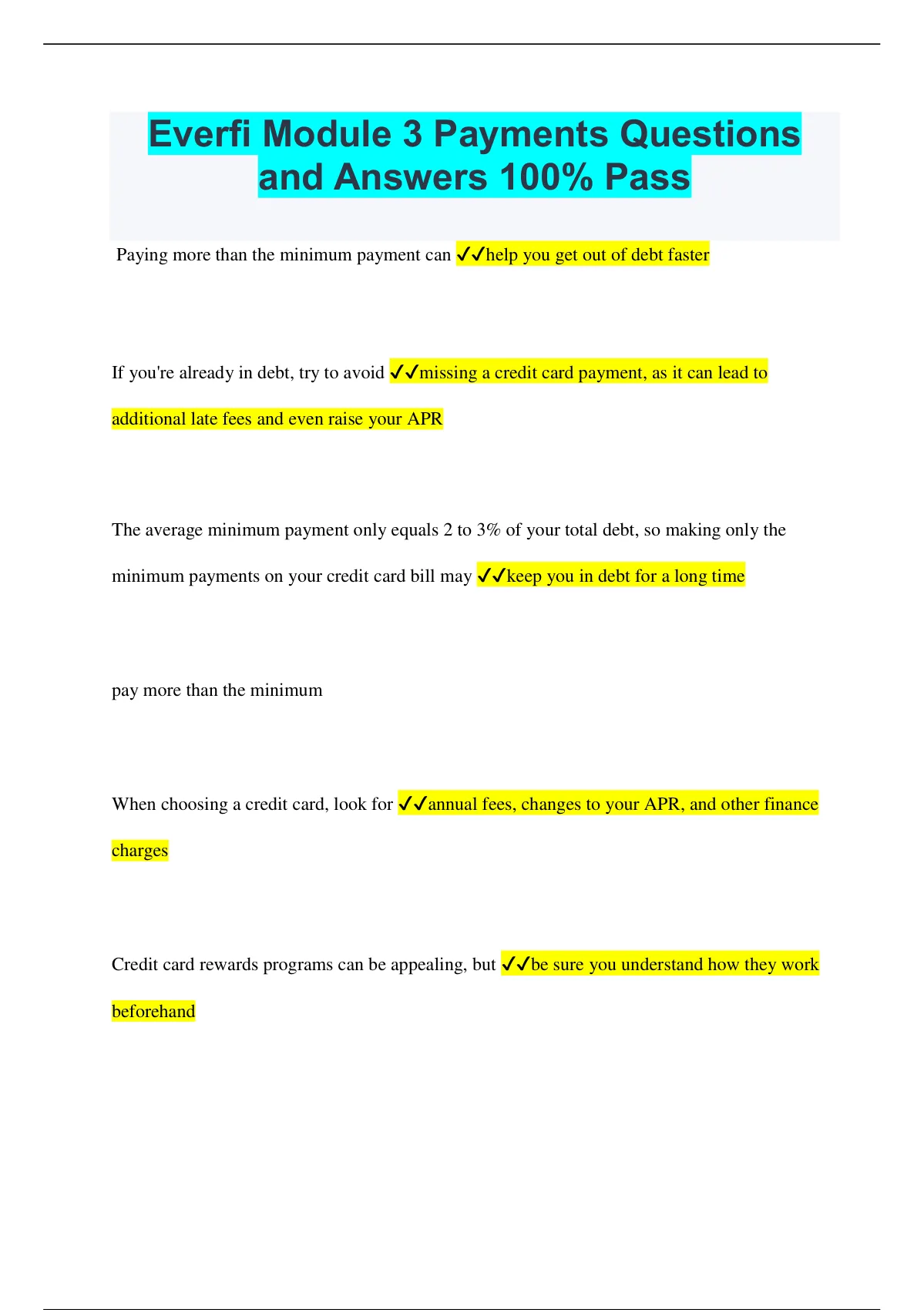

Paying Only The Minimum Balance On Your Credit Card Can Lead To Financial Pitfalls

Paying only the minimum balance on your credit card sounds tempting. It seems like an easy way to manage finances.

