Which Of The Following Financial Institutions Typically Have The Highest Fees: Uncover Costly Choices

Certain financial institutions are known for high fees. This can affect your wallet.

So, which ones are the worst offenders? Understanding which financial institutions have the highest fees can save you money and stress. Banks, credit unions, and online lenders each have different fee structures. Some charge for account maintenance, others for overdrafts or transactions.

Knowing this can help you make smarter financial decisions. In this blog, we will dive into the details and reveal the financial institutions that typically have the highest fees. Stay tuned to learn where your money might be slipping away and how to avoid these costly traps.

Introduction To Financial Institution Fees

Understanding fees charged by financial institutions is essential. These fees can impact your savings and investments. They vary between banks, credit unions, and online financial services.

What Are Financial Institution Fees?

Financial institution fees are charges for various services. Common fees include account maintenance, transaction, and ATM fees. You might also encounter overdraft and wire transfer fees.

Banks, credit unions, and online services all have fee structures. Each institution sets its own rates. Therefore, fees can vary greatly. Knowing the types of fees helps you avoid unnecessary costs.

Importance Of Understanding Fees

Understanding these fees is crucial. It helps you manage your finances better. High fees can erode your savings. They can also increase the cost of using financial services.

Awareness of fees aids in comparing institutions. You can choose the one with the lowest fees. This ensures you get the best value for your money. It also helps in planning your budget effectively.

Knowing fees also prevents surprises. Unexpected charges can disrupt your financial planning. Being informed allows you to avoid these pitfalls. It ensures smooth financial management.

Banks And Their Fee Structures

Understanding the fee structures of banks can be crucial for managing your finances. Banks often have a variety of fees that can catch you off guard. This section will explore common and hidden bank fees, helping you stay informed and avoid unnecessary charges.

Common Bank Fees

Banks charge several common fees that can add up quickly. Here are some examples:

- Monthly Maintenance Fees: These fees are charged for maintaining your account. They can range from $5 to $15 per month.

- ATM Fees: Using an out-of-network ATM can cost you around $2.50 to $5.

- Overdraft Fees: If your account balance goes negative, you might be charged $35 per transaction.

- Returned Deposit Fees: If a deposited check bounces, banks may charge a fee of $10 to $15.

Hidden Bank Charges

Some bank fees are not immediately obvious. These hidden charges can sneak up on you:

- Account Closure Fees: Closing an account within a certain period might cost $25 to $50.

- Paper Statement Fees: Receiving paper statements instead of digital ones can incur a fee of $1 to $3 per statement.

- Foreign Transaction Fees: Making purchases abroad can result in fees of 1% to 3% of the transaction amount.

- Inactivity Fees: If your account remains inactive for a certain period, banks may charge a fee of $5 to $10 per month.

Being aware of these fees can help you manage your bank accounts better. Always read the fine print and ask your bank about any fees you do not understand.

Credit Unions: A Cost Comparison

When comparing financial institutions, credit unions often stand out for their lower fees. But are they always the best choice? Let’s break down the costs associated with credit unions.

Lower Fees Benefits

Credit unions typically charge lower fees compared to traditional banks. This is because they operate as non-profit organizations. Their goal is to serve their members, not to make a profit.

Here are some common fee differences:

| Service | Credit Unions | Traditional Banks |

|---|---|---|

| Monthly Maintenance | $0 – $5 | $10 – $15 |

| Overdraft Fees | $20 – $25 | $30 – $35 |

| ATM Fees | $0 – $2 | $2 – $4 |

Members of credit unions also enjoy lower loan interest rates and higher savings account yields. This can lead to significant savings over time.

Potential Hidden Costs

Despite lower fees, credit unions may have some hidden costs. For instance, they might have fewer branches and ATMs. This could result in fees when using out-of-network ATMs.

Consider these possible hidden costs:

- Limited branch locations

- Out-of-network ATM fees

- Membership fees

Some credit unions require a small fee to join. This is usually a one-time fee but can add to the overall cost of banking with them.

Additionally, credit unions may offer fewer online banking options. This might be inconvenient if you prefer digital banking.

By understanding both the benefits and potential hidden costs, you can make an informed decision about whether a credit union is right for you.

