Kategori Transaksi Fee Base yang Merupakan Dompet Elektronik Adalah: A Comprehensive Guide

Introduction

In today’s rapidly advancing digital economy, the importance of understanding various terms and categories in financial transactions cannot be overstated. One term that has emerged in the landscape of e-wallets is “kategori transaksi fee base yang merupakan dompet elektronik adalah.” But what does this term really mean? Why is it important for consumers and businesses to understand it?

This blog post will delve into the meaning of this term, its relevance in the digital transaction space, and how it impacts users and merchants alike. We will explore what makes an e-wallet a fee-based transaction platform and why it’s crucial to be aware of its implications. Let’s dive deeper into understanding “kategori transaksi fee base yang merupakan dompet elektronik adalah” and how it affects digital transactions today.

What is Kategori Transaksi Fee Base yang Merupakan Dompet Elektronik Adalah?

The phrase “kategori transaksi fee base yang merupakan dompet elektronik adalah” essentially refers to a category of transactions that are primarily governed by fees in the context of electronic wallets. An electronic wallet, or e-wallet, is a digital payment system that allows users to store and transfer money electronically.

However, when we talk about “fee base,” we are referring to a particular kind of transaction model in which users or merchants incur fees for processing transactions. These fees are typically levied by the e-wallet service provider for facilitating digital payments. This category of transactions is common in digital payment systems where services like mobile payments, online shopping, and peer-to-peer transfers are used.

Understanding this model helps users make informed decisions regarding which e-wallets to use, how to avoid excessive charges, and how to optimize their transactions for cost-effectiveness.

How Kategori Transaksi Fee Base Works in E-Wallets

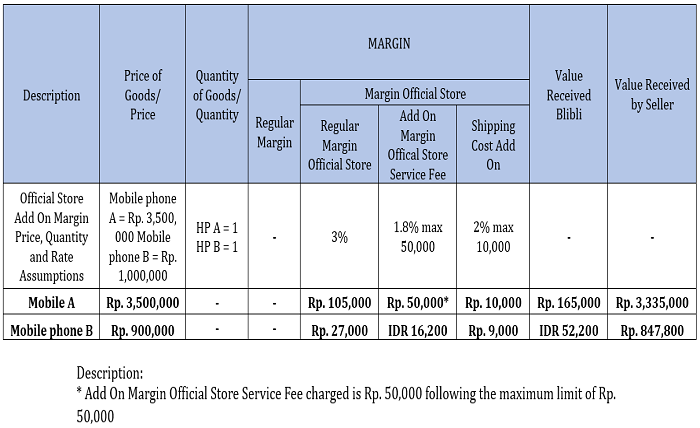

In e-wallets, the “kategori transaksi fee base yang merupakan dompet elektronik adalah” refers to how transactions are structured around the fees charged for each operation. These fees can take different forms, including flat fees, percentage-based fees, or tiered charges depending on the type of transaction or service being used.

For example, when you use an e-wallet for a peer-to-peer payment or a bank transfer, a certain percentage of the amount you are sending may be charged as a fee. This fee can vary depending on the platform’s policy, the transaction amount, and the type of service used. The fee can also differ based on geographical location or the payment method (e.g., credit card vs. bank transfer).

By understanding the fee structures in the “kategori transaksi fee base yang merupakan dompet elektronik adalah,” users can choose the most efficient e-wallet based on their needs. This includes considering factors like low fees for small transactions or higher fees for larger transactions involving international transfers.

Different Types of Kategori Transaksi Fee Base

The “kategori transaksi fee base yang merupakan dompet elektronik adalah” can be broken down into several types based on the transaction fees involved. Below are some common categories of e-wallet transactions that come with varying fee structures:

Flat Fees

In this model, users pay a fixed fee for each transaction. The fee does not change regardless of the amount transferred or the recipient. This model is common for services like bill payments or fixed transaction services, where the amount to be transferred is usually predictable.

Percentage-Based Fees

Percentage-based fees are calculated as a percentage of the total amount being transferred. This model is often seen in peer-to-peer transfer services or e-commerce transactions. For example, a digital wallet might charge 2% for every transaction made through the platform.

