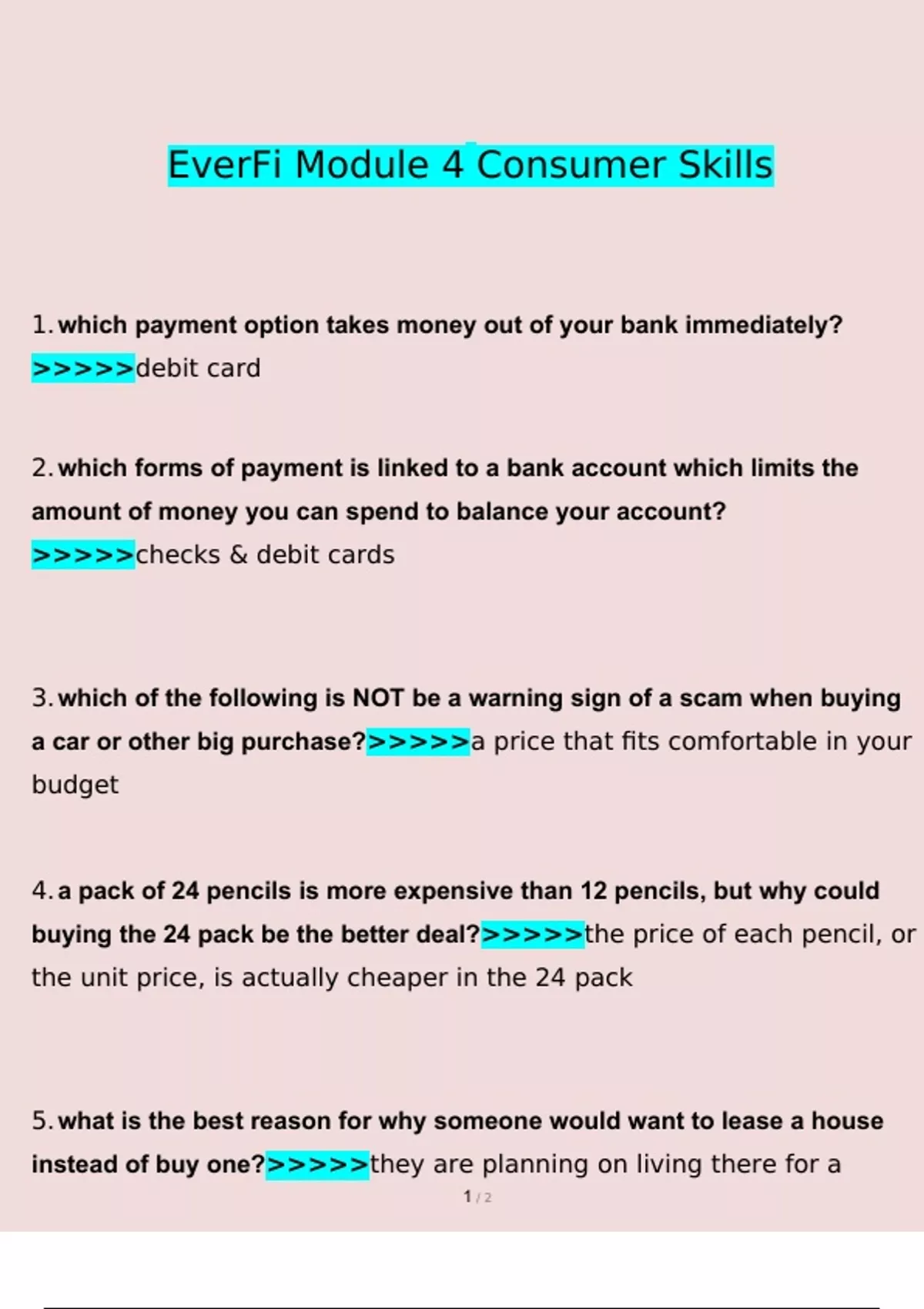

Which Payment Option Takes Money Out Of Your Bank Immediately: Instant Solutions

If you need a payment option that takes money out of your bank immediately, you’re likely looking for a quick and direct solution. The answer is simple: debit cards and certain online payment services do this.

