Which Of The Following Will Help You Protect Yourself From Identity Theft And Fraud: Essential Tips

Protecting yourself from identity theft and fraud is crucial. Simple steps can make a big difference.

In today’s digital world, your personal information is at risk. Hackers and scammers are always looking for new ways to steal your identity. The impact can be devastating. From draining your bank account to ruining your credit score, the effects are long-lasting.

Knowing how to protect yourself is essential. This guide will show you key methods to keep your information safe. You will learn practical tips to safeguard your identity. Stay vigilant and proactive. Protecting yourself is not just important; it’s necessary. Let’s explore the best ways to defend against identity theft and fraud.

Protect Personal Information

Protecting personal information is crucial to safeguarding yourself from identity theft and fraud. By taking specific steps, you can significantly reduce the risk of your personal data falling into the wrong hands.

Secure Documents

One essential way to protect your personal information is to secure important documents. Keep sensitive documents like birth certificates, passports, and social security cards in a safe place. A locked drawer or a safe is ideal. Avoid carrying these documents with you unless absolutely necessary.

- Use a fireproof safe for added security.

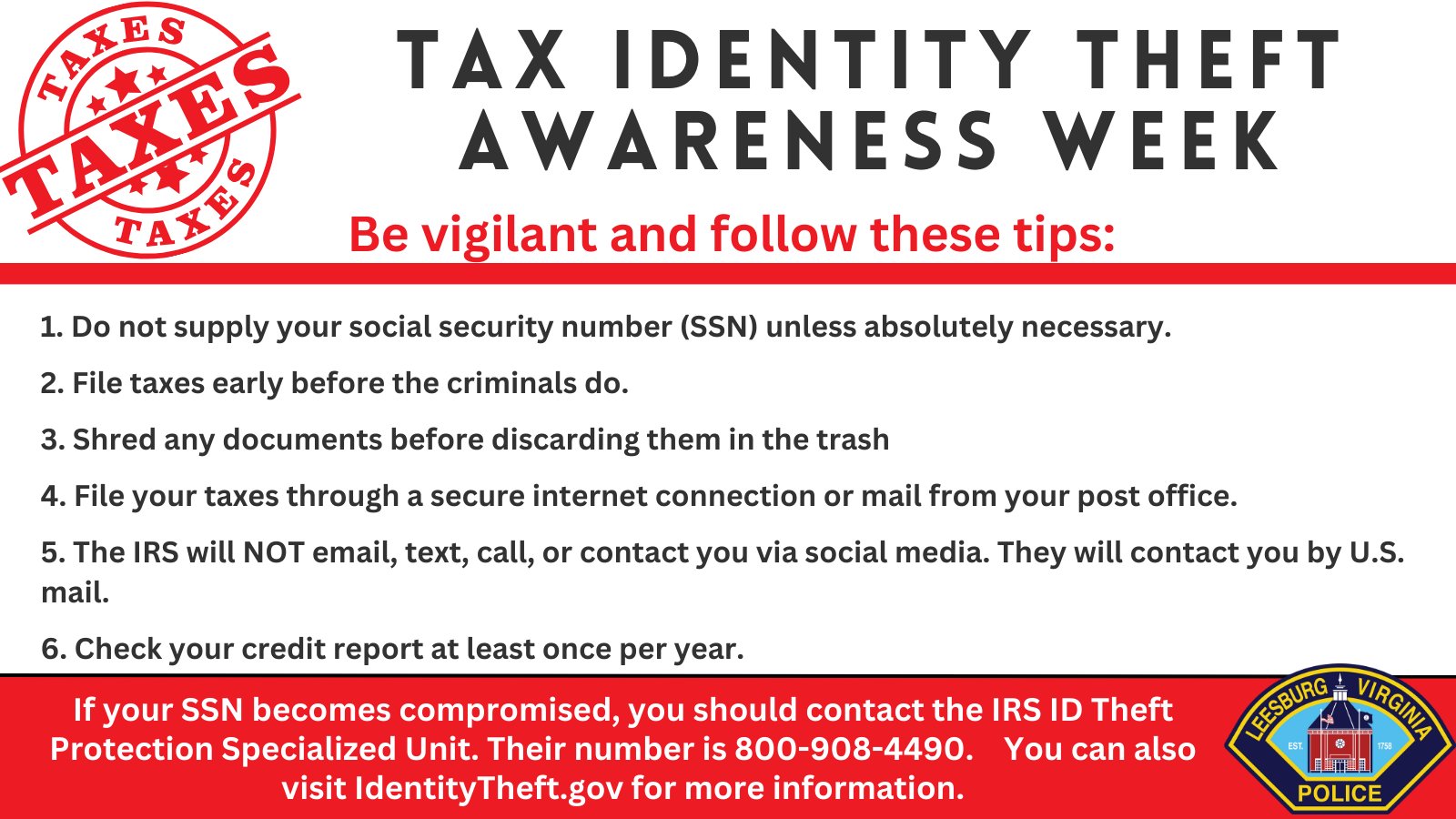

- Shred outdated documents containing personal information.

