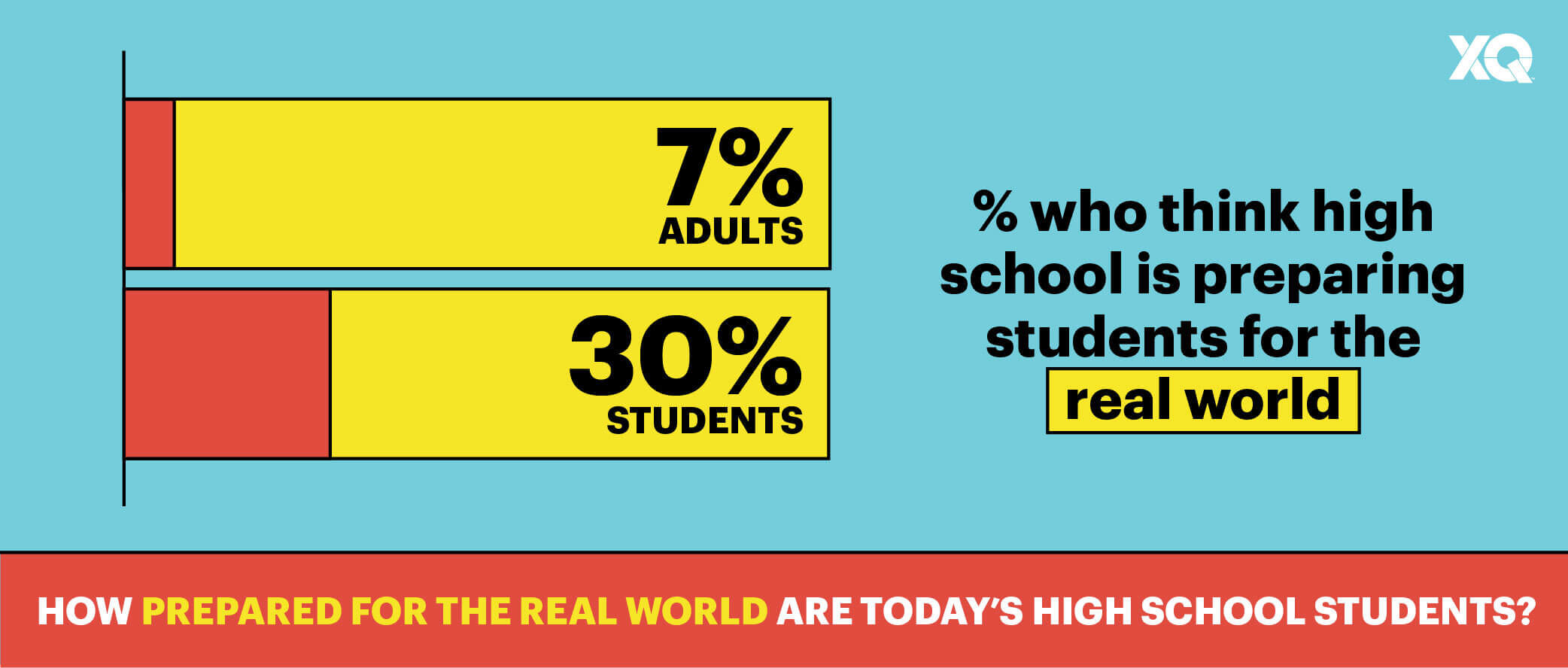

Credit: xqsuperschool.org

Importance Of Early Financial Planning

Preparing to pay for higher education can start in 9th grade or earlier. Early financial planning is crucial for reducing stress. It helps families understand the costs involved. They can also explore various financial aid options. This preparation sets the foundation for a smoother college journey.

Benefits Of Starting In 9th Grade

Starting financial planning in 9th grade has many benefits. First, it gives families more time to save. Second, students can focus on scholarships and grants. Early planning also allows for better budgeting. Families can avoid last-minute financial stress.

Here are some key benefits:

- More Time to Save: Starting early allows more time to accumulate savings.

- Explore Scholarships: Students can research and apply for scholarships.

- Budgeting: Families can plan and manage their finances better.

Long-term Financial Goals

Setting long-term financial goals is vital. It helps families stay on track. They can monitor their progress and make necessary adjustments. Long-term goals also provide motivation. They remind families of the importance of saving for education.

Consider the following steps:

- Set Clear Goals: Define the amount needed for college.

- Create a Savings Plan: Determine how much to save each month.

- Review Regularly: Check progress and adjust if needed.

By starting early, families can make informed financial decisions. They can take advantage of various savings options. This proactive approach ensures that students can focus on their studies without financial worries. Early planning is the key to a successful college journey.

Understanding College Costs

Preparing to pay for higher education can start early, even as early as the 9th grade. Understanding the various components of college costs is crucial. These costs can be broadly categorized into tuition and fees, room and board, and books and supplies. Knowing these costs helps in better financial planning for college.