Tiered Fees

Tiered fees are more complex and depend on various factors such as the volume of transactions, the frequency of use, and the type of service. For instance, higher transaction volumes might come with lower fees, while infrequent users may incur higher charges per transaction. This model is often used by e-wallet platforms that cater to both individuals and businesses.

Understanding these different types of fees helps consumers and businesses to identify which category of transaction best suits their needs and how they can minimize transaction costs over time.

The Role of Kategori Transaksi Fee Base in Consumer Behavior

The way “kategori transaksi fee base yang merupakan dompet elektronik adalah” impacts consumer behavior cannot be underestimated. Users who are aware of transaction fees are more likely to be cautious when selecting an e-wallet platform. By comparing the different fee structures across platforms, they can ensure that they are choosing the most cost-effective service for their particular use case.

For instance, consumers who use e-wallets for small transactions might prefer a flat fee structure, while those making large or international transactions may look for platforms offering lower percentage-based fees. The decision-making process can be complex, but the key lies in understanding how fees impact the overall cost of transactions.

Impact of Kategori Transaksi Fee Base on E-Wallet Providers

For e-wallet providers, offering a “kategori transaksi fee base yang merupakan dompet elektronik adalah” involves balancing customer satisfaction with business profitability. While keeping transaction fees low can attract more users, it also reduces the profit margins for service providers. On the other hand, higher transaction fees can limit usage, leading to customer churn.

E-wallet providers must constantly evaluate their fee structures to find a balance that meets the needs of users while maintaining profitability. This is particularly important in competitive markets where users can easily switch platforms if they feel the fees are too high.

By offering flexible fee structures and competitive pricing, e-wallet providers can retain customers and foster loyalty, ensuring the sustainability of their business.

How to Minimize Fees in Kategori Transaksi Fee Base

If you are someone who frequently uses an e-wallet, minimizing transaction fees should be a priority. There are several ways to reduce fees in the “kategori transaksi fee base yang merupakan dompet elektronik adalah”:

-

Choose an E-Wallet with Lower Fees: Before signing up for an e-wallet, research the fee structure thoroughly. Compare different platforms and choose one with competitive rates that fit your transaction patterns.

-

Opt for High-Volume Transactions: Some e-wallet providers offer reduced fees for larger transactions. If your transactions are typically large, this option might be beneficial.

-

Use E-Wallets for Peer-to-Peer Transactions: If you often make payments to friends and family, look for e-wallet platforms that offer fee-free or low-fee peer-to-peer services.

-

Be Mindful of International Transactions: International transactions often come with higher fees. Look for platforms with lower international transfer fees or consider using alternatives like cryptocurrency for cross-border payments.

By following these tips, you can significantly reduce the fees associated with “kategori transaksi fee base yang merupakan dompet elektronik adalah” and make the most of your e-wallet.

Conclusion

In conclusion, understanding “kategori transaksi fee base yang merupakan dompet elektronik adalah” is essential for anyone using digital wallets for transactions. It helps users navigate the world of electronic payments, choose the right e-wallets, and minimize transaction costs. By being aware of the different types of fees, how they impact both consumers and service providers, and ways to reduce them, you can make smarter financial decisions.

Whether you’re a frequent user of e-wallets or just starting to explore digital payments, being informed about the fee structures and how they work is key to maximizing the benefits of using these platforms.

FAQs

-

What is an e-wallet?

- An e-wallet, or electronic wallet, is a digital service that allows users to store and manage their funds electronically. It can be used for making payments, transferring money, and other financial transactions.

-

What are the types of fees in e-wallet transactions?

- Common types of fees include flat fees, percentage-based fees, and tiered fees, depending on the type of transaction and the e-wallet platform used.

-

Why do e-wallet providers charge fees?

- E-wallet providers charge fees to cover the costs of transaction processing, security, and maintenance of the platform, as well as to generate profit for the service.

-

How can I minimize transaction fees in my e-wallet?

- You can minimize fees by choosing an e-wallet with low transaction fees, opting for high-volume transactions, and being mindful of international transfer fees.

-

Is there a difference between e-wallets in terms of fees?

- Yes, different e-wallets have different fee structures. Some platforms offer low fees for small transactions, while others offer reduced fees for large or international transfers.