Which Is A Tax Free Savings Account That Can Only Be Used For Educational Expenses: Discover the Best Option

A 529 plan is a tax-free savings account for educational expenses. It offers families a way to save for school costs.

Education can be expensive. Finding the right way to save money is crucial for many families. A 529 plan can help ease the financial burden of education. This special savings account allows you to grow your money without worrying about taxes.

You can use the funds for various education-related costs. It’s a smart way to invest in your child’s future. In this blog, we will explore how a 529 plan works. We will also discuss its benefits and why it might be the right choice for you. Stay tuned to learn more about this helpful savings tool.

Introduction To Tax-free Savings Accounts

Tax-Free Savings Accounts (TFSAs) are special types of accounts. They help you save money without paying taxes on the interest earned. These accounts are excellent for long-term savings goals. One of the most common uses for TFSAs is saving for education.

Importance Of Tax-free Accounts

Tax-free accounts are crucial for many reasons. They allow your savings to grow faster. Since you do not pay taxes on the earnings, your money can compound over time. This is especially beneficial for long-term goals like education.

Saving money can be challenging. Tax-free accounts make it easier. They give you a financial advantage. This is why many people choose them for significant expenses.

Educational Savings Focus

One popular type of tax-free account is the 529 Plan. It is designed specifically for educational expenses. These accounts offer great flexibility. You can use them for tuition, books, and other school-related costs.

The 529 Plan has many benefits. It allows you to contribute large amounts of money. The earnings are tax-free. This helps your savings grow faster. You can also transfer the account to another family member. This is useful if the original beneficiary does not need the funds.

Credit: www.youtube.com

529 College Savings Plans

529 College Savings Plans are specialized savings accounts designed for educational expenses. These plans offer tax benefits and can be used for various educational costs. They provide a flexible way to save for college and other educational expenses, making them popular among parents and students.

Key Features

529 College Savings Plans come with a variety of key features:

- Tax Advantages: Contributions grow tax-free, and withdrawals for qualified education expenses are also tax-free.

- High Contribution Limits: Many plans have high contribution limits, sometimes exceeding $300,000.

- State-Specific Benefits: Some states offer additional tax benefits for residents who contribute to their state’s plan.

- Flexible Use: Funds can be used for a wide range of educational expenses, including tuition, room and board, and supplies.

- Transferable: You can change the beneficiary to another family member without penalties.

Benefits For Education

529 College Savings Plans provide numerous benefits for educational expenses:

- Cover a Range of Costs: Use for K-12 tuition, college expenses, and even student loan repayment.

- Financial Aid Friendly: These accounts generally have a minimal impact on financial aid eligibility.

- Ease of Management: Many plans offer automatic investment options and easy account management.

- Gift Contributions: Friends and family can contribute to the account, helping grow the savings.

- No Age Limits: There are no age limits for beneficiaries, making it versatile for lifelong learning.

529 College Savings Plans are an excellent tool for planning and saving for educational expenses. With various tax benefits and flexible usage options, they make higher education more accessible and affordable.

Coverdell Education Savings Accounts

Coverdell Education Savings Accounts (ESAs) are tax-free savings accounts. These accounts are designed for educational expenses. Many families choose Coverdell ESAs. They offer benefits for saving for education. Understanding these accounts can help you plan for your child’s future.

Core Characteristics

Coverdell ESAs have unique features. You can contribute up to $2,000 per year. Contributions are not tax-deductible. Earnings grow tax-free. Funds must be used for qualified education expenses. These expenses can include tuition, books, and supplies. The beneficiary must use the funds by age 30. You can open a Coverdell ESA at many financial institutions. The account can be transferred to another family member.

Advantages And Limitations

Coverdell ESAs offer several advantages. Earnings grow tax-free. Withdrawals for qualified expenses are also tax-free. The funds can be used for K-12 and college expenses. Flexibility allows for a wide range of educational expenses. You can transfer the account to another family member.

There are some limitations to consider. The $2,000 annual contribution limit may be low. Contributions must stop when the beneficiary turns 18. Income limits apply for contributors. Funds must be used by the beneficiary’s 30th birthday. Failure to use the funds for education may result in taxes and penalties.

