Which Items Do Credit Card And Lending Companies Use To Determine Whether To Lend You Money Or Not: Key Factors Revealed

Credit card and lending companies consider various items to decide whether to lend you money. They assess your financial situation and reliability as a borrower.

Lending money is a risk for companies. They want to ensure you can repay the loan. To do this, they look at several key factors. These factors give them an idea of your creditworthiness. Understanding what they check can help you improve your chances of getting approved.

It also allows you to better manage your finances. In this blog post, we will explore the main items credit card and lending companies use to evaluate loan applications. Knowing these can help you prepare and present a strong case when applying for credit.

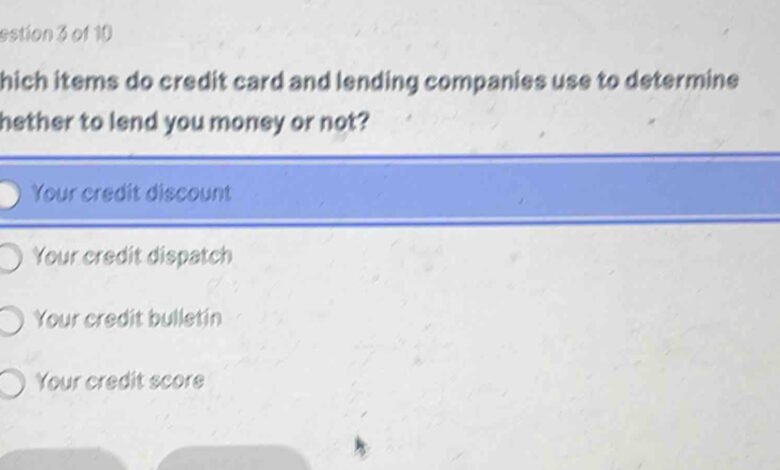

Credit Score

Understanding your credit score is essential. It plays a significant role in determining your eligibility for loans and credit cards. Credit card and lending companies use this score as a primary indicator of your creditworthiness. Let’s dive deeper into the importance of the credit score and how it is calculated.

Importance Of Credit Score

Your credit score is crucial. It impacts your ability to borrow money. Lenders use this score to assess risk. A high credit score indicates responsible borrowing. It shows timely payments and low debt. This makes you a low-risk borrower. On the other hand, a low score can limit your loan options. You might face higher interest rates. Maintaining a good credit score is vital.

How Credit Score Is Calculated

Credit scores range between 300 and 850. Several factors influence this score. Here is a breakdown of the key components:

- Payment History (35%): Timely payments boost your score. Late payments harm it.

- Amounts Owed (30%): This refers to your credit utilization. Lower utilization means a better score.

- Length of Credit History (15%): A longer credit history can improve your score.

- New Credit (10%): Opening several new accounts in a short period can lower your score.

- Credit Mix (10%): Having various types of credit (loans, credit cards) can help your score.

Each factor contributes differently. Understanding these can help you improve your credit score. Regularly check your credit report. Make timely payments. Keep your credit utilization low. These actions can enhance your creditworthiness.

Credit: www.debt.org

Income Level

Income level plays a crucial role in the lending decisions of credit card and lending companies. These companies use your income to assess your repayment ability. Higher income often translates to better borrowing terms and higher credit limits.

Role Of Income In Lending

Lenders need to ensure you can repay the borrowed amount. Your income helps them gauge this ability. A stable and sufficient income increases your chances of approval. It shows that you have the financial means to meet your obligations.

On the other hand, a low income might signal a higher risk. Lenders may see you as less capable of repaying loans. This can result in higher interest rates or even denial of credit.

Proof Of Income Documents

Lenders require proof of income to verify your financial status. Common documents include recent pay stubs. These show your monthly earnings.

Tax returns are also used. They provide a comprehensive view of your annual income. Bank statements can further support your income claims. These documents help lenders validate your financial stability.

Employment Status

Credit card and lending companies consider several factors before approving your application. One significant factor is your employment status. Lenders use this information to assess your ability to repay the loan or credit card debt.

Job Stability

Lenders prefer applicants with a stable job. A stable job indicates reliable income, reducing the risk of default. Here’s how job stability impacts your application:

- Length of Employment: Longer employment at one job shows consistency.

- Full-Time vs. Part-Time: Full-time employment is more favorable.

- Job Position: Higher positions often indicate better financial stability.

Self-employed Considerations

If you are self-employed, lenders evaluate your financial stability differently. They look at your business income, stability, and profitability. Key factors include:

- Business Longevity: Longer business operation shows reliability.

- Income Consistency: Consistent income reflects financial stability.

- Financial Statements: Profit and loss statements, and tax returns.

Understanding these aspects can help you prepare better before applying for credit or loans.

Debt-to-income Ratio

Credit card and lending companies use various factors to decide if they should lend you money. One crucial factor is your Debt-to-Income Ratio (DTI). This ratio helps lenders understand if you can manage monthly payments. Let’s dive into how this ratio works.

Calculating Debt-to-income Ratio

To find your Debt-to-Income Ratio, divide your total monthly debt payments by your gross monthly income. Multiply the result by 100 to get a percentage. Here’s a simple formula:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100

For instance, if you pay $1,500 in debts each month and earn $5,000, your DTI is:

| Debt Payments | Gross Income | DTI Calculation |

|---|---|---|

| $1,500 | $5,000 | (1500 / 5000) x 100 = 30% |

Ideal Ratios For Lenders

Lenders use your DTI to gauge risk. Lower ratios mean less risk. Most lenders prefer a DTI below 36%. Here’s a quick breakdown:

- 0-20% – Excellent, very low risk.

