Which Of The Following Statements About Check Cashing Companies Is False? Find Out Now!

Check cashing companies offer financial services to those without bank accounts. They provide quick access to cash.

But not everything you hear about them is true. Understanding check cashing companies can be tricky. Many people rely on them for their convenience and speed. They serve as an alternative for those who need immediate cash. But some myths and misconceptions circulate about their services.

It’s essential to separate fact from fiction. This blog will help you identify false statements about check cashing companies. Knowing the truth can help you make informed decisions. So, let’s dive in and uncover the real facts about these financial service providers.

Credit: heavenclick.com

Introduction To Check Cashing Companies

Check cashing companies offer financial services to people without bank accounts. They provide quick access to cash. These companies are popular in areas with limited banking options. They serve customers who need immediate funds.

Purpose And Function

The main purpose of check cashing companies is to convert checks into cash. They charge a fee for this service. They help people who cannot or do not want to use a bank. The process is usually fast and simple.

Customers bring a check to the company. The company verifies the check. They then give cash to the customer. The fee is often a percentage of the check amount. This makes check cashing convenient but can be costly.

Common Uses

People use check cashing services for various reasons. Here are some common uses:

- Paying bills: Many people cash checks to pay for utilities or rent.

- Grocery shopping: Immediate cash allows for quick shopping trips.

- Emergency expenses: Quick access to cash helps in urgent situations.

- Avoiding bank fees: Some avoid banks to escape overdraft or account fees.

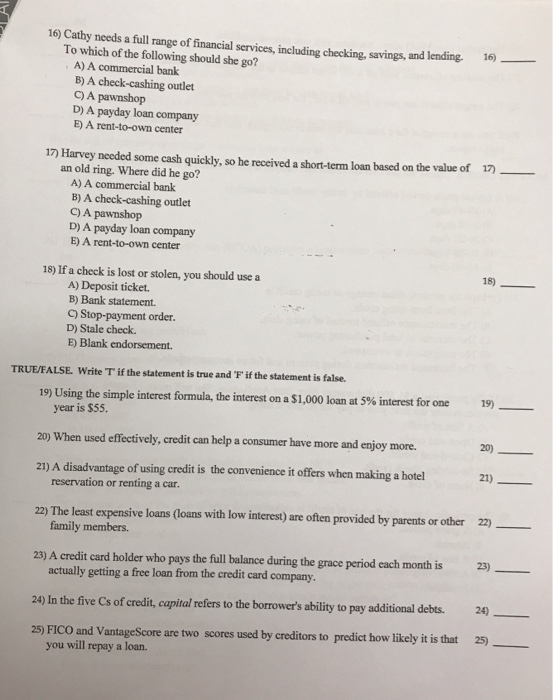

Check cashing companies also offer other services. They may provide money orders and wire transfers. Some even sell prepaid debit cards. These services add convenience for their customers.

| Service | Description |

|---|---|

| Check Cashing | Converts checks to cash for a fee |

| Money Orders | Offers a secure payment method |

| Wire Transfers | Transfers money quickly to another location |

| Prepaid Debit Cards | Provides a card with a fixed amount of money |

Understanding check cashing companies helps in making informed financial decisions. They provide useful services but at a cost. Choose wisely based on your needs.

Credit: www.chegg.com

Services Offered

Check cashing companies offer a range of services to meet financial needs. These services help people access money and manage bills. Below are some common services provided by check cashing companies.

Check Cashing

Check cashing is a primary service. People bring checks to these companies. The staff verifies the check and provides cash. This service is quick and convenient. It helps those without a bank account.

Money Orders

Money orders are another service offered. A money order is a secure payment method. It is like a check but more reliable. People use money orders to pay bills or send money. They are easy to purchase and use.

Bill Payments

Bill payment services are also available. People can pay utility bills at these locations. This service is convenient for those who prefer cash. It allows for timely payments without the need for a bank account.

Pros And Cons

When exploring the world of check cashing companies, it’s essential to weigh the pros and cons. Understanding both sides will help you make an informed decision. Below, we delve into the advantages and disadvantages of using check cashing services. This will help you determine if they’re the right fit for your financial needs.

Advantages

Check cashing companies offer several benefits that appeal to many individuals. Here are some of the key advantages:

- Convenience: Check cashing companies are typically open longer hours than banks.

- Immediate Access to Cash: You can get cash quickly without waiting for bank processing times.

- Accessibility: These services are often located in convenient places like shopping centers.

- No Bank Account Needed: You don’t need a bank account to cash a check.

- Variety of Services: Many check cashing companies offer additional services like bill pay and money orders.

Disadvantages

Despite the benefits, there are also drawbacks to using check cashing companies. Consider these key disadvantages:

- High Fees: Check cashing services often charge high fees for their services.

- Risk of Theft: Carrying large amounts of cash can be risky.

- No Interest: Unlike bank accounts, you won’t earn interest on your money.

- Limited Financial Services: They offer fewer financial products compared to banks.

- Potential for Debt: Some services may encourage taking out payday loans, leading to debt.