But it can lead to serious consequences. Credit cards offer convenience. They allow you to buy now and pay later. But if you only pay the minimum balance each month, debt can grow quickly. High interest rates can turn small balances into large debts over time.

This can affect your financial health. Understanding the dangers of paying just the minimum can help you make smarter choices. It can save you from future financial stress. Let’s explore the hidden risks and find better ways to manage your credit card debt.

Credit: www.self.inc

Consequences Of Minimum Payments

Paying only the minimum balance on your credit card can lead to serious financial issues. Many people think it’s an easy way out, but it can have long-term effects. Let’s explore some of the consequences of minimum payments.

Accumulating Interest

One of the biggest issues is accumulating interest. When you pay only the minimum, the remaining balance starts to gather interest. This can make the debt grow faster than you think.

Credit cards usually have high-interest rates. This means that the interest adds up quickly. For example, if you have a $1,000 balance with a 20% interest rate, and you make only minimum payments, you could end up paying much more in interest over time.

| Balance | Interest Rate | Minimum Payment | Interest Paid |

|---|---|---|---|

| $1,000 | 20% | $25 | $200+ |

Debt Cycle

Another consequence is getting stuck in a debt cycle. Making only the minimum payment means you are barely touching the principal amount. This causes the debt to linger for years.

Over time, you might find yourself in a never-ending loop of debt. You pay a little each month, but the balance never seems to go down. This can lead to stress and financial instability.

- Hard to pay off principal amount

- Long-term financial burden

- Increased stress levels

Breaking this cycle requires more than just minimum payments. It needs a plan to pay off the debt faster.

Credit: www.stuvia.com

Impact On Credit Score

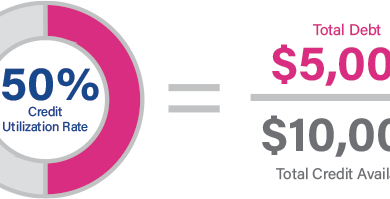

Paying only the minimum balance on your credit card can have a significant impact on your credit score. This section explores how it affects two critical components of your credit score: credit utilization and payment history.

Credit Utilization

Your credit utilization ratio is the amount of credit you are using compared to your total available credit. A high credit utilization ratio can lower your credit score. Ideally, you should keep your credit utilization below 30%.

If you only pay the minimum balance, your outstanding balance remains high. This increases your credit utilization ratio. A high ratio signals to lenders that you might be overextended, making you a riskier borrower.