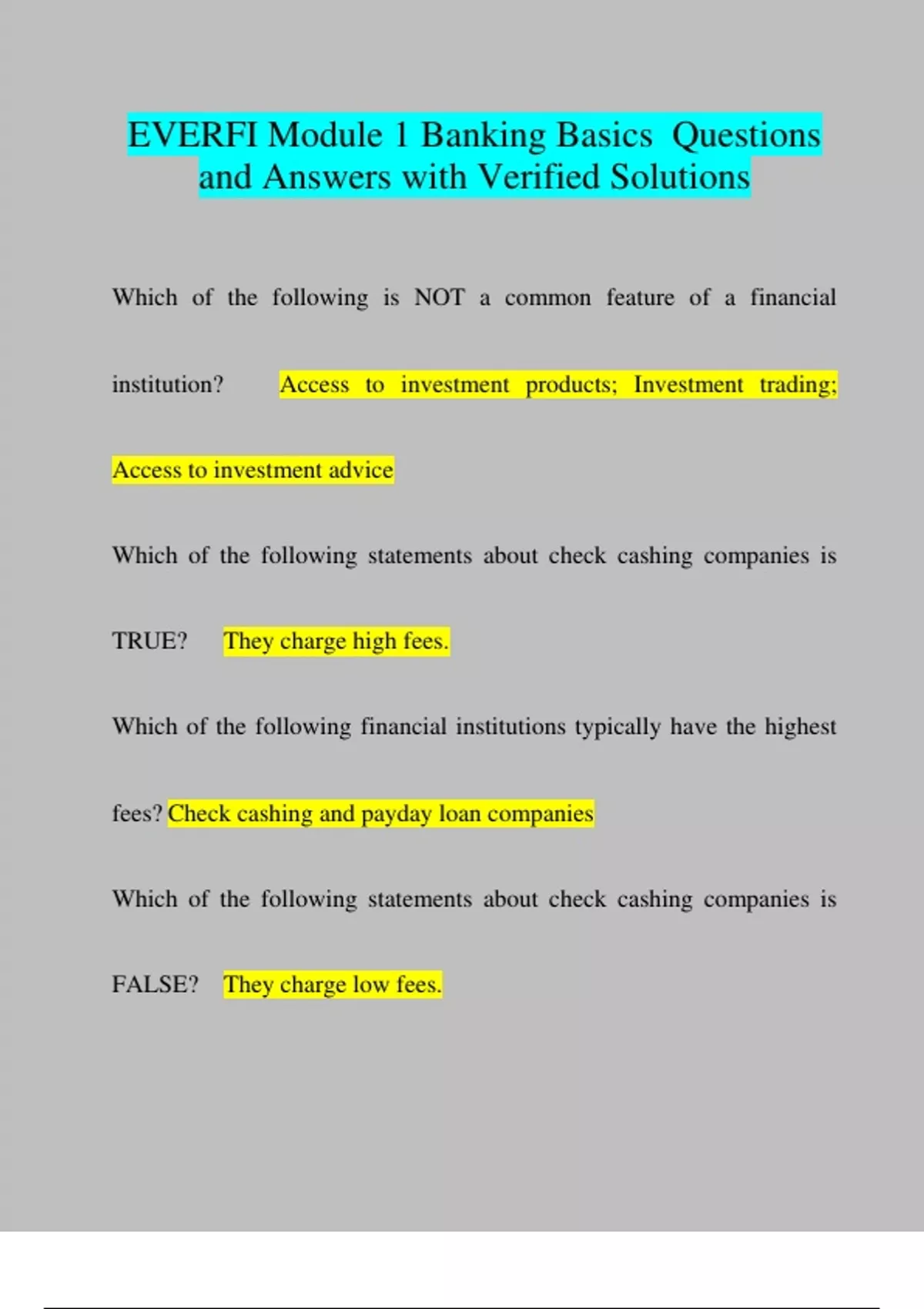

Credit: www.stuvia.com

Investment Firms And Brokerage Fees

Investment firms and brokerage fees are often significant for many investors. These fees can affect your returns. Understanding these costs can help you make better financial decisions.