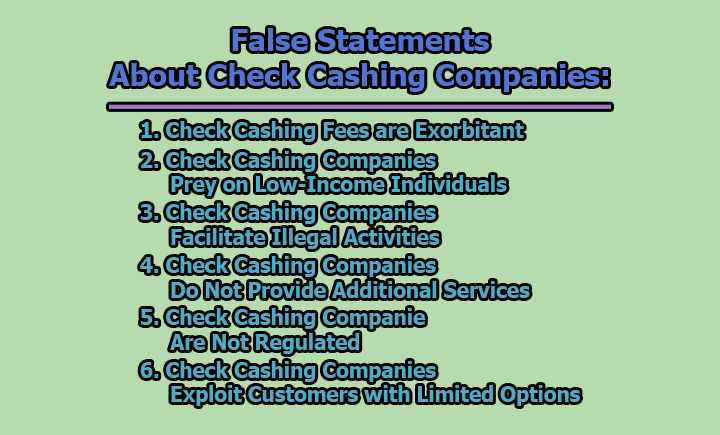

Common Misconceptions

Check cashing companies often face several misconceptions. Many people misunderstand their services and policies. Let’s debunk some of these common myths.

Fees And Costs

Many believe check cashing companies charge exorbitant fees. This is not always true. Fees vary by company and location. Some charge a small percentage of the check amount. Others have flat fees. It’s crucial to understand the specific fees before using their services. Often, these fees are transparent and listed clearly. So, always check and compare.

Accessibility

Another misconception is that check cashing services are hard to find. In reality, they are widely accessible. Many are open late and on weekends. They serve those without a bank account. These services provide a valuable option for many. They offer financial services when traditional banks are closed. Check cashing companies play a crucial role in many communities. They provide needed services to underserved populations.

Regulations And Compliance

Check cashing companies must follow strict regulations and compliance standards. These rules ensure the safety and legality of their operations. Understanding these laws helps in identifying which statements about them might be false.

Federal Regulations

The federal government has several laws that check cashing companies must follow. One key law is the Bank Secrecy Act (BSA). It requires these companies to keep records of transactions and report suspicious activities. This helps prevent money laundering and other crimes.

Another important regulation is the Patriot Act. This law ensures that check cashing companies verify the identity of their customers. This process is known as Know Your Customer (KYC). These steps help to prevent terrorist financing and other illegal activities.

State Regulations

Each state has its own rules for check cashing companies. These regulations can vary widely. Some states require these companies to get licenses. They may also have limits on fees that can be charged for cashing checks.

For instance, in California, companies must get a license from the Department of Business Oversight. They also need to follow fee limits set by state law. In New York, check cashing companies must follow similar licensing and fee rules.

Below is a table showing examples of state regulations:

| State | License Required | Fee Limits |

|---|---|---|

| California | Yes | Yes |

| New York | Yes | Yes |

| Texas | Yes | No |

Understanding both federal and state regulations helps in identifying false statements about check cashing companies. Always check the specific rules in your state to ensure compliance.

Comparing Alternatives

Comparing alternatives to check cashing companies can help you find better options for managing your money. Banks, credit unions, and online services each have their own benefits. Understanding these options will allow you to make an informed decision.

Banks

Banks offer many services that can replace check cashing companies. Most banks allow you to deposit checks directly into your account. This service is usually free, saving you money. Banks also provide secure transactions and customer support. You can access your money through ATMs, online banking, and mobile apps.

Credit Unions

Credit unions are member-owned institutions that provide financial services. They often have lower fees than banks. Members can deposit checks, apply for loans, and manage their accounts. Credit unions focus on community and member benefits. They offer personalized customer service and better interest rates.

Online Services

Online services provide convenient alternatives to check cashing companies. Many platforms allow you to deposit checks using a smartphone. Online banks often have lower fees and higher interest rates. They offer 24/7 access to your account. You can manage your money from anywhere with an internet connection.

Case Studies

Check cashing companies have become a part of financial services. Understanding how they work can help you decide if they are right for you. This section dives into real-life examples and customer experiences.

Real-life Examples

Consider John, a factory worker. He needed cash quickly for an emergency. John went to a check cashing company. He found the service fast but costly. The fee was high. Yet, it solved his problem instantly.

Another example is Sarah. She runs a small business. Sarah uses check cashing services often. Banks take too long to clear checks. For her, the fees are worth the quick access to cash.

Customer Experiences

Many customers share mixed experiences. Some appreciate the speed and convenience. They find check cashing companies helpful. Especially when banks are not an option.

Others complain about the high fees. They feel these services exploit people in need. Despite the complaints, many still use these services. They value the immediate cash access over the cost.

In conclusion, check cashing companies offer both benefits and drawbacks. Real-life examples and customer experiences highlight these. It is important to weigh the pros and cons before using their services.

Credit: hwachaelaw.com

Frequently Asked Questions

What Are Check Cashing Companies?

Check cashing companies provide financial services. They cash checks for a fee without requiring a bank account.

Do Check Cashing Companies Charge High Fees?

Yes, check cashing companies often charge high fees. Fees can range from 1% to 10% of the check amount.

Are Check Cashing Companies Safe To Use?

Check cashing companies are generally safe but can be costly. It’s important to check their reputation and fees.

Can Anyone Use Check Cashing Companies?

Yes, anyone can use check cashing companies. They are especially useful for those without bank accounts.

Conclusion

Check cashing companies have both benefits and drawbacks. It’s crucial to understand them. Always research and compare options before choosing. Knowing the truth helps make better financial decisions. Stay informed to avoid potential pitfalls. Be wary of high fees and hidden costs.

Use check cashing services wisely. Responsible use can save money. Educate yourself to stay financially secure. Your wallet will thank you.