| Credit Limit | Outstanding Balance | Credit Utilization Ratio |

|---|---|---|

| $10,000 | $3,000 | 30% |

| $10,000 | $6,000 | 60% |

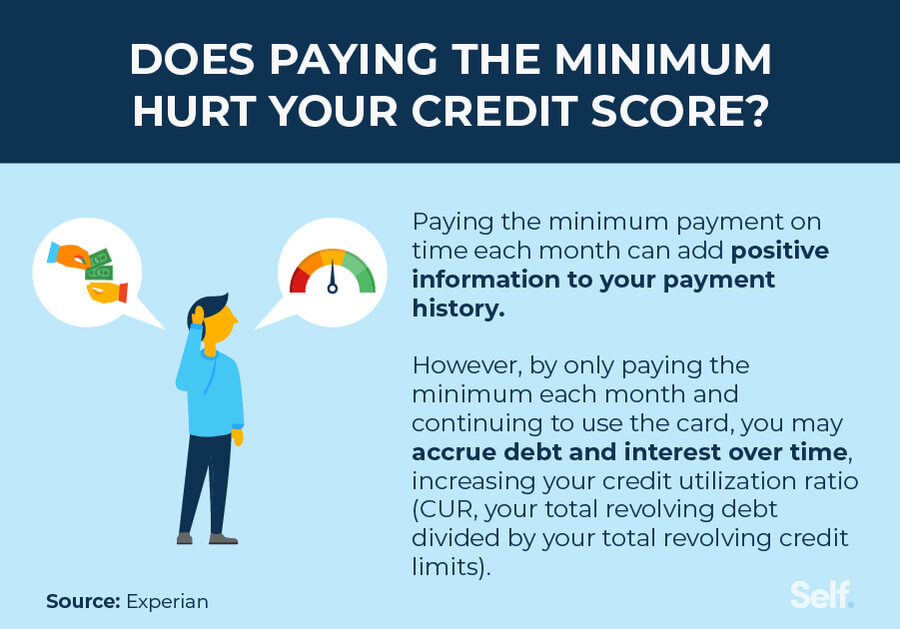

Payment History

Payment history is the record of your on-time and late payments. It makes up 35% of your credit score. Paying only the minimum balance can lead to missed payments if you forget or can’t pay the full balance later. This damages your payment history.

Lenders view a consistent payment history as a sign of responsible credit management. Late or missed payments suggest financial instability. This can significantly lower your credit score.

- Always pay more than the minimum to reduce outstanding balances.

- Set up automatic payments to avoid missing due dates.

Being proactive with your payments ensures a positive payment history. A good payment history boosts your credit score and improves your financial health.

Long-term Financial Burden

Paying only the minimum balance on your credit card can lead to a long-term financial burden. Interest accumulates quickly, increasing overall debt.

Paying only the minimum balance on your credit card each month might seem manageable. Yet, it can lead to a significant long-term financial burden. This practice can extend your repayment period and increase the total cost of your purchases. Understanding these impacts can help you make better financial decisions.Extended Repayment Period

When you pay only the minimum balance, your repayment period stretches over a much longer time. Credit card companies set the minimum payment to cover a small portion of your balance. Often, this amount includes just the interest and a tiny part of the principal. For example, let’s say you have a balance of $1,000 with an annual interest rate of 18%. If you pay just the minimum of $25 each month, it could take you over five years to pay off the balance. During this time, your debt continues to grow due to interest charges.Increased Total Cost

Paying only the minimum balance also increases the total cost of your debt. Interest accumulates on the remaining balance each month. This interest compounds, making your debt more expensive over time. Here’s a simple breakdown:| Scenario | Monthly Payment | Time to Pay Off | Total Cost |

|---|---|---|---|

| Minimum Payment | $25 | 5+ Years | $1,500+ |

| Higher Payment | $100 | 1 Year | $1,100 |

Alternatives To Minimum Payments

Paying only the minimum balance on your credit card can lead to long-term debt. It’s crucial to explore alternatives that can help you pay off your balance faster. Here are some effective strategies you can use.

Budgeting Strategies

Creating a budget is a powerful way to manage your finances. Start by listing all your income sources and monthly expenses. This will help you see where your money is going.

Here are some simple steps to create a budget:

- Calculate your total monthly income.

- List all your fixed and variable expenses.

- Subtract your expenses from your income to see your net savings.

- Allocate a portion of your savings to pay more than the minimum balance.

By following these steps, you can allocate funds to pay off your credit card debt faster.

Debt Repayment Plans

There are several debt repayment plans you can use. Each plan has its own benefits.

| Plan | Description |

|---|---|

| Debt Snowball | Pay off the smallest debts first. This gives a sense of accomplishment. |

| Debt Avalanche | Focus on paying debts with the highest interest rates first. This saves money on interest. |

Choose the plan that best fits your situation. Both methods can help you reduce debt faster than paying only the minimum balance.

By adopting these alternatives, you can manage your credit card debt more effectively. This will help you achieve financial freedom sooner.

Benefits Of Paying More

Paying only the minimum balance on your credit card might seem convenient. But this practice can lead to more debt and higher interest charges. To avoid this, it’s wise to pay more than the minimum balance. Here are some benefits of paying more:

Reduced Interest Charges

Paying more than the minimum balance can significantly reduce interest charges. Credit card companies charge interest on the remaining balance. By paying a larger amount, you lower the balance, which leads to less interest.

For instance, if your credit card balance is $1,000 and the interest rate is 20%, paying only the minimum might cost you hundreds in interest. But if you pay $200 instead of $50, the interest amount decreases. This saves you money in the long run.