Imagine you are at the store, and you want to pay quickly. You swipe your debit card, and the money leaves your bank account right away. It’s seamless and fast. Some online payment services also transfer funds instantly. These options are convenient for many people who want to keep track of their spending in real-time.

They help you avoid debt and manage your budget better. Understanding these immediate payment methods can make your financial life easier and more efficient. Let’s dive deeper into how they work and why they might be the best choice for you.

Introduction To Instant Payment Solutions

Instant payment solutions are becoming a key part of our daily lives. These services allow money to be transferred immediately. They ensure quick and efficient transactions. This is vital for both businesses and individuals. With these solutions, you don’t have to wait days for funds to clear. Everything happens in real-time.

Instant payment methods connect directly to your bank account. The money leaves your account right away. This is different from other methods that may take a few days to process. Instant payments are especially useful in today’s fast-paced world.

Importance Of Instant Payments

Instant payments bring many benefits. They help in managing cash flow better. Businesses can pay their suppliers quickly. This ensures that operations run smoothly. Consumers can settle bills immediately. This avoids late fees and penalties. Instant payments also add a layer of security. You know right away if the transaction is successful. There is no waiting and wondering.

Common Uses For Immediate Transfers

Immediate transfers are used in many scenarios. One common use is paying for online purchases. Many e-commerce platforms accept instant payments. This speeds up the delivery process. You can also use instant payments for peer-to-peer transfers. This is great for splitting bills with friends. Another common use is for emergency funds. If you need money urgently, instant transfers are the best option.

Businesses use these transfers to pay salaries. Employees get their paychecks on time. This builds trust and satisfaction. Many people also use instant payments for subscriptions. This ensures uninterrupted service. Immediate transfers are also popular for international remittances. Families can send money across borders quickly and securely.

Bank Transfers

Bank transfers are a popular way to move money. They allow for quick and direct transactions from one bank account to another. Many people use them for their convenience and reliability. But how exactly do bank transfers work, and what are their pros and cons?

How Bank Transfers Work

Bank transfers involve electronically moving money from one bank account to another. This can be done through online banking platforms, mobile apps, or by visiting a bank branch. Here’s a simple breakdown:

- Initiate Transfer: Log into your bank account and choose the transfer option.

- Enter Details: Provide the recipient’s bank details, including account number and bank code.

- Confirm: Review the details and confirm the transaction.

- Processing: The bank processes the transfer, often instantly or within a few hours.

- Completion: The money is debited from your account and credited to the recipient’s account.

Pros And Cons Of Bank Transfers

Bank transfers have several benefits and drawbacks. Understanding these can help you decide if they are the best option for your needs.

| Pros | Cons |

|---|---|

| Fast and efficient | May incur fees |

| Secure transactions | Cannot be reversed easily |

| Widely accepted | Requires accurate details |

| Easy to track | Potential for delays |

Pros: Bank transfers are fast and efficient. They provide secure transactions and are widely accepted by businesses and individuals alike. Additionally, they are easy to track via your bank statements.

Cons: Some bank transfers may incur fees, especially international ones. They also cannot be reversed easily once processed. Ensuring accurate details is crucial, as errors can cause delays.

Debit Card Payments

Debit card payments are a popular way to make purchases. They provide a quick and efficient way to access your bank funds. Using a debit card ensures that money is taken directly from your bank account, making it a preferred option for many.

Mechanism Of Debit Card Payments

Debit cards connect directly to your bank account. When you swipe or insert your card, the payment system verifies your account. The system checks if there are enough funds available. Once confirmed, the transaction is approved.

The money is then deducted from your account almost instantly. This immediate transfer ensures that your balance reflects the purchase right away. Unlike credit cards, there is no delay in processing the payment.

Benefits Of Using Debit Cards

One key benefit is immediate payment processing. This helps in keeping track of your spending. You can see the deduction in your bank account instantly.