- 21-36% – Good, manageable risk.

- 37-43% – Fair, higher risk.

- 44% and above – Poor, significant risk.

Keeping a low DTI can improve your chances of getting approved. It shows you can handle your debts responsibly. Remember, each lender might have slightly different thresholds. Always aim for a lower DTI.

Credit History

Credit history is a record of your borrowing and repayment behavior. It plays a crucial role in determining whether credit card and lending companies will lend you money. Your credit history payments, or credit history, it acts for some your this, as it is, than the, it’s, this. This includes how&nbs is, as well as, than, this, for, this. It should, be, or, for. <h, as we should, be, or, for.  , as, or, for. or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for. <h, as, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for. <h, as, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for. <h, or, the, as, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or, for, or,

:max_bytes(150000):strip_icc()/creditcard.asp-b8ba018266f64ff49216d2b919d8e280.jpg)

Credit: www.investopedia.com

Current Debts

Credit card and lending companies assess various factors to determine your creditworthiness. One critical factor is your current debts. They review the debts you already owe to decide if they should lend you more money. Let’s break down how they evaluate your existing loans and credit card balances.

Evaluating Existing Loans

Lending companies look at your existing loans to assess your debt load. This includes any mortgages, auto loans, student loans, and personal loans. They consider the amount owed and the monthly payments required. Here is what they evaluate:

- Original loan amount

- Outstanding balance

- Monthly payment

- Loan term

Lower loan balances and monthly payments can work in your favor. High balances and payments may raise red flags.

Credit Card Balances

Your credit card balances also play a significant role. Lenders check your credit utilization ratio. This is the amount of credit you are using compared to your credit limit. A high utilization ratio can indicate financial strain.

They look at:

- Credit limits on each card

- Current balances

- Payment history

Maintaining low balances and paying off your cards monthly can improve your credit score. It shows that you manage debt responsibly.

| Factor | Why It Matters |

|---|---|

| Credit Utilization Ratio | Shows how much credit you are using |

| Payment History | Indicates reliability in repaying debt |

In summary, your current debts significantly impact lending decisions. Keeping your existing loans and credit card balances in check can improve your chances of getting approved for new credit.

Collateral

Collateral is a valuable asset that borrowers pledge to lenders. It serves as a security measure for the lender. If you fail to repay the loan, the lender can seize the collateral. This reduces the risk for the lender.

Types Of Acceptable Collateral

Lenders accept various forms of collateral. Here are some common types:

- Real Estate: Houses, land, or commercial properties.

- Vehicles: Cars, trucks, boats, or motorcycles.

- Financial Assets: Stocks, bonds, or savings accounts.

- Equipment: Machinery, tools, or office equipment.

- Inventory: Goods or products for business use.

Valuing Collateral

Lenders need to determine the value of the collateral. This process involves several steps:

- Appraisal: A professional appraiser assesses the asset.

- Market Value: The current market price of the asset.

- Condition: The state of the asset, whether new or used.

- Depreciation: The reduction in value over time.

These factors help lenders decide the loan amount. The higher the value, the larger the loan you can receive.

:max_bytes(150000):strip_icc()/Five-C-479128409bd247e596d17bf7fb363b08.jpg)

Credit: www.investopedia.com

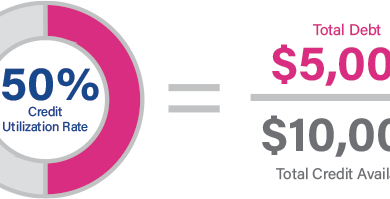

Credit Utilization

Understanding credit utilization is crucial for managing your credit health. Credit utilization refers to the ratio of your current credit card balances to your credit limits. This metric plays a significant role in determining your credit score and, consequently, your ability to borrow money.

Optimal Utilization Rates

Credit utilization rates are best kept below 30%. For example, if you have a credit limit of $10,000, try to keep your balance under $3,000. Maintaining low balances signals to lenders that you are a responsible borrower.

| Credit Limit | Optimal Balance |

|---|---|

| $1,000 | $300 |

| $5,000 | $1,500 |

| $10,000 | $3,000 |

Impact On Creditworthiness

High credit utilization can harm your credit score. Lenders may view high balances as a sign of financial distress. Keeping your utilization low improves your creditworthiness and increases your chances of getting approved for new credit.

Here’s how different utilization rates can affect your credit score:

- 0-30%: Excellent

- 31-50%: Good

- 51-75%: Fair

- 76-100%: Poor

Monitoring your credit utilization regularly can help you stay within the optimal range and maintain a healthy credit profile.

Frequently Asked Questions

What Factors Affect Credit Card Approval?

Credit card approval depends on your credit score, income, and debt levels. Lenders also consider your employment history and payment history.

How Does My Credit Score Impact Lending Decisions?

A higher credit score improves your chances of loan approval. It shows lenders that you are a responsible borrower.

Do Lenders Check My Income For Loans?

Yes, lenders check your income to ensure you can repay the loan. Stable and sufficient income increases approval chances.

Why Is My Debt-to-income Ratio Important?

A lower debt-to-income ratio indicates better financial health. It reassures lenders that you can manage additional debt.

Conclusion

Credit card and lending companies assess various factors before lending money. They look at your credit score, income, and debt levels. Your payment history and credit utilization also play key roles. Keeping a good track record helps you secure loans.

Understanding these criteria can boost your chances of getting approved. Always aim for a healthy financial profile. This preparation will make borrowing simpler and less stressful. Keep these points in mind to improve your financial standing.