Faster Debt Elimination

Another benefit is faster debt elimination. Paying more each month reduces the principal balance quicker. This means you can pay off your debt faster.

For example, paying $100 on a $1,000 debt can clear it in 10 months. Paying only the minimum can stretch this to years. A larger payment shortens the repayment period and reduces the total interest paid.

Consider this table for better understanding:

| Payment Amount | Time to Pay Off | Total Interest Paid |

|---|---|---|

| $50 (Minimum) | Years | High |

| $100 | 10 Months | Lower |

| $200 | 5 Months | Lowest |

As shown, paying more speeds up debt elimination and reduces interest. This keeps your finances healthy and stress-free.

Tips For Managing Credit Card Debt

Managing credit card debt is crucial for financial health. Paying only the minimum balance can lead to more debt due to high interest rates. Here are some tips to help manage credit card debt effectively.

Setting Up Automatic Payments

Automatic payments can ensure you never miss a due date. This helps avoid late fees and keeps your credit score intact. Set up automatic payments through your bank or credit card issuer’s website. Choose a date that aligns with your payday to ensure funds are available.

Tracking Expenses

Tracking your expenses helps you see where your money goes. It can prevent unnecessary spending and help you stay within budget. Use apps or a simple spreadsheet to record daily expenses. Review this regularly to identify areas where you can cut back.

Seeking Professional Help

Paying only the minimum balance on your credit card can lead to financial trouble. Seeking professional help can be a smart move to get back on track. Professionals can provide guidance and support in managing your debt effectively. Here are some options to consider:

Credit Counseling

Credit counseling agencies offer free or low-cost advice. They help you understand your financial situation and create a budget. These agencies work with you to develop a plan to pay off your debt. They can negotiate with creditors on your behalf. This can lead to lower interest rates and waived fees.

Debt Consolidation

Debt consolidation involves combining multiple debts into one. This can make it easier to manage your payments. You might get a lower interest rate with debt consolidation. This can save you money in the long run. Consider this option if you have high-interest credit card debt.

Both credit counseling and debt consolidation can provide relief. By seeking professional help, you can take control of your finances. Start today to avoid further financial stress.

Credit: www.livemint.com

Building Healthy Financial Habits

Building healthy financial habits is crucial for long-term stability. Paying only the minimum balance on your credit card can be detrimental. It creates a cycle of debt that becomes hard to escape. By developing smart financial habits, you can avoid this trap. Let’s explore some key strategies.

Creating An Emergency Fund

An emergency fund is essential. It provides a safety net for unexpected expenses. Without it, you might rely on credit cards in emergencies. This can lead to more debt. Aim to save at least three to six months of living expenses. Start small. Even $500 can make a difference. Consistent saving builds this fund over time.

Regular Financial Reviews

Regular financial reviews help you stay on track. Assess your income, expenses, and debts monthly. This practice helps you identify areas for improvement. Adjust your budget as needed. It also helps you set and achieve financial goals. Knowing where your money goes is empowering. It helps you make informed decisions.

Frequently Asked Questions

What Happens If I Pay Only The Minimum Balance?

Paying only the minimum balance can lead to high interest charges. This increases your debt over time. Your credit utilization ratio also remains high, which can negatively impact your credit score.

Does Paying The Minimum Affect My Credit Score?

Yes, paying only the minimum can affect your credit score. High credit utilization ratio and accruing interest can lower your score over time.

Can I Avoid Debt By Paying The Minimum Balance?

No, paying the minimum balance does not avoid debt. It allows interest to accumulate, making your debt grow larger over time.

How Does Paying The Minimum Impact Interest?

Paying the minimum causes high interest charges to accumulate. This means you’ll pay more over time, increasing your overall debt.

Conclusion

Paying only the minimum balance can hurt your finances. You accumulate more debt. Interest builds up quickly. This makes it hard to pay off. Your credit score may drop. It limits future financial options. Always aim to pay more than the minimum.

Stay financially healthy and stress-free. Avoid the debt trap. Make wise financial choices. Your future self will thank you.