Another advantage is avoiding debt. Since the money comes directly from your account, you can only spend what you have. This can help you manage your finances better and avoid interest fees.

Debit cards are also widely accepted. Most stores and online platforms accept debit card payments. This makes it convenient to use them for various transactions.

Additionally, many banks offer fraud protection for debit card users. This means that your transactions are monitored for any suspicious activity. In case of fraud, you can report it and get assistance from your bank.

Overall, debit card payments offer a secure and straightforward way to handle your finances.

Credit: www.stuvia.com

Mobile Payment Apps

Mobile payment apps are changing how we handle money. These apps make transactions quick and easy. They connect directly to your bank account. Payments are processed immediately, providing instant gratification.

Popular Mobile Payment Apps

Many mobile payment apps are popular today. Some of the most used ones include:

- PayPal – Known globally, it offers fast transactions and is user-friendly.

- Venmo – Popular in the US, it allows you to send money to friends and family.

- Cash App – Allows you to send and receive money instantly.

- Google Pay – Integrates with other Google services for seamless transactions.

- Apple Pay – Secure and easy to use on Apple devices.

Security Features In Mobile Payments

Security is a big concern with mobile payments. These apps use several features to keep your money safe:

- Encryption – This ensures that your data is protected during transactions.

- Two-Factor Authentication – Adds an extra layer of security by requiring two forms of verification.

- Biometric Verification – Uses your fingerprint or facial recognition for secure access.

- Instant Notifications – Alerts you to any activity on your account.

- Fraud Detection – Monitors transactions for unusual activity.

These features help prevent fraud and unauthorized access. They ensure your money and data are safe.

Electronic Checks

Electronic checks are a modern method of payment that uses the convenience of digital technology. This payment option quickly removes money from your bank account. They work similarly to traditional paper checks but are processed faster and more efficiently. Let’s delve into how electronic checks work, their process, and their benefits.

Process Of Electronic Checks

The process of electronic checks involves several steps:

- Authorization: You provide your bank account information, routing number, and authorization for the transaction.

- Processing: The information is submitted electronically to the payment processor.

- Verification: Your bank verifies the details to ensure funds are available.

- Funds Transfer: The funds are withdrawn from your account and transferred to the recipient’s account.

This entire process happens quickly, often within minutes, ensuring the recipient gets the funds almost immediately.

Advantages Of Electronic Checks

Electronic checks offer several benefits:

- Speed: Transactions are processed much faster compared to paper checks.

- Convenience: No need to write, mail, or deposit physical checks.

- Security: Electronic checks use encryption and other security measures to protect your information.

- Cost-effective: Lower processing fees compared to credit card transactions.

These advantages make electronic checks a preferred choice for many businesses and individuals.

Wire Transfers

Wire transfers are a popular payment method. They move money directly from one bank account to another. This method is often used for large sums of money. Wire transfers are known for their speed and reliability. They are ideal for urgent payments.

Steps In Wire Transfers

First, you visit your bank in person or online. Next, you provide the recipient’s bank details. This includes their name, bank account number, and routing number. Then, you confirm the amount to be sent. Finally, the bank processes the transfer. The money leaves your account immediately.

Cost And Time Considerations

Wire transfers usually come with a fee. The fee depends on your bank. Domestic transfers are often cheaper than international ones. The cost may range from $15 to $50 per transfer.

Wire transfers are quick. Domestic transfers are completed within one business day. International transfers may take up to three business days. This speed makes wire transfers a preferred choice for many.

Instant Payment Services

Instant Payment Services are a popular way to quickly transfer funds from your bank account. These services are designed to provide immediate access to funds for both the sender and the receiver. Let’s explore more about these services and how they compare to traditional methods.

Overview Of Instant Payment Services

Instant Payment Services offer quick and efficient transactions. These services include options like PayPal, Venmo, and Zelle. They enable users to send and receive money almost instantly. This means you can transfer funds in seconds, not days. The funds are deducted from your bank account immediately, providing swift financial transactions.