Trading Fees Overview

Investment firms typically charge trading fees for buying and selling stocks. These fees can vary widely. They might charge a flat fee per trade or a percentage of the transaction amount. Some firms offer discounted rates for frequent traders. Here is a table for a clearer understanding:

| Firm | Flat Fee per Trade | Percentage Fee per Trade |

|---|---|---|

| Firm A | $9.99 | 0.5% |

| Firm B | $4.95 | 0.25% |

| Firm C | $7.00 | 0.35% |

These fees can add up quickly, especially for active traders. Choosing a firm with lower trading fees can save you money.

Account Management Costs

Many investment firms charge account management fees. These fees cover the cost of maintaining your account. They might also include services like financial advice and portfolio management. Here are some common account management costs:

- Annual maintenance fees: A yearly fee to keep your account active.

- Inactivity fees: Charges if you do not trade for a certain period.

- Advisory fees: Costs for personalized financial advice.

These fees can be a flat rate or a percentage of your account balance. Some firms also charge performance fees. These are based on the returns they generate for you.

Comparing these costs across different firms can help you find the best deal. Remember, lower fees mean more money stays in your pocket.

Online Banks And Virtual Financial Services

Online banks and virtual financial services have become popular. They offer convenience and innovative features. People can manage finances without visiting physical branches. Many prefer these services for their ease and accessibility.

Fee Structures Of Online Banks

Online banks often have lower fees. They save on overhead costs. No physical branches mean fewer expenses. This saving often gets passed on to customers. Many online banks offer free checking accounts. Some even provide free ATM withdrawals. Overdraft fees are often lower. Maintenance fees are rare. This makes online banks attractive to many.

Comparing Virtual And Traditional Banks

Traditional banks have physical branches. They offer face-to-face customer service. This convenience comes at a cost. Physical branches mean higher overhead. These costs often get passed to customers. Traditional banks may charge higher fees. They often have higher maintenance fees. Overdraft fees can be steep. ATM fees add up.

Virtual banks operate differently. They save on overhead costs. These savings benefit customers. Fee structures are simpler and lower. Many users enjoy the flexibility. They can bank from anywhere. Fee transparency is a big draw. Customers know what they are paying. This clear fee structure builds trust.

Payday Lenders And Their High Costs

Payday lenders charge the highest fees among financial institutions. These lenders often impose steep interest rates and hidden costs. Borrowers can find themselves in deeper debt quickly.

Payday lenders offer quick cash to borrowers in need. These loans are easy to get. But they come with very high fees. Many people turn to payday loans when they have no other options. Sadly, this choice can lead to bigger money problems. The high costs can trap borrowers in a cycle of debt.Understanding Payday Loan Fees

Payday loans often have high fees. These fees can be much higher than other loans. Lenders charge fees based on the loan amount. These fees can add up quickly. For example, a $500 loan may have a $75 fee. This means you owe $575 in two weeks. The fee may seem small, but it is not. The annual percentage rate (APR) can be over 400%.Impact Of High Fees On Borrowers

High fees can hurt borrowers. Many cannot repay the loan on time. They must take out another loan to pay off the first one. This leads to more fees and more debt. Borrowers end up paying much more than they borrowed. It is hard to escape this cycle of debt. The stress can affect their health and well-being. Payday lenders target people with few options. These people often have bad credit or low income. They need money fast, so they take the loan. Payday lenders know this and charge high fees. This makes it hard for borrowers to break free. They keep paying fees without making progress. Payday lenders claim to help people in need. But their high fees make things worse. Borrowers should be aware of these costs. They should look for other ways to get money. Community resources and financial counseling can help. Avoiding payday loans can save money and stress. “`Mortgage Lenders And Associated Costs

Mortgage lenders often have higher fees compared to other financial institutions. These fees can quickly add up, making your mortgage more expensive than expected. Knowing these costs can help you budget better and avoid surprises.

Common Mortgage Fees

Many mortgage lenders charge several common fees. Here are some you might encounter:

- Origination Fee: A fee for processing the loan application. Usually 0.5% to 1% of the loan amount.

- Appraisal Fee: Cost for assessing the property’s value. Typically between $300 and $500.