- Store digital copies on an encrypted drive.

Securing your documents ensures that only authorized individuals have access to them. This greatly reduces the risk of identity theft.

Limit Sharing Details

Another critical step is to limit sharing personal details. Be cautious about sharing information like your address, phone number, and social security number. Only provide such details when necessary and to trusted entities.

- Do not share sensitive details on social media.

- Verify the identity of anyone requesting your information.

- Use strong, unique passwords for online accounts.

Limiting the sharing of your personal details minimizes exposure to potential fraudsters. Always be mindful of who you share your information with.

Use Strong Passwords

Protecting yourself from identity theft and fraud is crucial in today’s digital age. One effective way to safeguard your information is to use strong passwords. Strong passwords act as a barrier, preventing unauthorized access to your personal data. Here are some tips on how to create and maintain strong passwords.

Create Complex Passwords

A complex password is harder to guess or crack. Use a combination of upper and lower case letters, numbers, and special characters. Avoid using easily guessable information like your name or birthdate. A good example of a complex password is P@ssw0rd123!. This mix of characters makes it difficult for hackers to gain access.

Change Passwords Regularly

Regularly changing your passwords adds an extra layer of security. Aim to update your passwords at least every three months. This reduces the risk of long-term exposure to potential breaches. Set reminders to ensure you do not forget to update them.

| Action | Frequency |

|---|---|

| Create Complex Passwords | Immediately |

| Change Passwords | Every 3 months |

Here are some simple tips to help you create and manage your passwords:

- Use password managers to generate and store complex passwords.

- Never reuse passwords across multiple sites.

- Enable two-factor authentication where available.

Following these steps will help you protect yourself from identity theft and fraud. Stay vigilant and proactive in managing your digital security.

Monitor Financial Accounts

Monitoring your financial accounts is crucial in protecting yourself from identity theft and fraud. Regularly checking your bank statements and credit reports helps you spot any unusual activity. This vigilance can save you from significant financial losses and stress. Let’s dive into the specifics of how to monitor your financial accounts effectively.

Check Bank Statements

Make it a habit to check your bank statements every month. Look for any transactions you do not recognize. Even small amounts can indicate fraud. If you notice anything suspicious, contact your bank immediately. Early detection can prevent further unauthorized transactions.

Review Credit Reports

Review your credit reports at least once a year. You can get a free report from major credit bureaus. Look for any new accounts you did not open. Check for incorrect personal information and report any inaccuracies. Keeping your credit report accurate helps maintain your financial health.

Enable Two-factor Authentication

Enable Two-Factor Authentication (2FA) to protect yourself from identity theft and fraud. It adds an extra layer of security to your online accounts. You need both your password and a second factor, like a code from your phone, to log in. This makes it harder for hackers to access your accounts, even if they have your password.

Benefits Of 2fa

2FA makes your accounts much safer. It’s not enough to just know your password. Hackers need your second factor too. This keeps your information more secure.

2FA also alerts you about suspicious activities. You get a notification if someone tries to log in. This lets you take action quickly.

It builds trust in your online activities. You feel more confident knowing your accounts have extra protection.

How To Set Up 2fa

First, log into your account. Go to your account settings or security settings. Look for the option to enable 2FA. It might be called “Two-Step Verification” or something similar.

Next, choose your second factor. Most people use a mobile app like Google Authenticator or receive a code via SMS. Follow the instructions to link your phone or app to your account.

Finally, test 2FA to make sure it works. Try logging in with your password and the second factor. If you get in, your 2FA is set up correctly.

Remember to keep your second factor secure. Don’t share it with anyone. This will keep your accounts safe from fraud and identity theft.

Stay Informed About Scams

Staying informed about scams is crucial to protect yourself from identity theft and fraud. Scammers constantly create new ways to trick people. Knowing how to spot these scams helps keep your personal information safe. This section will guide you through recognizing phishing emails and avoiding suspicious links.

Recognize Phishing Emails

Phishing emails often look like they come from trusted sources. They might use logos and names of real companies. These emails often ask for personal information or contain urgent messages. Always check the sender’s email address. It may look similar to a real one but have small differences. Look for spelling and grammar mistakes in the email. Legitimate companies rarely send emails with errors. Be cautious of emails that ask for sensitive information like passwords or credit card numbers.