Tuition And Fees

Tuition and fees are the primary expenses for college. Tuition is the amount paid for instruction. Fees cover additional services like library access, student activities, and technology. Private colleges often have higher tuition and fees compared to public colleges. In-state public colleges usually offer lower tuition rates for residents. Out-of-state students pay higher rates.

It’s important to research the costs of different colleges. Creating a list of potential colleges and comparing their tuition and fees can be helpful. Consider both public and private institutions to get a broad view of potential costs.

Room And Board

Room and board include housing and meal plans. This cost varies based on the type of accommodation. Dormitories, apartments, or living off-campus offer different price points. Meal plans also differ in cost depending on the number of meals and dining options provided. On-campus housing is often more expensive but offers convenience. Off-campus living might be cheaper but includes additional costs like utilities and groceries.

Understanding these expenses is crucial. Check the housing and meal options offered by colleges on your list. Compare their costs to find the most suitable and affordable options.

Books And Supplies

Books and supplies are essential for academic success. These include textbooks, notebooks, and other learning materials. The cost of books and supplies can add up quickly. Some courses require expensive textbooks, while others may use online resources. Renting textbooks or buying used ones can save money. Some colleges offer book rental programs or digital textbook options at lower prices.

Researching the expected costs for books and supplies for each course can help in budgeting. Look for ways to minimize these costs through rentals, used books, or digital alternatives.

| Cost Category | Details |

|---|---|

| Tuition and Fees | Instruction costs, service fees, varies by institution type and residency status |

| Room and Board | Housing and meal plans, varies by accommodation type and college |

| Books and Supplies | Textbooks, notebooks, learning materials, cost-saving options available |

Creating A Savings Plan

Preparing to pay for higher education can start early. One key step is creating a savings plan. This plan can help set clear goals and ensure funds are available when needed. A savings plan can start in 9th grade or even earlier. Here are some practical steps to get started.

Setting Up A College Fund

Setting up a college fund is a great first step. This fund will be dedicated solely to education expenses. You can start by researching different types of college funds. Common options include 529 plans and Coverdell Education Savings Accounts.

529 plans offer tax advantages and flexibility. They can be used for tuition, books, and even room and board. Coverdell accounts also provide tax benefits. They can be used for K-12 expenses in addition to college costs. Choose the option that best fits your needs.

Setting up automatic contributions can help grow the fund steadily. Even small, regular deposits can add up over time. Encourage family members to contribute as well. Birthdays and holidays are great opportunities for this.

Choosing The Right Savings Account

Choosing the right savings account is crucial. The right account will provide good interest rates and low fees. Look for accounts specifically designed for education savings. These accounts often offer better terms.

High-yield savings accounts are a good option. They offer higher interest rates than regular savings accounts. This can help your money grow faster. Make sure to compare different banks and credit unions. Look for accounts with no minimum balance requirements.

Consider a custodial account if the student is a minor. These accounts are managed by an adult until the child reaches adulthood. They can be used for education expenses and offer some tax advantages.

Here is a comparison table to help you decide:

| Account Type | Interest Rate | Tax Advantages | Flexibility |

|---|---|---|---|

| 529 Plan | Moderate | Yes | High |

| Coverdell ESA | Moderate | Yes | Moderate |

| High-Yield Savings | High | No | High |

| Custodial Account | Varies | Yes | Moderate |

By setting up a dedicated college fund and choosing the right savings account, you can make significant strides in preparing for higher education costs. Start early, stay consistent, and watch your savings grow.

Exploring Scholarships And Grants

Exploring scholarships and grants is a crucial step in preparing for higher education. Starting early can make a significant difference. By 9th grade or even earlier, students can begin searching for financial aid opportunities. This proactive approach can ease the financial burden of college.

Researching Opportunities

Begin by identifying different scholarships and grants available. Many organizations offer financial aid based on various criteria. These can include academic performance, extracurricular activities, and community service. Some scholarships are specific to certain fields of study or demographic groups.

Use online databases to find scholarships. Websites like Fastweb, Scholarships.com, and the College Board can help. Local community foundations and businesses may also offer scholarships. Visit your school’s guidance counselor for additional resources.

Make a list of potential scholarships and grants. Keep track of deadlines and requirements. Staying organized will help you manage multiple applications effectively.

Applying Early

Starting the application process early can increase your chances of success. Some scholarships have deadlines a year or more before the start of college. Applying early shows initiative and gives you time to gather necessary documents.

Prepare your application materials in advance. This includes transcripts, letters of recommendation, and personal statements. Tailor each application to the specific scholarship requirements.

Submit your applications as soon as they are complete. Early submissions can sometimes receive more attention from selection committees.

Remember, persistence is key. Not every application will result in an award. Apply to multiple scholarships to maximize your chances.

Encouraging Part-time Work

Starting to think about paying for higher education early is smart. One way to help is by encouraging part-time work. Students can learn valuable skills and save money at the same time. Working while in school can be a great way to prepare for the future.