- Credit Report Fee: Charged to check your credit history. Often around $25.

- Underwriting Fee: Covers the lender’s cost of evaluating your loan. Can range from $400 to $900.

- Title Insurance: Protects against title issues. Costs vary based on the loan amount.

Additional Hidden Costs

Some costs are not as obvious but can impact your budget:

- Prepayment Penalty: Charged if you pay off your mortgage early.

- Private Mortgage Insurance (PMI): Required if your down payment is less than 20%. Adds 0.3% to 1.5% to your loan annually.

- Escrow Fees: Covers the holding and disbursement of funds for property taxes and insurance. Varies by lender.

- Rate Lock Fee: A fee for locking in your interest rate. This can be a flat fee or a percentage of the loan.

Understanding these fees can help you make better financial decisions. Always ask your lender to explain any fees you don’t understand. This will help you avoid unexpected costs and keep your mortgage affordable.

Credit: www.studypool.com

Strategies To Minimize Financial Institution Fees

Understanding how to minimize financial institution fees can save you money. Different strategies can help you keep more cash in your pocket. Here are some ways to reduce fees effectively.

Choosing Low-fee Institutions

Not all financial institutions are the same. Some charge more fees than others. It is important to compare options before opening an account. Look for banks or credit unions with low or no monthly fees.

Many online banks offer fewer fees. They often provide free checking and savings accounts. Research and read reviews to find the best fit for your needs. This can help you avoid unnecessary costs.

Negotiating And Avoiding Fees

You can often negotiate fees with your bank. Contact customer service and ask for a fee waiver. Banks want to keep their customers happy. They may agree to remove or reduce fees for loyal customers.

Be aware of common fees. Overdraft and ATM fees can add up quickly. Avoid these by keeping track of your balance. Use your bank’s ATMs to avoid extra charges. Set up alerts to monitor your account.

Following these strategies can help you manage your money better. You will find yourself paying less in fees over time.

Conclusion: Making Cost-effective Financial Choices

Understanding fees associated with different financial institutions is crucial. Fees can significantly impact your finances. Choosing the right institution can save you money. Let’s summarize the key points to make informed decisions.

Summary Of Key Points

- Banks often have higher fees for services like overdrafts and account maintenance.

- Credit unions usually offer lower fees but require membership.

- Online banks can provide lower fees due to reduced overhead costs.

- Investment firms may charge high fees for managing funds and transactions.

- Payday lenders have extremely high fees and interest rates.

Final Thoughts On Choosing Institutions

Consider your financial needs and habits. If you frequently use ATMs, choose a bank with low ATM fees. If you need loans, look for institutions with low-interest rates. Always compare the fees of different institutions before making a decision.

For easy reference, here’s a quick comparison table:

| Institution | Typical Fees |

|---|---|

| Banks | High for overdrafts, maintenance |

| Credit Unions | Low, membership required |

| Online Banks | Low, fewer physical branches |

| Investment Firms | High for fund management |

| Payday Lenders | Very high fees, high-interest rates |

Choosing the right financial institution can lead to significant savings. Take the time to compare and select the one that fits your needs best.

Credit: online.stage.miami.edu

Frequently Asked Questions

Which Financial Institutions Have The Highest Fees?

Typically, payday lenders and check cashing services have the highest fees. These institutions charge significant fees for short-term loans and financial services.

Why Do Payday Lenders Charge High Fees?

Payday lenders charge high fees due to the risk of lending to individuals with poor credit. The fees compensate for potential defaults.

Are Credit Unions Cheaper Than Banks?

Yes, credit unions generally have lower fees compared to traditional banks. They are member-owned and operate as non-profits, focusing on serving their members.

Do Online Banks Have Lower Fees?

Online banks usually have lower fees compared to traditional brick-and-mortar banks. They save on operating costs and pass those savings to customers.

Conclusion

Choosing the right financial institution can save you money. Banks and credit unions often have lower fees. Online banks also offer competitive rates. Be sure to compare fees before making a decision. This can help you avoid unnecessary costs. Always read the fine print.

Understand what you are signing up for. Making an informed choice will benefit your finances in the long run. Remember, every dollar saved counts.