Comparing 529 And Coverdell Accounts

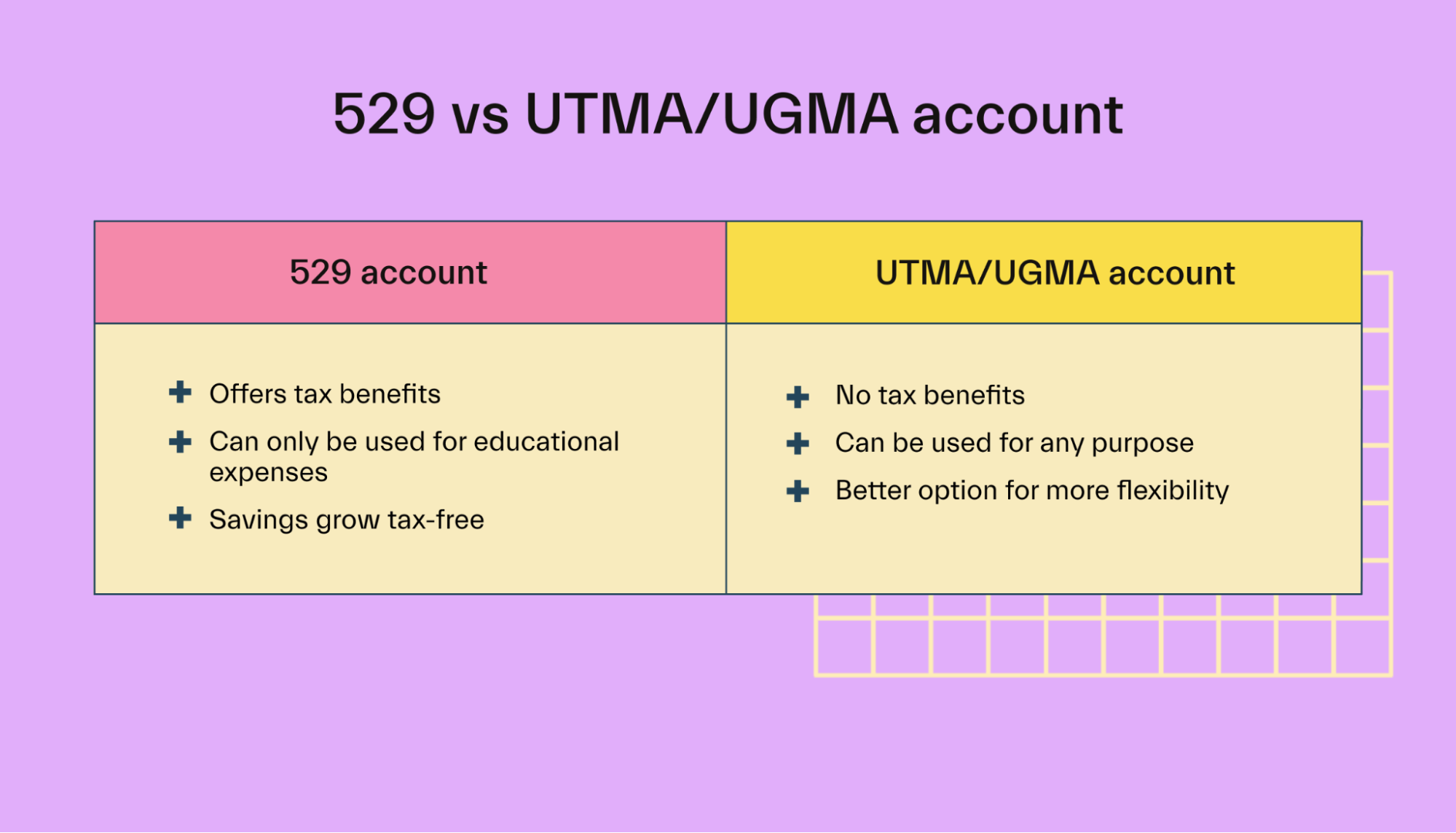

Tax-free savings accounts for educational expenses provide an excellent way to save for future schooling needs. Two popular options are the 529 plan and the Coverdell Education Savings Account (ESA). Both have unique features and benefits. Understanding their differences can help you choose the best option for your educational savings.

Contribution Limits

Contribution limits differ between 529 plans and Coverdell ESAs. For 529 plans, the limits are high. Some states allow contributions over $300,000. This makes it easier to save large amounts over time. However, Coverdell ESA contributions are capped at $2,000 per year. This limit applies per child, making it less flexible for large savings.

Eligible Expenses

Eligible expenses covered by these accounts also vary. 529 plans can be used for a wide range of educational costs. This includes tuition, fees, room, board, and even K-12 expenses. Coverdell ESAs, on the other hand, cover similar costs. They also extend to books, supplies, and even some special needs services. This makes Coverdell ESAs more versatile for specific educational needs.

Tax Benefits Of Education Savings Accounts

Education Savings Accounts (ESAs) offer tax-free savings for educational expenses. ESAs help families save for tuition, books, and other school costs.

Education Savings Accounts (ESAs) offer a smart way to save for education. They provide significant tax benefits. These tax advantages can make a big difference in your savings.Federal Tax Advantages

ESAs allow your earnings to grow tax-free. You do not pay federal taxes on interest or dividends. Withdrawals for qualified education expenses are also tax-free. This means you keep more of your money.State-specific Benefits

Some states offer extra benefits for ESAs. These benefits can include state tax deductions or credits. Each state has its own rules. Check your state’s specific ESA benefits. You might save even more on your state taxes. “`

Credit: www.mos.com

Choosing The Right Account

Choosing the right tax-free savings account for educational expenses is important. There are specific accounts designed to help save money for future education costs. Selecting the right one can make a significant difference in your savings and expenses.