Benefits Of A Job

Part-time jobs teach responsibility. Students learn how to manage their time and money. They gain work experience which can be useful later. A job also helps students understand the value of hard work. This can boost their confidence and independence.

Saving money from a job can ease the burden of college costs. Even small savings can add up over time. Students who work part-time are better prepared financially for higher education. They also learn how to budget and prioritize spending.

Balancing Work And School

Balancing work and school can be a challenge. But it is possible with careful planning. Students should choose jobs that do not interfere with their studies. Flexible hours or weekend shifts can be ideal.

Time management is key. Students need to set priorities and stick to a schedule. Keeping track of assignments and work hours helps avoid stress. It’s important to find time for rest and recreation too.

Parents and teachers can support students in this balancing act. They can help students develop good habits and stay organized. Encouraging part-time work can be a valuable part of preparing for higher education.

Credit: www.gauthmath.com

Understanding Student Loans

Planning for higher education requires understanding student loans. Knowing the differences, interest rates, and repayment terms can help students and parents make informed decisions. Let’s dive into the details.

Federal Vs. Private Loans

There are two main types of student loans: federal and private. Federal loans are provided by the government. Private loans come from banks or other financial institutions.

| Federal Loans | Private Loans |

|---|---|

| Fixed interest rates | Variable or fixed interest rates |

| Income-driven repayment plans | Limited repayment options |

| Forgiveness programs available | No forgiveness programs |

Interest Rates And Repayment

Interest rates can significantly impact the total cost of a student loan. Federal loans generally have lower rates compared to private loans.

- Federal Loans: The government sets the interest rates. They are usually lower and fixed.

- Private Loans: Interest rates are set by lenders. They can be variable or fixed and are often higher.

Repayment terms also vary:

- Federal loans offer flexible repayment plans, including income-driven plans.

- Private loans have stricter repayment terms. They may not offer income-driven plans.

Understanding these differences can help in choosing the right loan. It’s essential to read the terms carefully before committing.

Involving The Whole Family

Preparing to pay for higher education can be a daunting task. Starting early can ease the financial burden. Involving the whole family in this process can make a significant difference. Each member plays a crucial role in achieving the goal. This approach ensures that everyone understands the importance of saving and planning ahead.

Family Contributions

Every family member can contribute in their own way. Parents can set up savings accounts dedicated to education funds. Grandparents and other relatives can also contribute to these accounts. Even small amounts can add up over time. Students can participate by saving a portion of their allowance or earnings from part-time jobs.

Engaging the entire family fosters a sense of responsibility. It helps everyone feel invested in the student’s future. It also teaches students the value of money and the importance of saving.

Discussing Financial Expectations

Open communication about financial expectations is crucial. Families should discuss how much they can realistically contribute. Understanding the family’s financial situation can help set clear expectations.

Students should be aware of the costs of higher education. This includes tuition, books, housing, and other expenses. Clear discussions can prevent misunderstandings and financial stress later on. Setting goals and creating a plan together can make the process smoother.

Encourage students to look for scholarships and grants. They should also understand the potential need for student loans. Preparing together can create a united front, making the journey to higher education a shared responsibility.

Credit: www.usd231.com

Seeking Professional Guidance

Preparing for higher education costs can be overwhelming. Seeking professional guidance can make the process easier and more manageable. Experts can offer valuable insights and strategies to navigate financial planning for college.

Financial Advisors

Financial advisors can provide personalized advice. They help families understand their financial situation. Advisors can suggest savings plans and investment options. They can also assist in creating a budget for college expenses. Professional guidance ensures you make informed decisions about your finances.

College Counselors

College counselors play a crucial role. They help students find suitable colleges and guide them through the application process. Counselors can also provide information about scholarships and grants. They ensure that students maximize their chances of receiving financial aid. Their expertise can make a significant difference in the college planning journey.

Frequently Asked Questions

When Should You Start Planning For College Costs?

Start planning for college costs as early as 9th grade. Early planning helps in budgeting and exploring scholarship opportunities.

How Can 9th Graders Prepare For College Expenses?

9th graders can start by researching scholarships and grants. They should also focus on maintaining good grades and participating in extracurricular activities.

Why Is Early Planning For College Important?

Early planning for college is important to manage finances effectively. It helps in reducing the burden of student loans and debt.

What Financial Aid Options Are Available For High School Students?

High school students can apply for scholarships, grants, and work-study programs. They should also consider federal student aid and private scholarships.

Conclusion

Starting early can ease the burden of higher education costs. Ninth grade is a good time to start planning. Save money and explore scholarships. Discuss future goals with your child. Teach them about budgeting and financial responsibility. Make a plan and stick to it.

Small steps now lead to big savings later. Remember, preparation is key. Early planning helps manage education expenses. By starting early, you set your child up for success. Every little bit helps in the long run. Make education goals a family priority today.