Comparison With Traditional Methods

Instant Payment Services differ significantly from traditional payment methods. Traditional methods like bank transfers and checks take much longer. Here is a comparison:

| Payment Method | Time to Process | Availability |

|---|---|---|

| Instant Payment Services | Seconds to Minutes | 24/7 |

| Bank Transfers | 1-3 Business Days | Bank Hours |

| Checks | 3-5 Business Days | Bank Hours |

As shown in the table, Instant Payment Services are much faster. They are available around the clock, unlike traditional methods. This makes them ideal for urgent transactions. Let’s look at some benefits of using these services:

- Speed: Transactions are completed in seconds.

- Convenience: Available 24/7 without visiting a bank.

- Security: Encrypted and secure transactions.

Despite their benefits, there are some considerations. Instant Payment Services may have fees. Always check the terms before using the service. Also, ensure your bank supports the service you choose.

Credit: paymentoptionsguide.com

Choosing The Right Payment Option

Choosing the right payment option can be a daunting task. Different payment methods have their pros and cons. Some options take money out of your bank immediately, while others do not. Understanding your needs and preferences is crucial.

Factors To Consider

When choosing a payment option, consider these important factors:

- Speed: How quickly does the payment process?

- Security: Is your payment method secure?

- Convenience: Is it easy to use?

- Fees: Are there any hidden fees?

- Acceptance: Is it widely accepted by merchants?

Understanding these factors helps you make an informed decision.

Balancing Speed And Security

Speed and security are crucial when choosing a payment option. An immediate transfer may be quick but is it secure?

| Payment Option | Speed | Security |

|---|---|---|

| Debit Card | Immediate | High |

| Credit Card | Varies | High |

| Bank Transfer | Immediate | High |

| Mobile Payments | Immediate | Varies |

Debit cards and bank transfers are quick and secure. They take money out of your bank immediately. Credit cards offer delayed payment but are also secure. Mobile payments vary in security and speed.

Future Of Instant Payments

The world of payments is changing fast. Instant payment options are becoming more popular. This means money is taken out of your bank right away. What does the future hold for these payments?

Emerging Trends

Many new technologies are shaping instant payments. Blockchain and cryptocurrencies are leading the way. They offer fast and secure transactions.

Mobile payments are also growing. Apps like Google Pay and Apple Pay make it easy. Users can pay with just a tap on their phone.

Real-Time Payment (RTP) networks are expanding. These networks allow money to move between banks instantly. Many countries are adopting RTP systems.

Potential Challenges

Despite the growth, there are challenges. Security is a big concern. Instant payments must be safe from fraud and hacking.

Regulations can also be complex. Different countries have different rules. This makes international payments tricky.

Adoption is another issue. Not everyone is ready to switch to new methods. Education and trust are key to wider use.

Costs could be higher. Some instant payment services charge fees. Users and businesses need to weigh the benefits against the costs.

| Trend | Description |

|---|---|

| Blockchain | Offers fast and secure transactions. |

| Mobile Payments | Easy payments with a tap on the phone. |

| Real-Time Payment Networks | Allows instant money transfer between banks. |

- Security concerns

- Complex regulations

- Adoption issues

- Possible higher costs

Credit: www.facebook.com

Frequently Asked Questions

Which Payment Method Deducts From Your Bank Instantly?

Debit cards and ACH transfers deduct money from your bank instantly. These methods directly access your bank account.

Do Credit Cards Take Money Out Immediately?

No, credit cards do not take money out immediately. They charge your account and bill you later.

Are Paypal Payments Instant?

PayPal payments can be instant if linked to your debit card. Otherwise, they may take a few days.

How Fast Are Wire Transfers?

Wire transfers are usually processed within a few hours. They take money out of your bank immediately.

Conclusion

Choosing the right payment option is crucial. Immediate bank withdrawals offer convenience. Options like debit cards and direct transfers ensure quick transactions. These methods help manage spending effectively. Always monitor your account to avoid overdrafts. Consider your needs and preferences.

Make informed choices to keep your finances in check. Understanding different payment options can save time and stress.