Assessing Financial Goals

Start by assessing your financial goals. Consider how much you want to save. Think about the timeline for these savings. Are you saving for a child’s future education? Or are you planning to return to school yourself? Understanding your goals will help you select the right account.

Evaluating Educational Needs

Next, evaluate your educational needs. Determine the type of education you are saving for. Is it for primary, secondary, or higher education? Different accounts may have specific rules for various education levels. Some accounts might offer more benefits for certain educational expenses.

By understanding your financial goals and educational needs, you can choose the best tax-free savings account. This ensures that you maximize your savings and minimize your educational costs.

Setting Up Your Educational Savings Account

Setting up an educational savings account can be a smart move. This type of account is tax-free and used only for educational expenses. Below, we will guide you through the process of opening and maximizing your educational savings account.

Steps To Open An Account

Follow these simple steps to open your educational savings account:

- Research: Look for financial institutions offering educational savings accounts.

- Compare Options: Compare fees, interest rates, and terms.

- Gather Documents: Prepare necessary documents like ID and Social Security Number.

- Application: Fill out the application form provided by the institution.

- Initial Deposit: Make the required initial deposit to activate your account.

Ensure you understand all terms and conditions before opening the account.

Tips For Maximizing Savings

Here are some tips to maximize your educational savings:

- Start Early: The sooner you start saving, the more you accumulate.

- Regular Contributions: Make regular contributions to your account.

- Take Advantage of Offers: Look for promotional interest rates or bonuses.

- Monitor Account: Regularly check your account to track progress.

- Use Windfalls: Use unexpected money like bonuses or tax refunds to boost savings.

Consistency is key to growing your educational savings account. Follow these tips to make the most of your savings.

Maximizing The Impact Of Your Savings

Maximizing the impact of your savings in a tax-free savings account for educational expenses can seem daunting. With the right strategies, you can make the most of this opportunity. This blog post will explore investment strategies and long-term planning to help you grow your savings efficiently.

Investment Strategies

Effective investment strategies are crucial for maximizing your savings. Here are some practical tips:

- Diversify your investments: Spread your savings across different assets. This reduces risk and increases potential returns.

- Invest in low-cost index funds: These funds have lower fees and can provide steady growth.

- Regularly review your portfolio: Check your investments periodically. Adjust them based on market conditions and your goals.

- Start early: The sooner you invest, the more time your money has to grow. Compounding interest can significantly boost your savings.

Long-term Planning

Long-term planning is essential for ensuring your savings last. Consider these steps:

- Set clear goals: Determine how much you need for education expenses. This will guide your savings and investment decisions.

- Create a budget: Track your income and expenses. Allocate a portion of your income to your savings account regularly.

- Consider inflation: Factor in the rising cost of education. Save more than you think you’ll need to cover future expenses.

- Seek professional advice: Consult a financial advisor. They can provide tailored advice and help optimize your savings strategy.

By following these investment strategies and long-term planning tips, you can maximize the impact of your tax-free savings account for educational expenses.

Common Mistakes To Avoid

Opening a tax-free savings account for educational expenses can be a wise choice. Yet, some common mistakes can diminish its benefits. Avoid these pitfalls to maximize your savings.

Overlooking Fees

Many overlook fees associated with these accounts. Some accounts have maintenance fees. Others may charge transaction fees. These fees can add up over time. They can reduce your savings significantly. Always review fee structures before opening an account.

Misunderstanding Withdrawal Rules

Another common mistake is misunderstanding withdrawal rules. These accounts have specific rules for withdrawals. Using funds for non-educational expenses can incur penalties. Always ensure withdrawals align with educational purposes. This helps avoid unnecessary fees and penalties.

Credit: slideplayer.com

Frequently Asked Questions

What Is A Tax-free Educational Savings Account?

A 529 Plan is a tax-free savings account for educational expenses. It offers tax-free growth and withdrawals for qualified educational costs.

How Does A 529 Plan Work?

A 529 Plan allows you to save money for education. Earnings grow tax-free, and withdrawals for qualified education expenses are also tax-free.

Who Can Open A 529 Plan?

Any U. S. citizen or resident alien, 18 or older, can open a 529 Plan. There are no income restrictions.

What Are The Benefits Of A 529 Plan?

The 529 Plan offers tax-free growth, tax-free withdrawals for education, and potential state tax deductions. It also has high contribution limits.

Conclusion

Choosing a tax-free savings account for education is a smart move. It helps save money specifically for educational expenses. Options like 529 plans offer tax benefits and flexibility. Start saving early to maximize the benefits. Remember, every little bit counts towards a brighter future.

Plan wisely and invest in education today. This ensures a better tomorrow for your loved ones. Stay informed and make the best choice for your family. Happy saving!