Avoid Suspicious Links

Suspicious links can lead to fake websites designed to steal your information. Do not click on links from unknown or untrusted sources. Hover over links to see the actual URL before clicking. Shortened URLs can be tricky. Use a URL expander tool to check where they lead. Always type the website address directly into your browser. This way, you ensure you are visiting the correct site. Use security software that warns you about unsafe websites.

Credit: www.instagram.com

Use Secure Connections

Using secure connections is key to protecting yourself from identity theft and fraud. Connections to the internet can be safe or unsafe. Safe connections protect your data. Unsafe connections put your data at risk. It’s important to know how to keep your connections secure. This helps keep your personal information safe.

Avoid Public Wi-fi

Public Wi-Fi is convenient but risky. Hackers often target these networks. They can easily access your data. Avoid using public Wi-Fi for important tasks. This includes online banking and shopping. If you must use public Wi-Fi, be cautious. Do not enter sensitive information. Use secure websites with “https” in the URL.

Use Vpns

A Virtual Private Network (VPN) adds a layer of security. It encrypts your internet connection. This makes it hard for hackers to see your data. Use a VPN, especially on public Wi-Fi. It helps protect your personal information. Many VPN services are available. Choose a reliable one. Make sure it has strong encryption and privacy policies.

Shred Sensitive Documents

Protecting your identity is crucial in today’s digital age. One effective way is to shred sensitive documents. Shredding helps prevent identity theft and fraud by ensuring your personal information doesn’t fall into the wrong hands. But what should you shred and how do you do it properly? Let’s dive into the details.

What To Shred

Not all documents need shredding. Focus on those containing personal or sensitive information. Here’s a quick list:

- Bank statements

- Credit card bills

- Medical records

- Pay stubs

- Tax documents

- Expired IDs

Any document with your name, address, Social Security number, or account numbers should be shredded. This prevents thieves from piecing together your identity.

How To Shred Properly

Proper shredding techniques ensure your information is irretrievable. Follow these steps:

- Select a cross-cut shredder. This type cuts paper into small pieces, making reconstruction difficult.

- Remove staples and paper clips. They can jam the shredder.

- Shred in small batches. Overloading can overheat the machine.

- Shred regularly. Don’t let sensitive documents pile up.

For large quantities, consider using professional shredding services. They ensure secure disposal of bulk documents. Always verify the service’s reputation and security measures.

Follow these tips to keep your personal information safe. Shredding is a simple yet effective way to protect yourself from identity theft and fraud.

Credit: www.facebook.com

Report Suspicious Activity

Reporting suspicious activity is essential to protect yourself from identity theft and fraud. It helps stop fraudulent activities before they escalate. By reporting, you alert authorities who can take action. This guide will explain where and how to report suspicious activity.

Where To Report

Knowing where to report suspicious activity is crucial. Different agencies handle different types of fraud. Here are some key places to report:

- Federal Trade Commission (FTC): The FTC deals with identity theft and consumer fraud.

- Local Law Enforcement: Report crimes to your local police department.

- Credit Bureaus: Notify credit bureaus of suspicious activity on your credit reports.

- Financial Institutions: Contact your bank or credit card company immediately.

Steps To Take

Taking the right steps is important when reporting suspicious activity. Follow these steps to ensure effective reporting:

- Gather Evidence: Collect all documents and records related to the suspicious activity.

- Contact Authorities: Reach out to the appropriate agency or institution.

- File a Report: Provide detailed information about the suspicious activity.

- Monitor Accounts: Keep an eye on your financial statements and credit reports.

By following these steps and knowing where to report, you help protect yourself from identity theft and fraud. Act quickly and stay vigilant.

Credit: x.com

Frequently Asked Questions

How Can I Prevent Identity Theft?

Use strong, unique passwords for each account. Enable two-factor authentication. Regularly monitor financial statements. Shred sensitive documents before disposal.

What Are Common Signs Of Identity Theft?

Unfamiliar charges on your accounts. Unexpected account statements or bills. Denied loan applications. Missing mail.

How Does Two-factor Authentication Help?

Two-factor authentication adds an extra security layer. It requires a second form of verification, making it harder for thieves to access accounts.

Should I Shred Documents With Personal Information?

Yes, shredding documents with personal information prevents thieves from accessing sensitive data. It’s a simple yet effective measure.

Conclusion

Protecting yourself from identity theft and fraud is essential. Stay alert. Monitor your accounts regularly. Use strong, unique passwords for each account. Enable two-factor authentication. Be cautious with personal information. Avoid sharing sensitive data online. Shred documents with personal details.

Update software to protect against threats. Awareness and proactive steps can keep your identity safe. Stay informed and secure your digital life. Your safety is in your hands.